Are you ready to break free from the chains of debt and achieve financial peace of mind? One crucial step in this journey, especially if you're a Wells Fargo customer, is understanding the significance of your "Wells Fargo Bank payoff number." This seemingly simple string of digits holds the key to unlocking your financial freedom.

In the realm of personal finance, knowledge is power. This rings particularly true when dealing with loans and mortgages. A clear understanding of financial tools and terminologies is essential. Among these, the "Wells Fargo Bank payoff number" stands out as a vital piece of information for anyone aiming to settle their debts with the banking giant.

Navigating the complexities of loan repayments can be daunting. However, armed with the right information, the process becomes much clearer. This article will serve as your comprehensive guide to understanding and obtaining your Wells Fargo Bank payoff number. We'll delve into its importance, explain how to request it, and answer frequently asked questions to empower you on your path toward financial liberation.

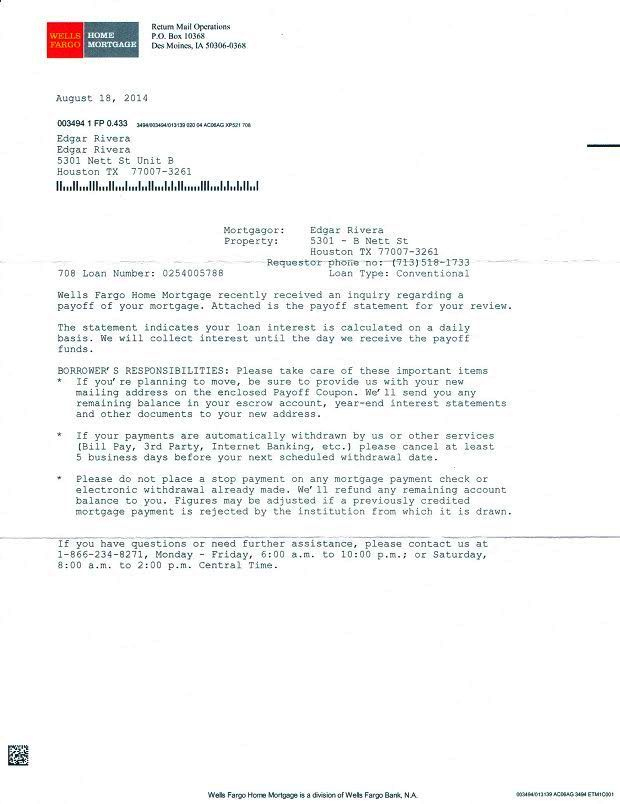

Imagine a scenario where you've diligently made consistent payments toward your loan, and the prospect of finally becoming debt-free draws near. It's an exciting time, filled with anticipation and a sense of accomplishment. This is where your Wells Fargo Bank payoff number enters the picture. It represents the precise amount you need to pay to completely settle your loan as of a specific date.

This crucial figure encompasses all outstanding principal, accrued interest, and any applicable fees. Obtaining this number is crucial to ensure you pay the exact amount required to close your loan account, avoiding any potential surprises or continued debt obligations.

Advantages and Disadvantages of Obtaining a Wells Fargo Bank Payoff Number

| Advantages | Disadvantages |

|---|---|

| Provides clarity on the exact amount needed to close your loan. | Payoff numbers are time-sensitive and may change due to interest accrual. |

| Helps avoid overpaying or underpaying on your loan. | Requires contacting Wells Fargo directly or navigating their online system. |

Best Practices for Obtaining Your Wells Fargo Bank Payoff Number

1. Gather Your Loan Information: Keep your loan account number, last statement, and any relevant communication from Wells Fargo handy.

2. Choose Your Preferred Method: Decide whether you prefer contacting Wells Fargo via phone, online banking, or a branch visit.

3. Verify Your Identity: Be prepared to provide security information to confirm your identity.

4. Specify the Payoff Date: Indicate the date you intend to make the final payment, as interest accrues daily.

5. Confirm Payment Instructions: Understand the accepted payment methods (e.g., cashier's check, wire transfer) and any associated fees.

Common Questions and Answers about Wells Fargo Bank Payoff Numbers

Q1: How often does my payoff number change?

A: Your payoff amount changes daily due to accruing interest. Request a new number close to your intended payoff date.

Q2: Can I get my payoff number online?

A: Yes, you can often find it through your online banking account or by contacting customer service.

Q3: What if I can't afford the full payoff amount?

A: Contact Wells Fargo to discuss potential options like loan modification or a hardship plan.

Q4: How long is a payoff number valid?

A: The validity period varies but is typically around 30 days. Confirm this with Wells Fargo.

Q5: What happens after I pay off my loan?

A: Wells Fargo will send you a loan satisfaction document confirming the loan is closed.

Q6: What if my loan is through a third party?

A: If Wells Fargo isn't your loan servicer, contact the company listed on your loan statements.

Q7: Is there a fee to obtain my payoff number?

A: Wells Fargo generally doesn't charge for providing this information.

Q8: Can I automate payments to reach my payoff amount faster?

A: Explore options like bi-weekly payments or increasing your automatic payment amount.

Tips and Tricks for Managing Your Wells Fargo Loan Payoff

- Set realistic payoff goals and track your progress.

- Make more than the minimum payment whenever possible to reduce interest charges.

- Explore options like refinancing or debt consolidation if they align with your financial goals.

- Consider setting up payment reminders to avoid late fees and potential negative impacts on your credit score.

In conclusion, obtaining and understanding your Wells Fargo Bank payoff number is a significant step towards financial freedom. This crucial figure provides clarity, prevents overpayment, and empowers you to strategically manage your debt. By following the steps outlined in this guide and utilizing the resources available to you, you can navigate the process confidently and celebrate the victory of achieving your financial goals.

wells fargo bank payoff number - The Brass Coq

Wells Fargo Home Equity Loan Payoff Phone Number - The Brass Coq

L.A. sues Wells Fargo, alleging 'unlawful and fraudulent conduct' Rigid - The Brass Coq

Wells Fargo Home Equity Loan Payoff Phone Number - The Brass Coq

Stung by scandal, Wells Fargo is offering a $250 bonus if you open a - The Brass Coq

7 Photos Wells Fargo Home Equity Loan Payoff Phone Number And Review - The Brass Coq

Wells Fargo Check Image Statement - The Brass Coq

Shortsale in Cypress TX 77429 - The Brass Coq

Editable Wells Fargo Bank Statement Template - The Brass Coq

Resultado de imagen para bank of america usa cashiers check samples - The Brass Coq

Cashier's check examples, examples of Cashier's check - The Brass Coq

Wells Fargo Home Equity Loan Payoff Phone Number - The Brass Coq

Debt Payoff Letter From Wells Fargo Bank - The Brass Coq

wells fargo bank payoff number - The Brass Coq

Wells Fargo Payoff Address, 2023, Phone Number, Regular & Overnight - The Brass Coq