Navigating the intricacies of a new job offer can feel like entering uncharted territory, especially in a different country. In Indonesia, one crucial aspect to understand is "tunjangan," a term that encompasses various employee benefits and allowances. These perks can significantly impact your overall compensation package, going beyond your base salary.

Simply put, "tunjangan" translates to allowances or benefits in English. These are additional payments or non-monetary perks provided by employers on top of your base salary. Understanding what percentage of your total compensation comes from "tunjangan" is vital for assessing the true value of a job offer.

The importance of "tunjangan" in Indonesian employment law and practices cannot be overstated. It's not merely a bonus; it forms an integral part of an employee's overall remuneration. These benefits can range from transportation and meal allowances to healthcare coverage and housing support.

However, determining the exact percentage of "tunjangan" as a proportion of the total salary ("tunjangan berapa persen dari gaji?") can be tricky. This is because the types and amounts of allowances vary considerably based on factors like industry, company size, job role, and individual employment contracts.

To make informed career decisions, it's crucial to grasp the nuances of "tunjangan" and its implications. By understanding these benefits, you can better negotiate your compensation package and ensure you receive the full value you deserve.

Advantages and Disadvantages of Tunjangan-Heavy Compensation

| Advantages | Disadvantages |

|---|---|

| Reduced Tax Burden | Potential for Lower Social Security Benefits |

| Increased Disposable Income (for specific allowances) | Complexity in Calculating Overall Compensation |

| Tailored Benefits to Employee Needs | Possible Discrepancies Between Companies and Industries |

Best Practices for Navigating Tunjangan in Indonesia

1. Thoroughly Review Your Employment Contract: Pay close attention to the breakdown of your salary and the types and amounts of "tunjangan" offered. Don't hesitate to clarify any doubts with the HR department.

2. Research Industry Standards: Investigate the typical "tunjangan" packages offered within your industry and for similar job roles. Online resources and professional networks can provide valuable insights.

3. Negotiate During the Hiring Process: Don't be afraid to negotiate the terms of your "tunjangan" during salary discussions. Emphasize your skills and experience to secure a favorable package.

4. Understand Tax Implications: Some allowances may be tax-exempt, while others are subject to income tax. Consult a tax advisor to optimize your tax liabilities.

5. Regularly Review and Adjust: As your career progresses, reassess your "tunjangan" package to ensure it aligns with your current needs and market standards. Don't shy away from requesting adjustments during performance reviews.

In conclusion, understanding "tunjangan berapa persen dari gaji" — the percentage of allowances in your total salary — is essential for anyone working or considering employment in Indonesia. By proactively researching, negotiating, and staying informed, you can maximize the benefits of this system and enhance your overall financial well-being.

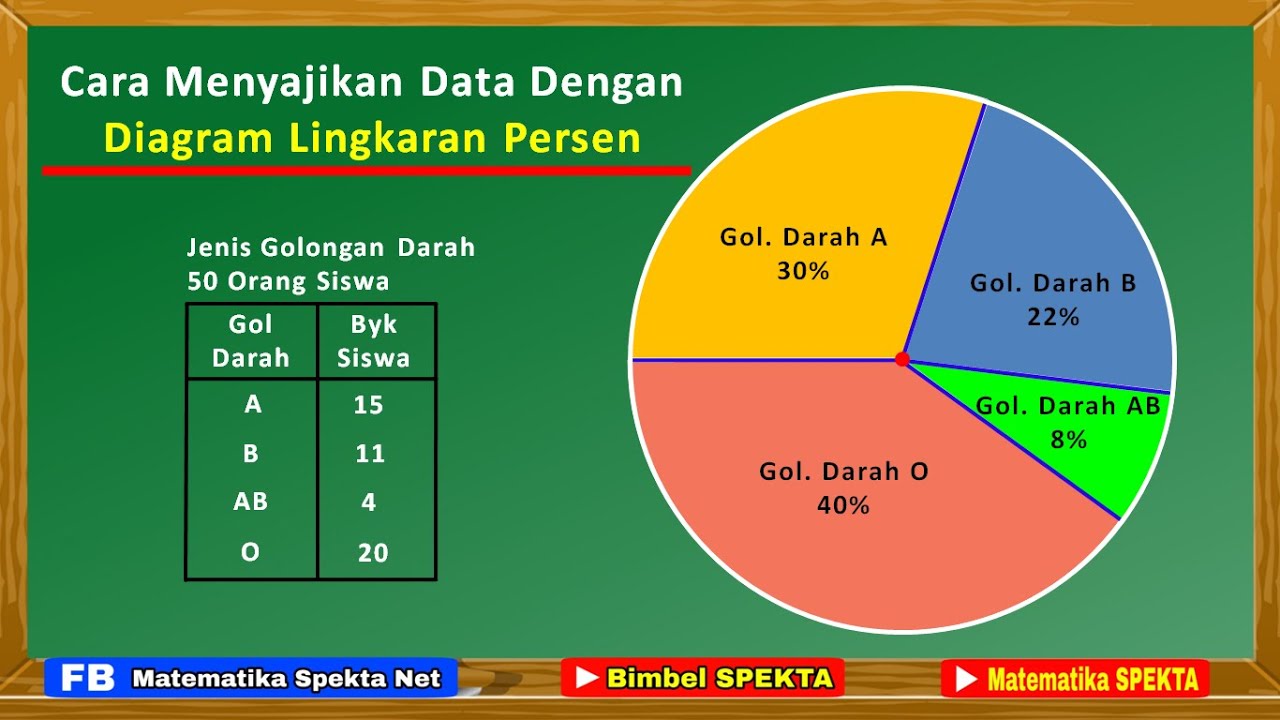

Cara Menampilkan Diagram Lingkaran Prsentase Pada Matlab - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

Metode 50/30/20: Cara Efisien Olah Keuangan - The Brass Coq

Perhitungan Potongan BPJS Kesehatan Karyawan - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

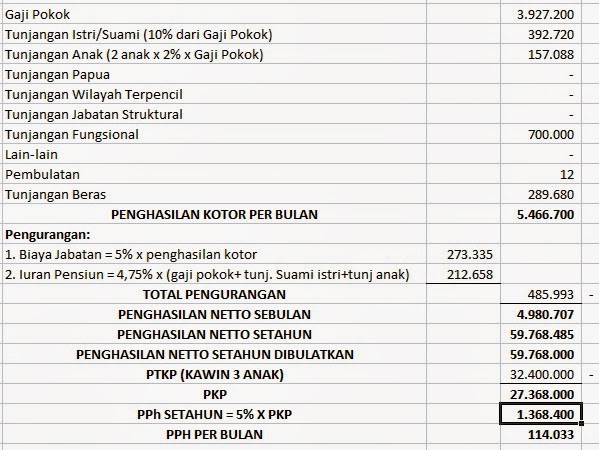

Bagaimana Cara Menghitung Pph 21 - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq

tunjangan berapa persen dari gaji - The Brass Coq