Imagine this: you're planning to buy your dream home, but you need a little help with the down payment. Or perhaps you're facing unexpected medical expenses and need access to additional funds. In Malaysia, the Employee Provident Fund (EPF) provides a safety net for such situations through Account 2. This article serves as your guide to understanding and accessing these funds, empowering you to make informed decisions about your financial well-being.

The EPF is a social security institution that safeguards the retirement savings of Malaysian employees. While Account 1 primarily serves as your retirement fund, Account 2 allows for pre-retirement withdrawals for specific purposes, such as purchasing a home, funding your education, or covering medical expenses. This system ensures that your savings work for you, even before retirement.

Established in 1950, the EPF has played a crucial role in enhancing the financial security of Malaysians. Over the years, the fund has evolved to meet the changing needs of its members, with the introduction of Account 2 being a significant milestone. This provision recognizes that financial needs extend beyond retirement, and provides a mechanism for members to access their savings responsibly.

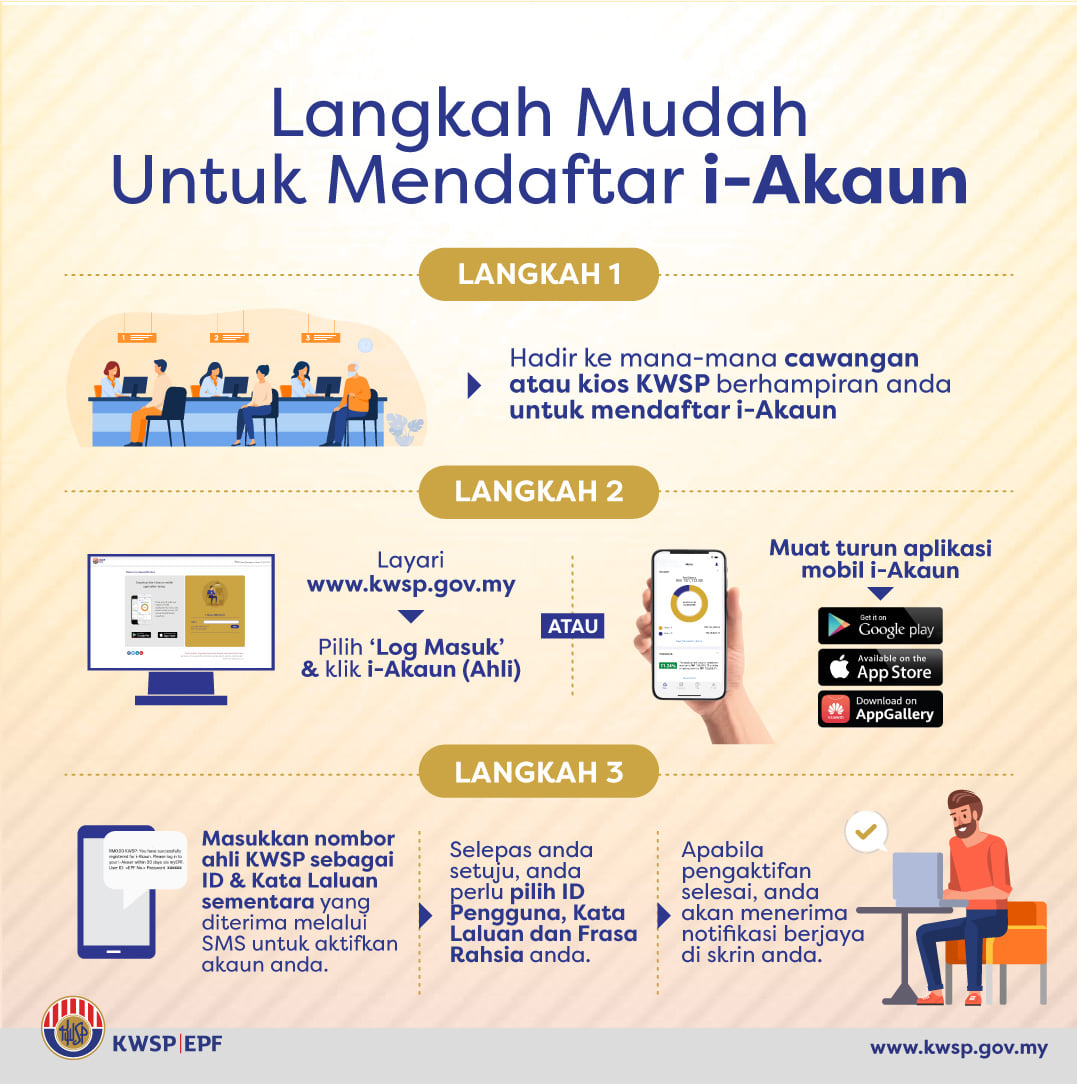

Understanding the application process is key to accessing your Account 2 funds. Generally, applications involve submitting the required documents, which vary depending on the purpose of withdrawal, through the EPF website or at designated counters. While the process is designed to be straightforward, familiarizing yourself with the specific requirements for your situation is essential. This ensures a smoother experience and minimizes potential delays.

The ability to access your EPF Account 2 funds comes with several advantages. Firstly, it provides financial flexibility, allowing you to address critical needs without derailing your long-term financial goals. Secondly, it promotes home ownership, a significant aspiration for many Malaysians. By providing access to funds for a down payment, the EPF contributes to building a more financially secure future for individuals and families. Lastly, it acknowledges the importance of healthcare and education. Access to these funds can alleviate the financial burden associated with medical emergencies or pursuing higher education.

Advantages and Disadvantages of Accessing EPF Account 2

While accessing your EPF Account 2 offers several benefits, it's important to weigh the advantages against potential drawbacks. Consider these factors before making a withdrawal:

| Advantages | Disadvantages |

|---|---|

| Financial flexibility for important needs. | Reduced retirement savings. |

| Support for homeownership. | Potential tax implications. |

| Access to funds for healthcare and education. | Possibility of overspending. |

Navigating the intricacies of EPF Account 2 might seem daunting, but it doesn't have to be. By understanding the purpose, eligibility requirements, and application process, you can make informed decisions about utilizing these funds to your advantage. Remember, the EPF is designed to support your financial well-being, both today and in the future.

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

Surat Permohonan Kuliah Sambil Kerja - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq

cara nak mohon akaun 3 kwsp - The Brass Coq