Imagine this: you've just decided to open your first bank account, excited to take control of your finances. You head to the bank, fill out the necessary forms, and eagerly await the moment you can start saving and managing your money. But then comes a slight hurdle – the 'surat pengaktifan akaun bank,' a document that can sometimes seem like a roadblock on your journey to financial freedom.

In many parts of the world, particularly in countries where Bahasa Melayu is spoken, 'surat pengaktifan akaun bank' is a crucial step in the account opening process. This document, which translates to 'bank account activation letter' in English, serves as the key to unlocking your new account and accessing all the benefits that come with it.

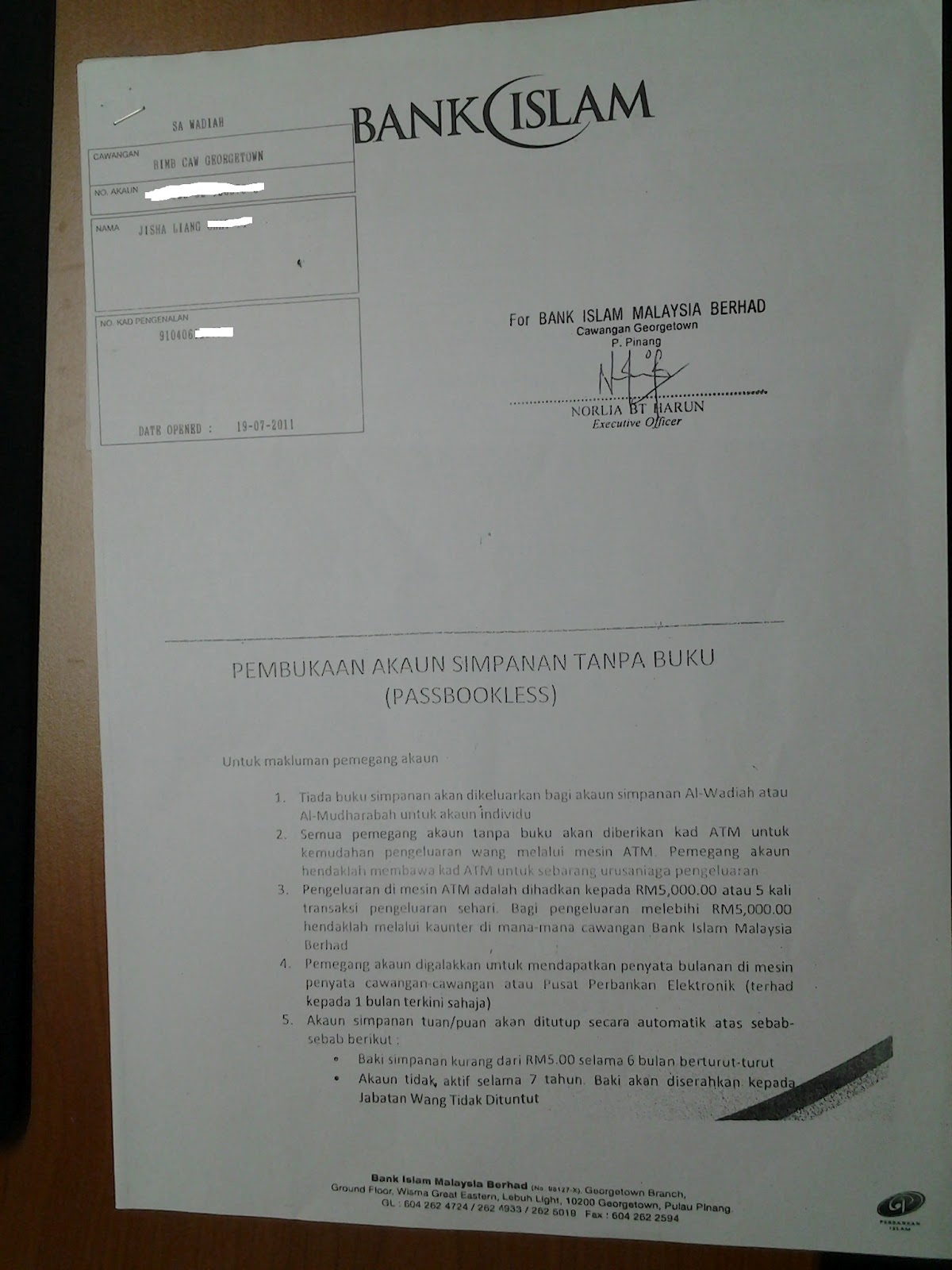

But what exactly is this document, and why is it so important? In essence, a 'surat pengaktifan akaun bank' is a formal notification from your bank confirming the successful opening of your new account. It contains essential information, such as your account number, account type, and any specific instructions you need to follow to activate and start using your account.

Think of it as a welcome letter from your bank, formally introducing you as a valued customer and providing you with the necessary tools to navigate the world of banking. Without this letter, your account remains dormant, like a car without fuel. You have the potential to move forward, but you need that crucial element to get started.

In today's digital age, you might wonder why this seemingly archaic process of physical letters still exists. While some banks are moving towards online activation methods, many still rely on this traditional approach to ensure security and prevent fraudulent activities. It acts as an extra layer of verification, confirming that you are the legitimate owner of the account and safeguarding your financial well-being.

Advantages and Disadvantages of Surat Pengaktifan Akaun Bank

While the 'surat pengaktifan akaun bank' plays a vital role in securing your account, it's essential to acknowledge both its advantages and potential drawbacks:

| Advantages | Disadvantages |

|---|---|

| Enhanced security and reduced fraud risk | Potential delays in account activation if the letter is lost or delayed |

| Formal confirmation of account opening | Reliance on physical mail, which can be less efficient than online methods |

| Provides essential account information in a clear and concise format | May pose challenges for individuals with limited access to postal services |

Despite the potential drawbacks, the 'surat pengaktifan akaun bank' remains a critical aspect of the account opening process in many regions, underscoring the importance of security and verification in the financial world. By understanding its purpose and significance, you can navigate this step with ease and unlock the full potential of your new bank account.

As you embark on your financial journey, remember that the 'surat pengaktifan akaun bank' is not just a piece of paper to be filed away and forgotten. It's a symbol of your commitment to managing your finances responsibly and a reminder of the importance of security in all your financial endeavors.

Contoh Surat Aktifkan Semula Akaun Dorman - The Brass Coq

Surat Pengaktifan Akaun Bank - The Brass Coq

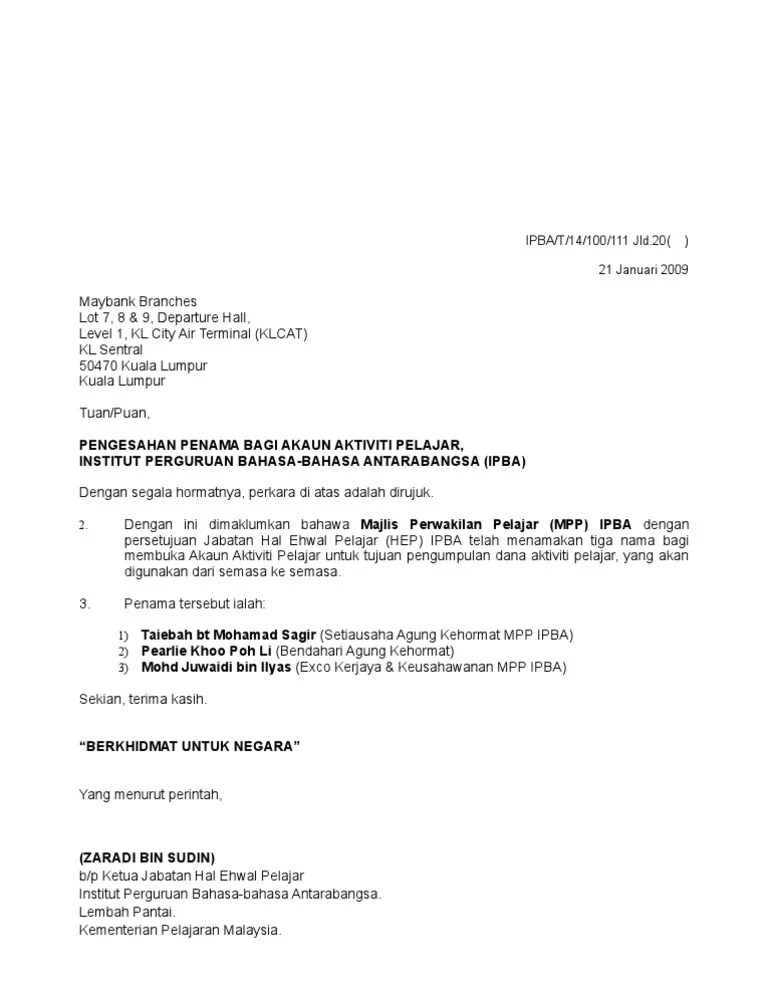

Surat Permohonan Buka Akaun Bank Persatuan - The Brass Coq

Surat Permohonan Kuliah Sambil Kerja - The Brass Coq

Contoh Surat Buka Akaun Bank Maybank at My - The Brass Coq

Contoh Surat Permohonan Pengaktifan Akaun Bank - The Brass Coq

Surat Pengesahan Akaun Bank - The Brass Coq

surat pengaktifan akaun bank - The Brass Coq