In the competitive business landscape, understanding your financials is paramount to success. It's not enough to simply generate revenue; you need to know how much of that revenue translates into actual profit. This is where understanding how to calculate your profit margin becomes crucial. Whether you're a seasoned entrepreneur or just starting out, this seemingly simple calculation can unlock invaluable insights into your business's health and guide you toward sustainable growth.

Imagine this: you've poured your heart and soul into launching a new product, and the initial sales figures are promising. But how can you be certain that your pricing strategy is optimal? Are you leaving money on the table, or are you inadvertently pricing yourself out of the market? Calculating your profit margin empowers you to answer these questions with clarity and make informed decisions about pricing, expenses, and overall business strategy.

Profit margin, often expressed as a percentage, represents the proportion of revenue that remains as profit after accounting for all your costs. It's the lifeblood of your business, reflecting its efficiency and profitability. A healthy profit margin not only ensures your business's sustainability but also provides the resources needed for reinvestment, expansion, and weathering economic storms.

The journey to financial mastery begins with understanding the fundamentals. Calculating your profit margin might seem like a daunting task, especially for those who aren't mathematically inclined. However, it's a surprisingly straightforward process that can be broken down into manageable steps. Armed with this knowledge, you'll be equipped to analyze your business's financial performance with a discerning eye and make strategic decisions that propel you toward greater success.

In the following sections, we'll delve deeper into the intricacies of calculating profit margins, explore its significance, and uncover practical strategies for leveraging this knowledge to optimize your business operations. Whether you're aiming to boost your bottom line, identify areas for improvement, or make informed investments, mastering the art of profit margin calculation is an essential skill for any entrepreneur or business owner.

While the historical origins of profit margin calculations may be rooted in ancient accounting practices, their relevance has only intensified in today's data-driven business world. Technology has revolutionized how we collect, analyze, and interpret financial information, making it easier than ever to calculate and track profit margins with precision. This accessibility has also highlighted the crucial role profit margins play in attracting investors, securing loans, and building a strong financial reputation.

One of the main issues surrounding profit margin calculations is the potential for errors or inconsistencies in data entry and interpretation. Even small discrepancies in recording revenue or expenses can significantly impact the accuracy of your calculations. Therefore, it's essential to establish robust accounting practices, utilize reliable software, and potentially seek guidance from financial professionals to ensure the integrity of your financial data and the reliability of your profit margin calculations.

Advantages and Disadvantages of Focusing on Profit Margin

| Advantages | Disadvantages |

|---|---|

| Provides a clear picture of your business's profitability. | Can lead to a narrow focus on cost-cutting, potentially sacrificing quality or long-term growth. |

| Helps identify areas for improvement in pricing, expenses, or operational efficiency. | May not fully capture intangible factors like brand value or customer loyalty. |

| Facilitates informed decision-making regarding investments, expansions, or product development. | Can vary significantly across industries, making comparisons less meaningful. |

As with any business metric, focusing solely on profit margins without considering the broader context can lead to an incomplete understanding of your company's overall health. It's crucial to balance profit margin analysis with other key indicators like customer satisfaction, market share, and employee morale to gain a holistic perspective.

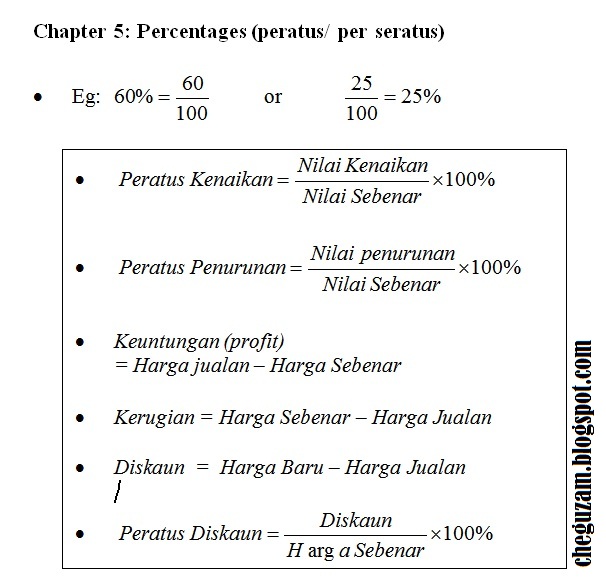

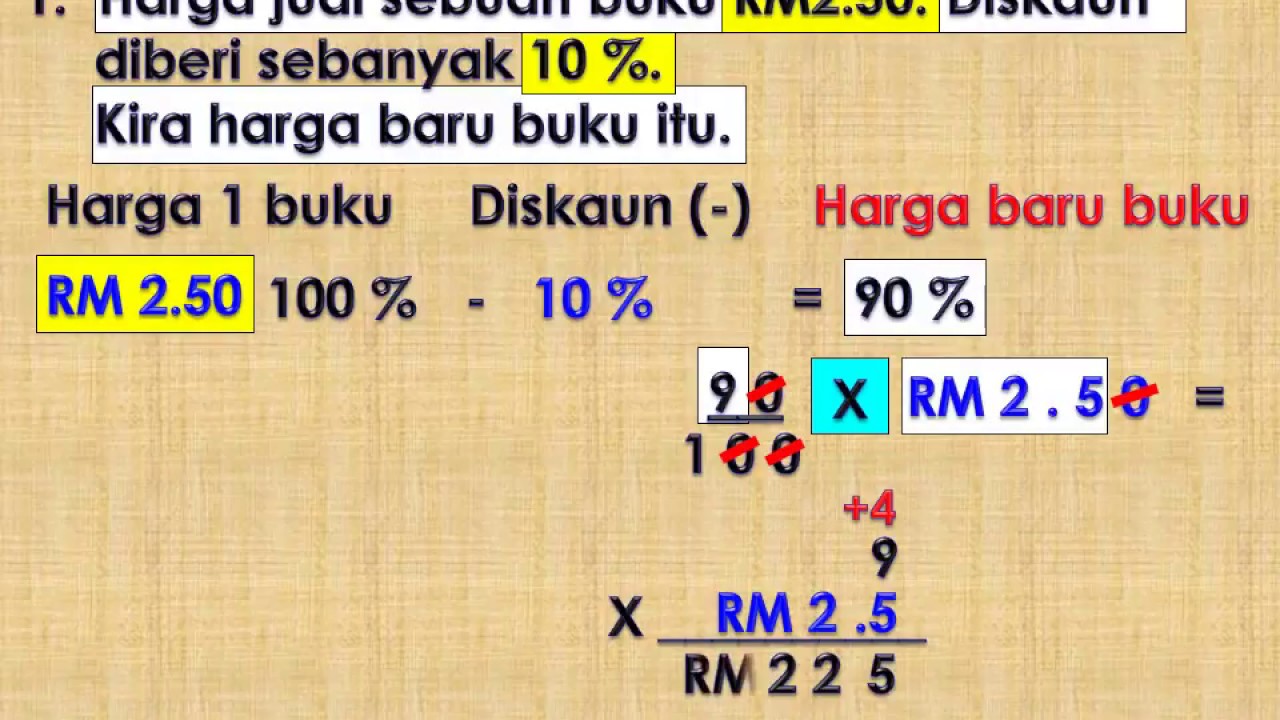

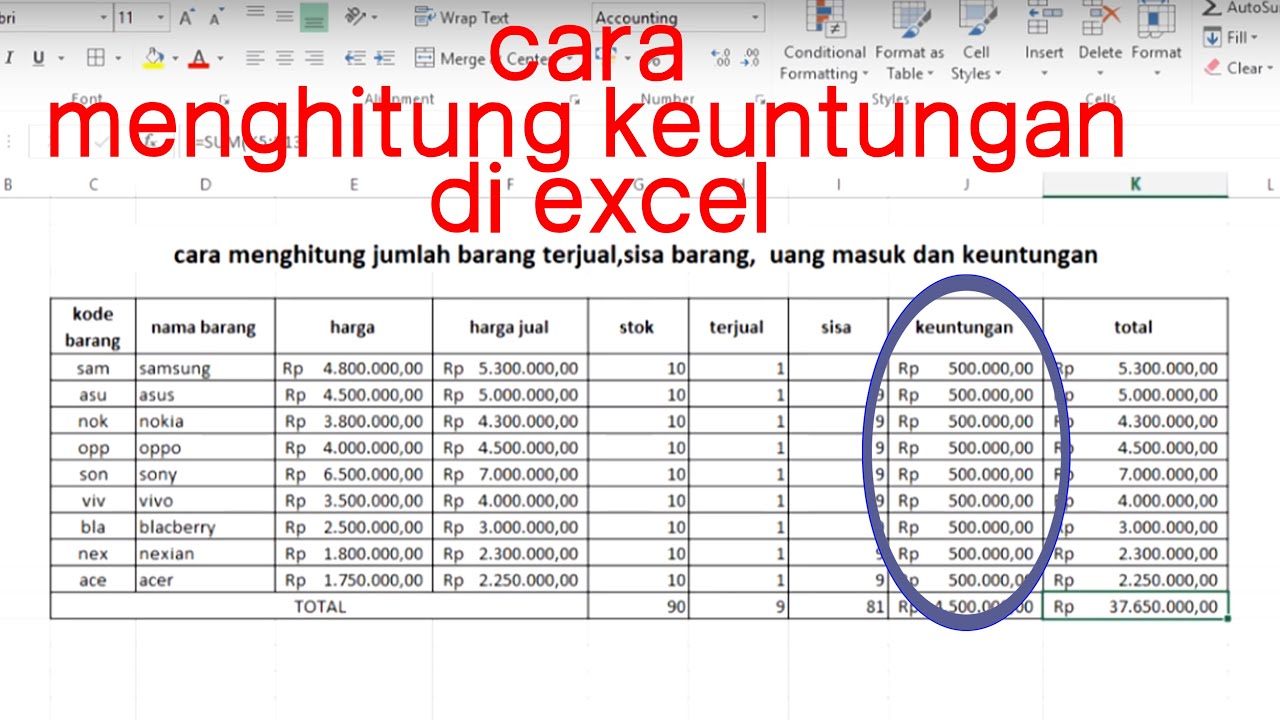

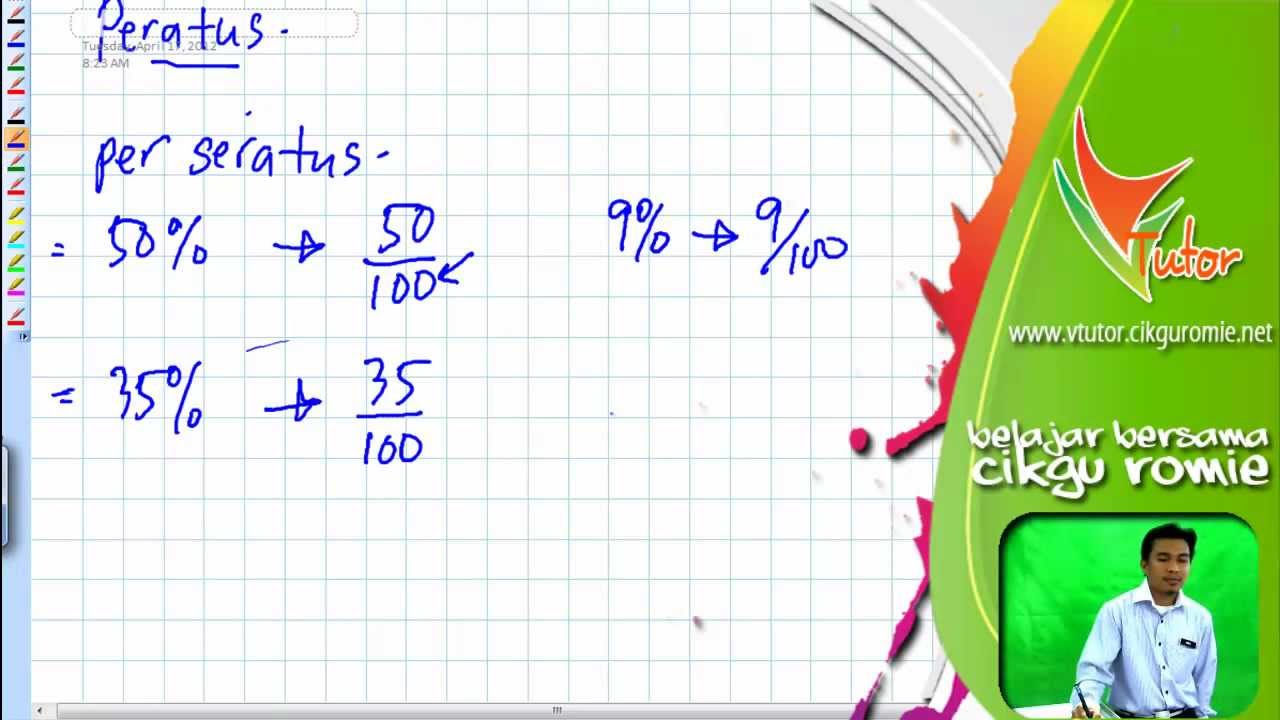

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

Formula Kos Jualan Untuk Tingkatkan Pendapatan Perniagaan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq

cara kira peratus keuntungan - The Brass Coq