In today's interconnected global economy, businesses are constantly seeking opportunities to expand and thrive. For businesses rooted in Islamic values, aligning financial practices with those values is paramount. This is where the concept of "buka akaun syarikat bank islam" – opening a business account with an Islamic bank – comes into play.

Choosing the right financial partner is a decision that can significantly impact a company's trajectory. Islamic banking, guided by ethical principles and a commitment to social responsibility, has emerged as a compelling option for businesses seeking financial solutions that align with their beliefs.

But what exactly does "buka akaun syarikat bank islam" entail, and how can it benefit your business? This exploration delves into the intricacies of Islamic business banking, providing a comprehensive understanding of its principles, benefits, and the process of opening an account.

Imagine a financial system that not only manages your money but also adheres to ethical principles that resonate with your beliefs. Islamic banking offers a distinct approach to finance, one that prohibits interest (riba), emphasizes profit and loss sharing, and promotes investments in ethical and socially responsible ventures.

"Buka akaun syarikat bank islam" is more than just a banking transaction; it's a conscious decision to align your business operations with a financial system that prioritizes fairness, transparency, and ethical conduct.

Islamic banking, with its roots in the Quran and Sunnah (teachings of Prophet Muhammad), has a rich history dating back centuries. The modern resurgence of Islamic finance began in the mid-20th century, gaining momentum as individuals and businesses sought financial alternatives that aligned with their values.

The core principles of Islamic banking revolve around the prohibition of interest (riba), considered exploitative and unjust. Instead of charging interest, Islamic banks operate on a profit and loss sharing (PLS) model. When you deposit money, you become an investor, sharing in the bank's profits or losses based on predetermined ratios.

Beyond PLS, Islamic banking emphasizes transparency and fairness in all financial transactions. Contracts are meticulously structured to ensure clarity and mutual benefit, promoting trust and ethical conduct between the bank and its customers.

Advantages and Disadvantages of Buka Akaun Syarikat Bank Islam

| Advantages | Disadvantages |

|---|---|

| Ethical and Socially Responsible Banking | Limited Availability in Some Regions |

| Profit and Loss Sharing Model | Potential for Slower Growth Compared to Conventional Banking |

Now, let's explore some practical benefits of opening a business account with an Islamic bank ("buka akaun syarikat bank islam"):

Benefit 1: Ethical Alignment: By choosing an Islamic bank, you align your business with ethical banking practices that resonate with your values. This can enhance your brand image and resonate with customers who prioritize ethical considerations.

Benefit 2: Transparency and Fairness: Islamic banking emphasizes transparent and fair dealings. Contracts are designed to be clear and mutually beneficial, fostering trust between the bank and its customers.

Benefit 3: Support for Ethical Investments: Islamic banks prioritize investments in ethical and socially responsible sectors. By banking with them, you indirectly contribute to the growth of businesses that align with Islamic principles.

Taking the leap to open a business account with an Islamic bank might seem like a significant step, but the process is often straightforward. Here's a simple guide:

Step 1: Research and Compare: Explore different Islamic banks operating in your region. Compare their products, services, fees, and customer reviews to find the best fit for your business needs.

Step 2: Gather Your Documents: Prepare essential documents, including your business registration certificate, proof of address, and identification documents for authorized signatories.

Step 3: Contact the Bank: Reach out to the bank's business banking department to schedule an appointment or initiate the account opening process online.

Step 4: Complete the Application: Fill out the application form accurately and completely, providing all necessary details about your business.

Step 5: Review and Submit: Carefully review all information provided in the application before submitting it along with the required documents.

Common questions entrepreneurs have about Islamic business banking ("buka akaun syarikat bank islam") often center around practical aspects. Here are some answers to common queries:

Q1: Are Islamic banking products and services more expensive? A: Not necessarily. The cost of banking products and services can vary between Islamic and conventional banks. It's essential to compare offerings from different institutions to find competitive rates and fees.

Q2: Can I get financing for my business through an Islamic bank? A: Absolutely. Islamic banks offer various financing solutions based on Islamic principles, such as Murabaha (cost-plus financing), Ijara (leasing), and Mudaraba (profit-sharing partnership).

Q3: What happens to my money if the bank incurs a loss? A: As an account holder in a PLS system, you share in the bank's profits and losses. If the bank incurs a loss, your funds may be impacted based on the predetermined profit-sharing ratio. However, it's important to note that Islamic banks are subject to regulatory oversight and risk management practices to minimize losses.

Navigating the world of business banking can be complex, but understanding your options and choosing a financial partner that aligns with your values can simplify the journey. "Buka akaun syarikat bank islam" offers a path for businesses seeking ethical and Sharia-compliant financial solutions. By embracing Islamic banking principles, you not only manage your business finances responsibly but also contribute to a more equitable and just financial system.

Buka Akaun Bank Islam 2024 - The Brass Coq

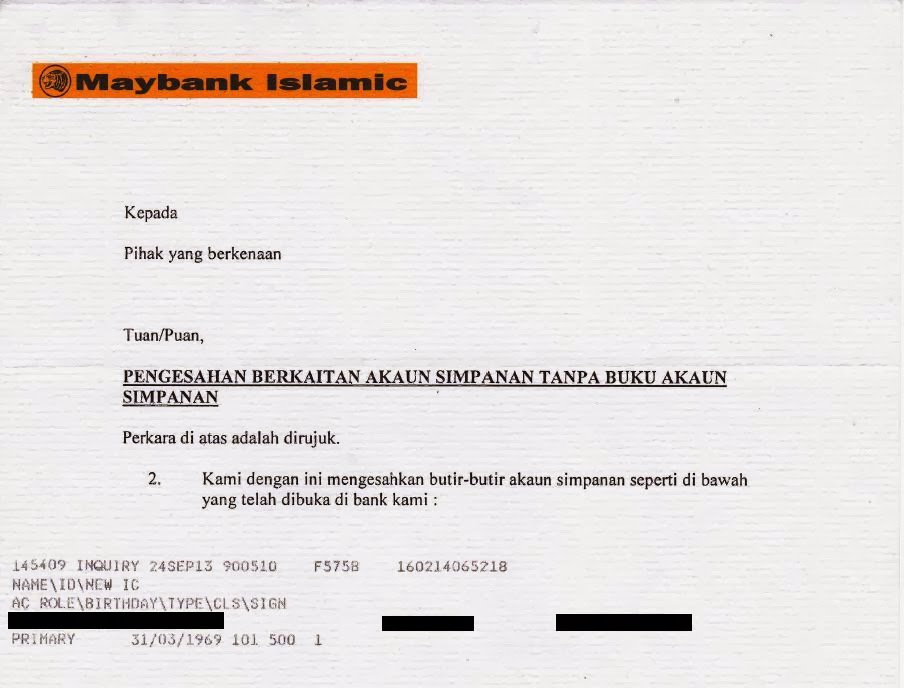

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - The Brass Coq

Surat Permohonan Buka Akaun Bank - The Brass Coq

Contoh Surat Buka Akaun Bank Untuk Pekerja - The Brass Coq

Contoh Surat Permohonan Buka Akaun Bank - The Brass Coq

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - The Brass Coq

Contoh Surat Buka Akaun Bank Cimb - The Brass Coq

Contoh Surat Aktifkan Akaun Bank Syarikat - The Brass Coq