In Indonesia, where motorcycles are more than just vehicles – they’re lifelines, symbols of freedom, and often, crucial income generators – finding yourself in a financial bind can be particularly challenging. Imagine needing to cover unexpected medical expenses, seize a business opportunity, or manage educational fees, all while relying on your motorcycle for daily life. This is where understanding “syarat gadai bpkb motor di pegadaian,” which translates to “requirements for motorcycle title loans at Pegadaian,” becomes essential.

Pegadaian, a prominent state-owned pawnshop company in Indonesia, offers a way to navigate these financial hurdles. A motorcycle title loan, commonly referred to as "gadai bpkb motor," allows individuals to secure quick funds by using their motorcycle's ownership document (Surat Tanda Nomor Kendaraan or STNK) as collateral. This process offers a lifeline for those who may not qualify for traditional bank loans or need immediate financial assistance.

Navigating the world of financial solutions can feel daunting, especially with unfamiliar terms and processes. This guide aims to demystify the concept of motorcycle title loans in Indonesia, specifically focusing on the requirements and procedures involved when dealing with Pegadaian. We'll delve into the advantages, potential drawbacks, and crucial factors to consider before making this financial decision.

Understanding the “syarat gadai bpkb motor di pegadaian” is the first step toward potentially unlocking a practical and accessible financial solution. Whether you’re facing a temporary financial hurdle or simply want to explore this option, equipping yourself with the right information is crucial for making informed decisions that align with your financial well-being.

Throughout this comprehensive guide, we'll break down complex jargon, provide practical tips, and answer frequently asked questions to empower you with the knowledge needed to confidently explore whether a motorcycle title loan from Pegadaian is the right fit for your individual circumstances.

Advantages and Disadvantages of Motorcycle Title Loans

Like any financial product, motorcycle title loans come with their own set of advantages and disadvantages. Let's weigh them:

| Advantages | Disadvantages |

|---|---|

| Quick access to funds | Higher interest rates compared to traditional loans |

| Less stringent eligibility requirements | Risk of losing your motorcycle if unable to repay |

| Flexible repayment options | Potential for debt cycles if not managed carefully |

Best Practices for Motorcycle Title Loans

If you're considering a motorcycle title loan, keep these best practices in mind:

- Borrow Only What You Need: Determine the absolute minimum amount you require to avoid unnecessary debt and interest payments.

- Compare Interest Rates and Terms: Don't settle for the first offer. Explore different Pegadaian branches or other reputable lenders to secure the most favorable rates and repayment terms.

- Read the Fine Print: Before signing any agreement, thoroughly understand all terms and conditions, including interest rates, late payment penalties, and loan duration.

- Budget for Repayments: Incorporate the loan repayments into your monthly budget to ensure timely payments and avoid defaulting on the loan.

- Explore Alternatives: Exhaust all other potential avenues for securing funds, such as personal loans, borrowing from family or friends, or exploring government aid programs, before committing to a motorcycle title loan.

Common Questions and Answers about Motorcycle Title Loans at Pegadaian

Let's address some common queries regarding motorcycle title loans at Pegadaian:

- What is the maximum loan amount I can get? The loan amount depends on your motorcycle's assessed value, typically up to 70-80% of its market value.

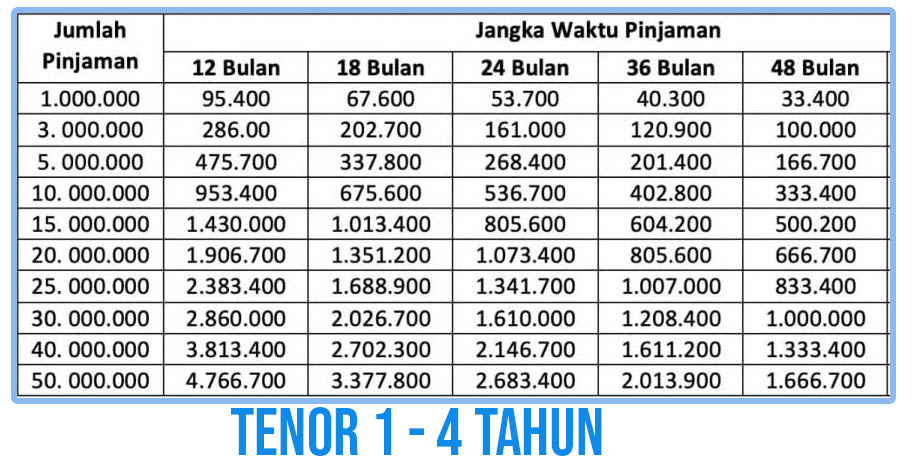

- How long is the loan tenure? Pegadaian generally offers flexible loan tenures, ranging from a few months to several years.

- What documents do I need to apply? Be prepared with your KTP (Indonesian ID card), Kartu Keluarga (family card), motorcycle STNK, and proof of residence.

- What happens if I miss a payment? Contact Pegadaian immediately. They may offer grace periods or alternative payment arrangements to prevent further complications.

- Can I get my motorcycle back after repaying the loan? Yes, upon full repayment, including principal and interest, Pegadaian will return your motorcycle's ownership documents.

- Is my motorcycle insured during the loan period? Pegadaian typically includes basic insurance coverage for your motorcycle during the loan tenure.

- Can I use my motorcycle while the loan is active? Yes, you can continue using your motorcycle. However, ensure you maintain it well and adhere to all traffic regulations.

- Can foreigners apply for a motorcycle title loan at Pegadaian? Foreign nationals with a valid KITAS (temporary stay permit) and other required documents can apply.

Navigating the financial landscape can be complex, especially when unexpected expenses arise. Motorcycle title loans, or "gadai bpkb motor" at Pegadaian, offer a viable solution for quick access to funds using your motorcycle as collateral. Understanding the requirements, advantages, disadvantages, and best practices is essential for making informed financial decisions. While this guide provides a comprehensive overview, always conduct thorough research, compare options, and seek professional financial advice tailored to your specific circumstances before making any commitments. By approaching these financial products with knowledge and caution, you can navigate challenges and make choices that align with your overall financial well-being.

Syarat dan Aturan Gadai BPKB Motor di pegadaian - The Brass Coq

Tabel Pinjaman Pegadaian Jaminan BPKB Motor - The Brass Coq

Gadai Laptop di Pegadaian. Syarat, Cara dan Taksiran Harga - The Brass Coq

Syarat Gadai BPKB Motor di Pegadaian 2023, Simak Juga Prosedur - The Brass Coq

Syarat Gadai BPKB Motor Di SMS Finance - The Brass Coq

10 Tabel Angsuran Pegadaian BPKB 2024 : Motor & Mobil - The Brass Coq

Mudah, Ini Dia Cara dan Syarat Untuk Gadai BPKB Mobil di Pegadaian - The Brass Coq

4 Tabel Angsuran Gadai BPKB Motor di Bank BRI 2024 & Syarat - The Brass Coq

Pinjaman Bank BRI Jaminan BPKB Motor/Mobil 2024 : Syarat, Tabel, dan - The Brass Coq

Cara Gadai BPKB Motor di Pegadaian? Syarat dan Info Lengkap - The Brass Coq

12 Syarat Gadai BPKB Motor di Pegadaian 2024 - The Brass Coq

12 Tabel Angsuran Gadai BPKB di Pegadaian 2024: Motor & Mobil - The Brass Coq

Tabel Angsuran Gadai Bpkb Motor Di Bank Bri - The Brass Coq

Cara Gadai BPKB Motor di Pegadaian hingga Syarat Lengkap - The Brass Coq

Cara Gadai BPKB Motor di Pegadaian hingga Syarat Lengkap - The Brass Coq