Imagine this: you're facing a situation requiring extended time off work – perhaps for health reasons, family care, or personal development. While these life events are important, the financial implications, particularly understanding 'pengiraan cuti separuh gaji' (half pay leave calculation), can feel overwhelming.

In Malaysia, where work-life balance is increasingly valued, grasping the concept of 'pengiraan cuti separuh gaji' becomes crucial. This intricate process determines the compensation received during periods when an employee is on approved leave but receives only half their regular salary.

Navigating the complexities of 'pengiraan cuti separuh gaji' might seem daunting, but it doesn't have to be. This comprehensive guide will equip you with the knowledge and tools to confidently approach this aspect of your financial planning.

We'll delve into the intricacies of 'pengiraan cuti separuh gaji,' breaking down the calculations, exploring its implications on your financial well-being, and providing practical tips for managing your finances during these periods.

Whether you're planning for an upcoming leave or simply want to be financially prepared, this guide aims to empower you with the knowledge to face 'pengiraan cuti separuh gaji' with confidence and ensure financial stability during challenging times.

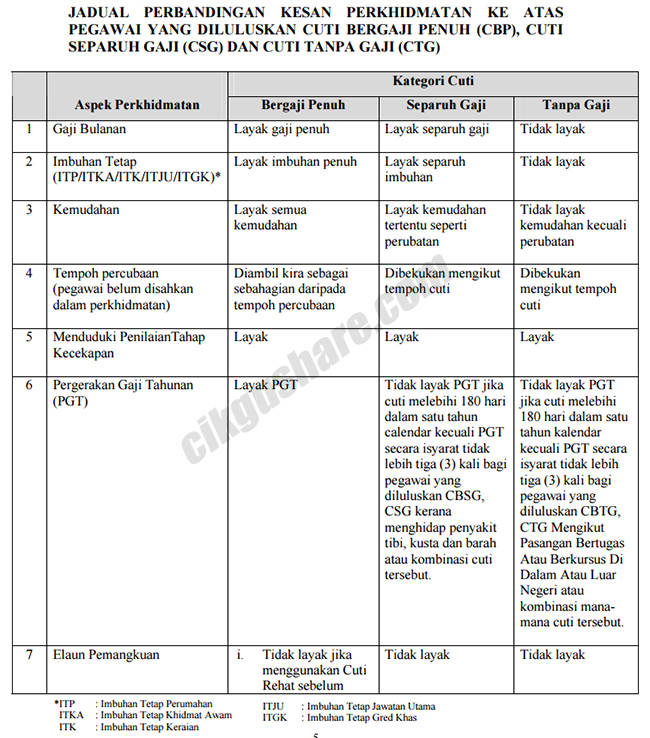

Advantages and Disadvantages of 'Pengiraan Cuti Separuh Gaji'

While 'pengiraan cuti separuh gaji' offers invaluable support during specific life events, it also comes with its own set of advantages and disadvantages. Understanding these can help you make informed decisions and plan your finances effectively.

| Advantages | Disadvantages |

|---|---|

| Provides financial support during extended leave | Reduced income can strain financial stability |

| Allows employees to prioritize personal matters without losing their jobs | May require adjustments to lifestyle and spending habits |

| Offers peace of mind and reduces financial stress during challenging times | Calculation methods might be complex and vary across organizations |

Best Practices for Managing Finances During 'Cuti Separuh Gaji'

Here are some practical strategies to help you manage your finances effectively during periods of 'cuti separuh gaji':

- Create a Realistic Budget: Assess your financial situation and create a comprehensive budget that aligns with your reduced income during the leave period. Identify and prioritize essential expenses.

- Build an Emergency Fund: Aim to have 3-6 months' worth of living expenses saved in an easily accessible account. This fund provides a financial cushion to cover unexpected costs.

- Explore Additional Income Sources: If possible, consider exploring freelance work or part-time opportunities to supplement your income during the leave period.

- Communicate with Creditors: Inform your creditors about your situation and explore potential options such as deferment plans or reduced payment arrangements.

- Seek Financial Guidance: Consult a financial advisor to discuss your options and develop a personalized financial plan tailored to your specific needs and circumstances.

Managing finances during 'cuti separuh gaji' requires careful planning and adjustment. By understanding the calculation process, planning, and seeking support when needed, you can navigate this period with greater financial security and peace of mind.

pengiraan cuti separuh gaji - The Brass Coq

KENAIKAN PANGKAT SECARA TIME - The Brass Coq

Cara Pengiraan Gaji Pekerja Yang Berhenti Contoh Pengiraan Yang Anda - The Brass Coq

Perintah am bab c (cuti) - The Brass Coq

Pekeliling Cuti Separuh Gaji Menjaga Ibu Sakit - The Brass Coq

Borang Cuti Tanpa Gaji Mengikut Pasangan Kpm - The Brass Coq

Kesan Cuti Tanpa Gaji Dalam Perkhidmatan Awam - The Brass Coq

SURAT PEKELILING PERKHIDMATAN BIL 4 TAHUN 2009 : KESAN KE ATAS - The Brass Coq

Cuti Separuh Gaji, Cuti Tanpa Gaji dan Kesannya Tehadap Perkhidmatan - The Brass Coq

Surat Permohonan Kerja Dari Rumah 2020 Corvette - The Brass Coq

Pekeliling Cuti Luput Terkini - The Brass Coq

borang_cuti_separuh_gaji by JokoJimin - The Brass Coq

pengiraan cuti separuh gaji - The Brass Coq

Pengiraan Cuti Tanpa Gaji Pekeliling Cuti Rehat Khas Pengiraan - The Brass Coq

Borang Cuti Separuh Gaji Kpm - The Brass Coq