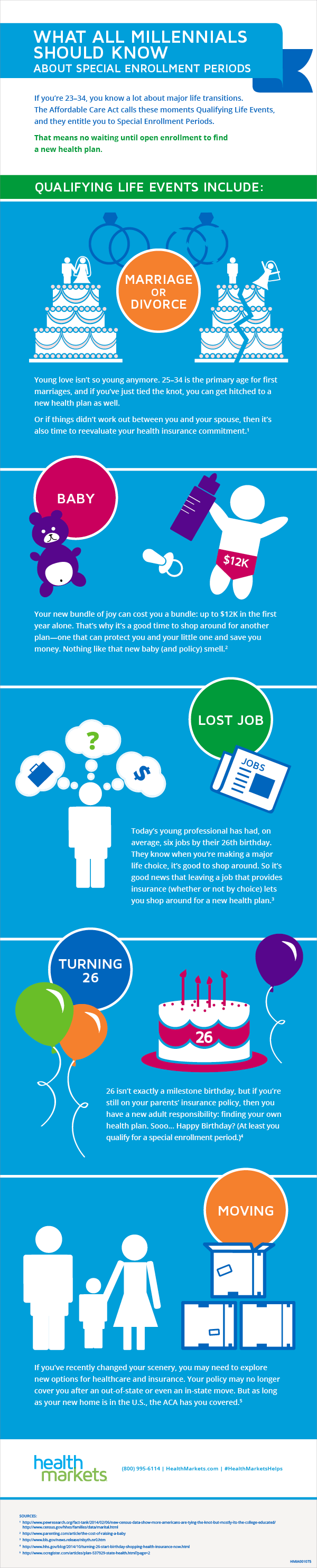

Life throws curveballs. A new job, a growing family, or even the loss of a loved one—these significant events can dramatically reshape our lives, and with those changes often come necessary adjustments to the safety nets we rely upon. Understanding how these life transitions intersect with our insurance and benefits is crucial to ensuring we're adequately protected and supported when we need it most. That's where the concept of "qualifying life events" comes in.

A qualifying life event signifies a major change in your personal circumstances that allows you to make changes to your health insurance, retirement plans, and other benefits outside of the typical open enrollment periods. These periods, often limited to a few weeks each year, are generally the only times you're allowed to adjust your elections. But life, as we know, doesn't always adhere to a neat and tidy schedule.

Imagine losing your job unexpectedly. Along with the stress of finding new employment, you'd also face the daunting task of securing health insurance for yourself and your family. Without the protection of a qualifying life event, you'd be left at the mercy of the next open enrollment period, potentially facing months without crucial coverage.

The origins of qualifying life events as a concept can be traced back to the need for flexibility and fairness within the complex world of benefits. Recognizing that life's biggest moments don't always align with predetermined enrollment windows, lawmakers and insurance providers established these special enrollment periods to offer individuals and families the opportunity to adapt their coverage during times of significant change.

The importance of understanding qualifying life events cannot be overstated. Failing to update your benefits during these crucial periods could leave you with inadequate coverage, missed savings opportunities, or even potential penalties. Navigating these transitions can feel overwhelming, but equipping yourself with the right knowledge can empower you to make informed decisions that safeguard your well-being and that of your loved ones.

Advantages and Disadvantages of Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage when you need it most | Limited time frame to make changes |

| Opportunity to enroll in benefits outside of open enrollment | Potential for confusion about eligibility and documentation |

Best Practices for Navigating Qualifying Life Events

1. Know Your Triggers: Familiarize yourself with the common qualifying life events. These can include marriage, divorce, birth or adoption of a child, job loss, changes in income, relocation, and more.

2. Act Quickly: You typically have a limited window, often 30 or 60 days, from the date of the qualifying event to make changes to your benefits.

3. Gather Documentation: Be prepared to provide supporting documents, such as marriage certificates, birth certificates, or termination letters, to verify the qualifying event.

4. Explore Your Options: Don't assume your current coverage is still the best fit. Take the time to research and compare plans to ensure you're getting the most value and protection.

5. Seek Guidance: If you're unsure about your options or the process, don't hesitate to seek assistance from your employer's HR department or an insurance professional.

Common Questions and Answers About Qualifying Life Events

1. What is considered a qualifying life event? Qualifying life events vary depending on your specific benefits and provider. Common examples include marriage, divorce, birth or adoption, job loss or changes in employment status, relocation, and changes in income.

2. How long do I have to make changes after a qualifying life event? You typically have 30-60 days from the date of the event. Check with your benefits provider for specific deadlines.

3. What documentation do I need to provide? Be prepared to submit documents such as marriage certificates, birth certificates, or termination letters to verify the qualifying event.

4. Can I change my coverage if I move to a new state? Yes, relocation is usually considered a qualifying event, allowing you to enroll in a new health insurance plan in your new state.

5. What happens if I miss the deadline to make changes? You may have to wait until the next open enrollment period to adjust your coverage.

6. Can I make changes to my spouse's or dependents' coverage during a qualifying event? Yes, qualifying life events often allow you to add or remove dependents or make changes to your spouse's coverage.

7. Do qualifying life events apply to all types of benefits? While most commonly associated with health insurance, these special enrollment periods can also apply to retirement plans, flexible spending accounts, and other benefits.

8. Where can I find more information about qualifying life events? Contact your employer's HR department, insurance provider, or consult reputable online resources like Healthcare.gov for detailed information.

Life is full of twists and turns. By understanding the power of qualifying life events, you can ensure that you and your loved ones are prepared for whatever life throws your way. These crucial windows of opportunity allow you to adjust your safety net when it matters most, offering peace of mind and vital protection during times of transition. Take the time to familiarize yourself with the qualifying events that apply to your situation and remember to act swiftly when life throws a curveball—your well-being may depend on it.

qualifying life event benefeds - The Brass Coq

Qualifying Life Events for Insurance: 2024 Guide - The Brass Coq

qualifying life event benefeds - The Brass Coq

New Special Enrollment Period Qualifying Life Events - The Brass Coq

What is a qualifying life event for health insurance? - The Brass Coq

The Amazing Truth About Qualifying Life Events for Millennials - The Brass Coq

qualifying life event benefeds - The Brass Coq

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior - The Brass Coq

qualifying life event benefeds - The Brass Coq

What Employers Need to Know About a Qualifying Life Event - The Brass Coq

Fillable Online Proof of qualifying life event form Fax Email Print - The Brass Coq

qualifying life event benefeds - The Brass Coq

qualifying life event benefeds - The Brass Coq

What is a qualifying life event for health insurance? - The Brass Coq

Due to qualifying life events, Federal Employees Health Benefits can - The Brass Coq