Navigating the world of employment in Malaysia involves understanding various aspects, one of the most crucial being how salaries are calculated. Whether you're a fresh graduate stepping into the workforce or an experienced professional, having a clear grasp of the salary calculation process is essential. It empowers you to ensure you're being compensated fairly and helps you plan your finances effectively.

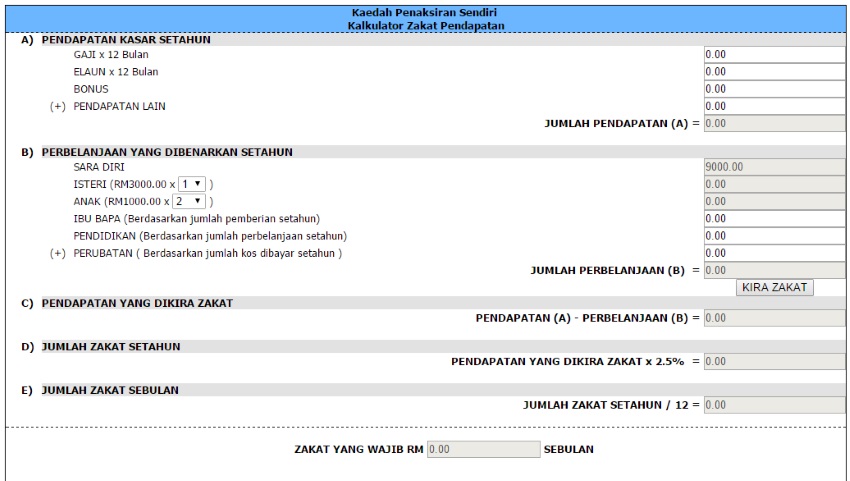

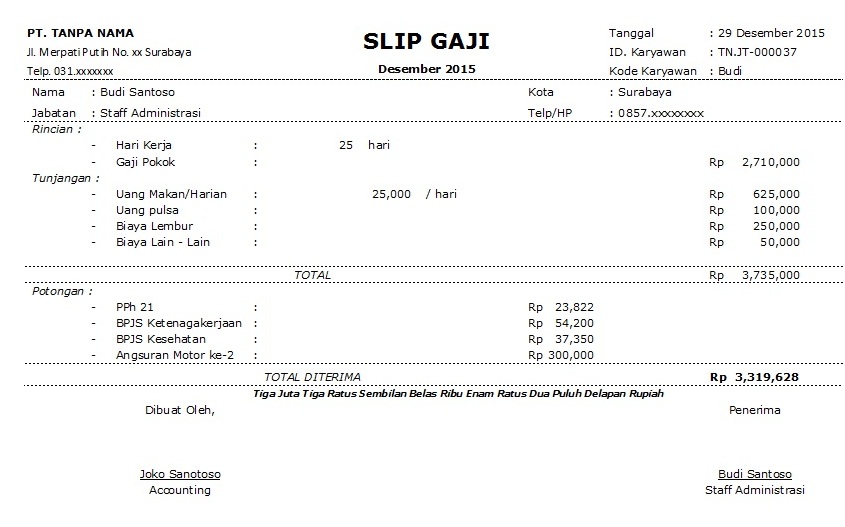

While the phrase "cara pengiraan gaji di Malaysia" directly translates to "how salary calculation in Malaysia," it encompasses a broader understanding of the Malaysian payroll system. This includes statutory contributions, allowances, deductions, and the legal framework governing employer-employee relationships concerning remuneration.

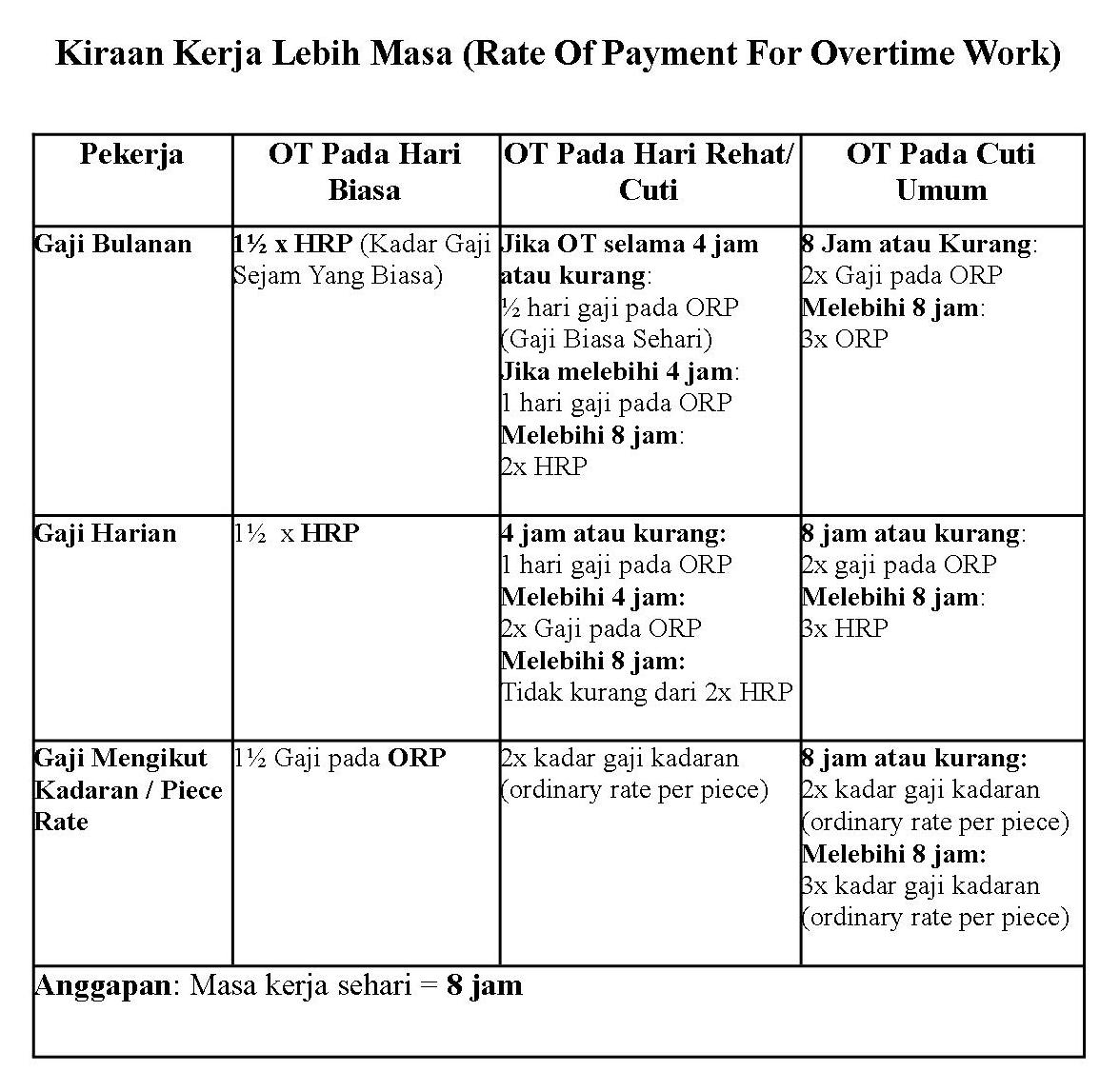

Historically, salary calculations were simpler, often involving basic pay and limited deductions. However, as the Malaysian economy developed and employment laws evolved, the process became more structured. The introduction of the Employment Act of 1955 laid down the groundwork for minimum wage, overtime pay, and other employee entitlements, significantly impacting how salaries are calculated. Over time, regulations regarding employee benefits, income tax, and social security contributions added layers to the calculation process.

Today, understanding "cara pengiraan gaji di Malaysia" is not just about knowing the formula but also about staying compliant with the ever-evolving legal landscape. Non-compliance can lead to disputes, penalties, and reputational damage for employers. For employees, a lack of understanding can result in discrepancies in their take-home pay and potential legal complications.

Several factors contribute to the complexity of salary calculations in Malaysia. One key aspect is the various types of employment contracts, ranging from permanent to contract-based and part-time arrangements, each with its own set of regulations influencing how salaries are determined. Additionally, various allowances, such as transportation, housing, and overtime, play a role, as do statutory deductions for contributions to the Employees Provident Fund (EPF), Social Security Organisation (SOCSO), and income tax.

Advantages and Disadvantages of a Transparent Salary Calculation System

| Advantages | Disadvantages |

|---|---|

| Builds trust and transparency between employers and employees | Can create salary disparities and potential dissatisfaction among employees in similar roles but with different experience levels |

| Reduces the likelihood of payroll errors and disputes | Requires meticulous record-keeping and updates to reflect changes in regulations or individual employee circumstances |

| Facilitates easier budgeting and financial planning for employees | May not always capture the full scope of an employee's contributions, especially in performance-based roles |

Understanding "cara pengiraan gaji di Malaysia" is not just about knowing what you earn but also about ensuring fairness, compliance, and financial well-being for both employers and employees. By staying informed and utilizing available resources, individuals and businesses can navigate the complexities of the Malaysian payroll system effectively.

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

cara pengiraan gaji di malaysia - The Brass Coq

Contoh Jadual Waktu Kerja Shift - The Brass Coq