Imagine a system where every employee is paid accurately and on time, where confusion around deductions is a thing of the past, and where the process is streamlined and efficient. This is the promise of a well-structured approach to payroll. Mastering the concepts of employee payroll calculation is fundamental for any business, big or small. It's more than just handing out paychecks; it's about building trust with your team and ensuring financial stability for everyone involved.

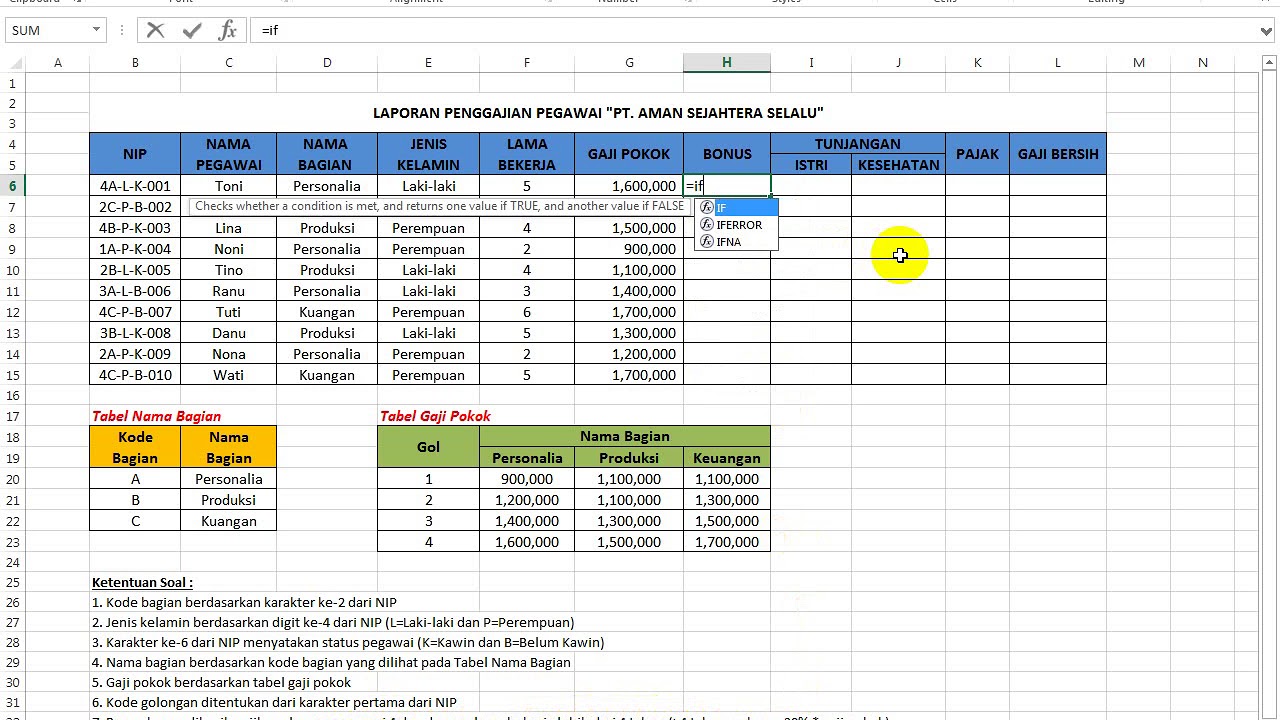

At its core, payroll calculation involves determining the exact amount of compensation due to each employee for their work. This seemingly simple task, however, involves a series of crucial steps to ensure accuracy and fairness. Let's break down the key elements that make up this process.

The journey begins with understanding the concept of "gross pay." This is the total amount an employee earns before any deductions, encompassing elements like regular hours worked, overtime, bonuses, and commissions. It forms the foundation upon which the rest of the calculation is built.

Next, we encounter "deductions," which can be either mandatory or voluntary. Mandatory deductions, like taxes and social security contributions, are required by law and vary based on location and income levels. Voluntary deductions, on the other hand, are chosen by the employee and can range from retirement plan contributions to health insurance premiums.

Finally, by subtracting the total deductions from the gross pay, we arrive at the "net pay." This is the amount that is actually paid out to the employee, often referred to as the "take-home pay." Each of these components plays a vital role in ensuring a transparent and accurate payroll system, fostering trust between employer and employee.

Advantages and Disadvantages of Accurate Payroll Systems

| Advantages | Disadvantages |

|---|---|

| Increased employee satisfaction and morale | Implementation and maintenance costs for software or outsourcing |

| Reduced risk of legal issues and penalties | Potential for errors if not implemented or managed properly |

| Improved financial planning and budgeting | Time commitment required for data entry and verification |

While implementing a robust payroll system offers numerous advantages, it's important to be aware of potential challenges. One common hurdle is managing the complexities of evolving tax laws and regulations, which require consistent updates and adaptations. Another challenge lies in maintaining employee data privacy and security, especially in today's digital age. By acknowledging these challenges and proactively seeking solutions, businesses can create a payroll system that is both effective and sustainable.

In conclusion, comprehending the foundations of employee payroll calculation is not merely a task for the accounting department; it's an integral part of cultivating a healthy and trusting work environment. By grasping the core concepts, navigating potential challenges, and leveraging available resources, businesses can establish a payroll system that benefits everyone involved. Remember, accurate and timely payments are more than just numbers; they are a testament to the value you place on your employees and the foundation for a thriving workplace.

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

Dasar Pengenaan Pajak Pph 21 - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq

konsep perhitungan daftar gaji karyawan - The Brass Coq