In a world increasingly reliant on digital footprints and online transactions, the concept of documentation remains paramount. There's a certain gravity, a weight, that comes with holding a tangible record, a physical manifestation of financial activity. In the realm of Islamic finance, this takes on even greater significance.

'Salinan akaun bank Islam,' the Malay term for 'copy of Islamic bank account statement,' might seem like a purely technical phrase. However, it represents a crucial element within the ecosystem of Islamic banking, underpinning transparency, accountability, and adherence to Shariah principles.

The need for such documentation is deeply rooted in the principles of Islamic finance. Transparency, in particular, is paramount. Every transaction, every movement of funds, must be clear, traceable, and justifiable. This ensures that all financial dealings comply with the ethical and moral framework of Islamic law, prohibiting activities like interest (riba) and excessive speculation (gharar).

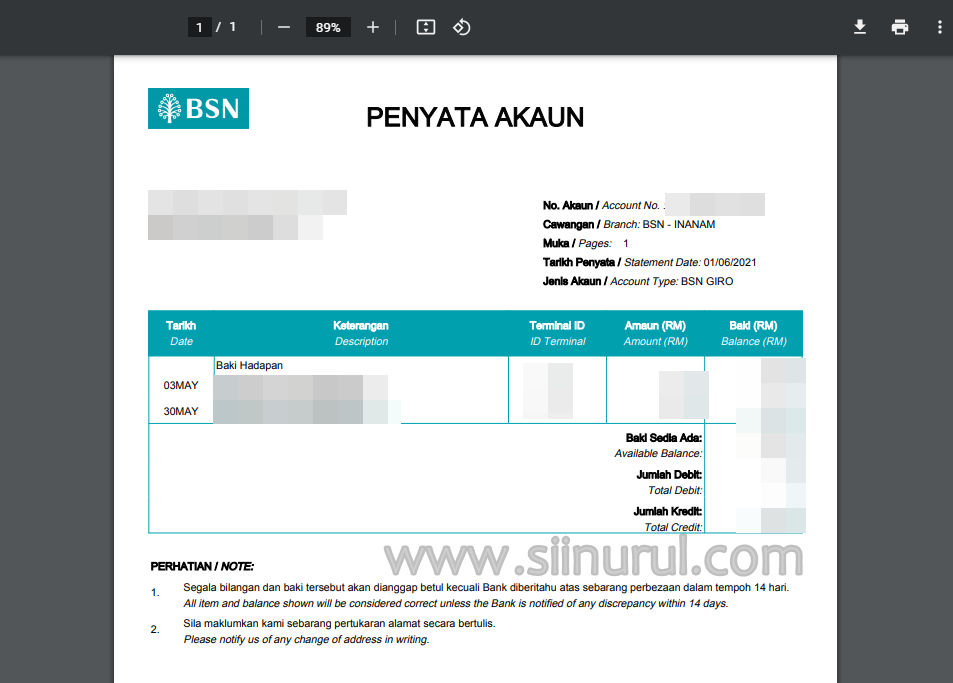

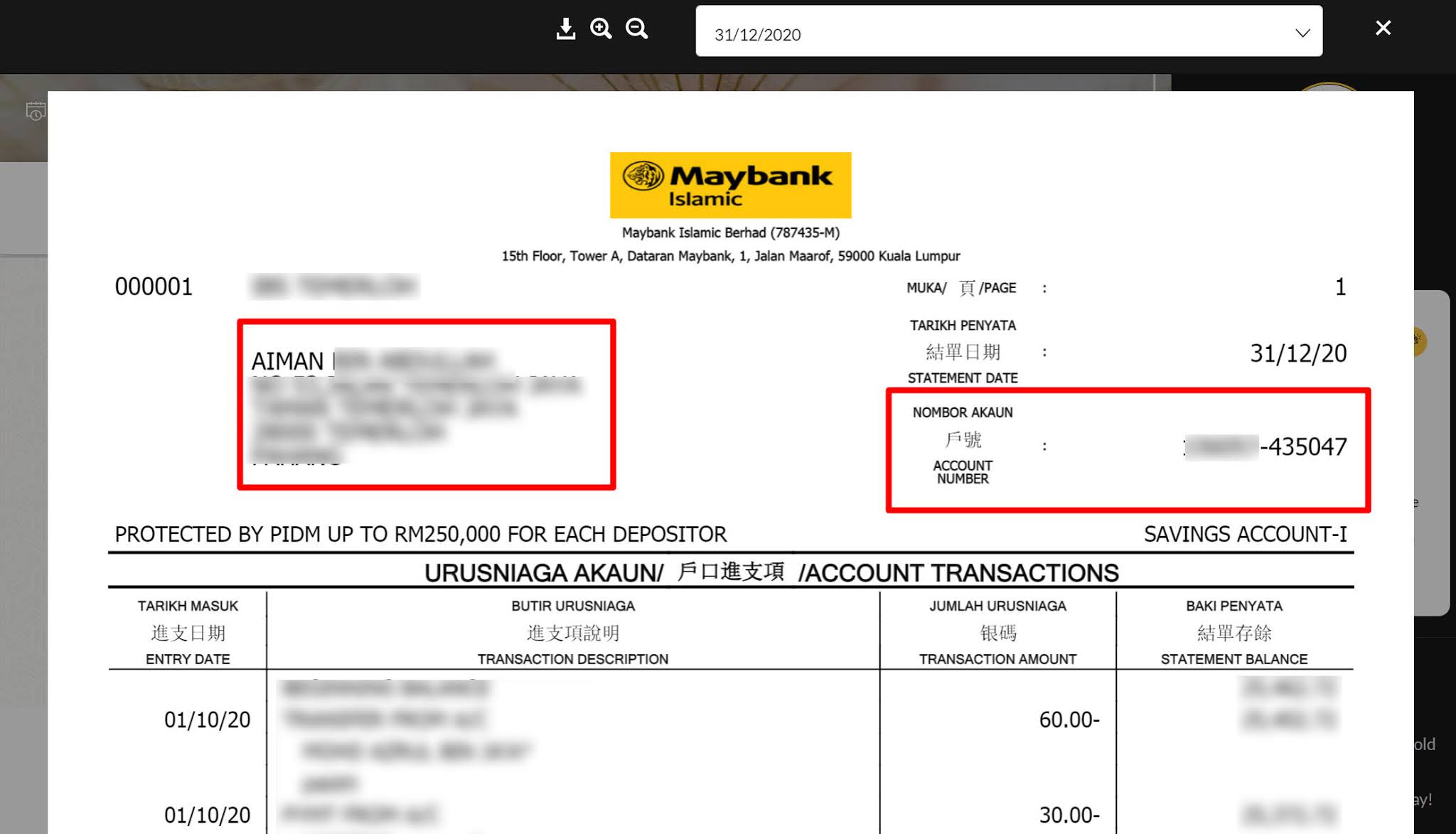

The 'salinan akaun bank Islam' serves as a window into the operations of an account. It's a detailed record, meticulously outlining deposits, withdrawals, transfers, and any profits or losses incurred through Shariah-compliant investments. This level of detail is not merely for record-keeping. It empowers account holders to scrutinize their financial activities, ensuring alignment with their own ethical values and the principles of Islamic finance.

The significance of this document extends beyond personal accountability. It plays a crucial role in maintaining the integrity of the Islamic financial system as a whole. Regulatory bodies utilize 'salinan akaun bank Islam' to supervise and audit Islamic financial institutions, ensuring their compliance with Shariah guidelines and guarding against any practices that contradict the spirit of Islamic finance.

While obtaining a 'salinan akaun bank Islam' might seem like a simple procedural step, it embodies a much deeper philosophy. It's a tangible representation of the principles of transparency, accountability, and ethical conduct that lie at the heart of Islamic finance. In a world often driven by opaque financial dealings, the emphasis on clarity and ethical consciousness offered by 'salinan akaun bank Islam' stands out as a beacon of responsible financial practice.

Advantages and Disadvantages of Salinan Akaun Bank Islam

| Advantages | Disadvantages |

|---|---|

| Transparency and Accountability | Potential for Paperwork |

| Compliance with Shariah Principles | Privacy Concerns (if physical copies are shared inappropriately) |

| Empowerment of Account Holders |

Understanding the nuances of 'salinan akaun bank Islam' requires looking beyond its functional aspect. It's about recognizing the ethical foundation upon which Islamic finance is built. This document, while seemingly simple, represents a commitment to transparency and accountability, shaping a financial landscape that is both ethical and sustainable.

salinan akaun bank islam - The Brass Coq

Cara Transfer Duit Ke Tabung Haji Melalui Bank Islam Online - The Brass Coq

Cara Dapatkan Penyata Bank Islam - The Brass Coq

Contoh Salinan Akaun Bank Islam - The Brass Coq

Cara Dapatkan Bank Statement Cimb Bank Melalui Cimbclicks - The Brass Coq

Contoh Bank Statement Bank Islam Dan Cara Download Online - The Brass Coq

Semakan Penyata Bank Islam Online - The Brass Coq

salinan akaun bank islam - The Brass Coq

Salinan Akaun Bank Islam Tanpa Buku 2024 - The Brass Coq

Salinan Slip Muka Depan Akaun Bank 3 Cara Dapatkan Penyata Simpanan - The Brass Coq

Contoh Nombor Akaun Bank Islam - The Brass Coq

Contoh Salinan Akaun Bank At Cermati - The Brass Coq

Bank Islam Malaysia Berhad - The Brass Coq

Contoh Salinan Akaun Bank - The Brass Coq

Contoh Salinan Akaun Bank at Cermati - The Brass Coq