In today's fast-paced digital world, it's easy to forget about the enduring relevance of the humble check. Yet, for certain transactions and individuals, checks remain an essential tool in the financial toolkit. Whether it's sending a thoughtful gift, navigating a specific financial situation, or simply your preferred method of payment, having a fresh supply of checks on hand is key.

For those of us who appreciate a seamless and streamlined approach to managing our finances, knowing the most efficient ways to order new checks is essential. And when it comes to banking, few institutions are as recognizable and widely used as Wells Fargo.

Navigating the world of banking can sometimes feel like traversing a labyrinth of options and information. That's why we're here to demystify the process of ordering Wells Fargo checks, providing you with the clarity and guidance you need to navigate this essential financial task with ease.

Whether you're a seasoned check-writer or new to this particular financial dance, we'll explore the various avenues available to you, ensuring a smooth and effortless experience. From the comfort of your own home to the in-person assistance of a local branch, we'll illuminate the path to replenishing your check supply with minimal effort and maximum efficiency.

So, let's dive into the world of Wells Fargo check ordering, empowering you to manage your finances with confidence and grace.

Advantages and Disadvantages of Ordering Checks Through Different Methods

When it comes to ordering new Wells Fargo checks, you have several options at your disposal. Each method comes with its own set of advantages and disadvantages, catering to different preferences and lifestyles. Let's break down the pros and cons of each approach to help you determine the most suitable route for your needs.

| Method | Advantages | Disadvantages |

|---|---|---|

| Online |

|

|

| Phone |

|

|

| In-Person |

|

|

Best Practices for Ordering Wells Fargo Checks

Whether you're a seasoned checkbook aficionado or new to the world of personal finance, ordering checks doesn't have to be a daunting task. Follow these best practices to ensure a smooth and hassle-free experience:

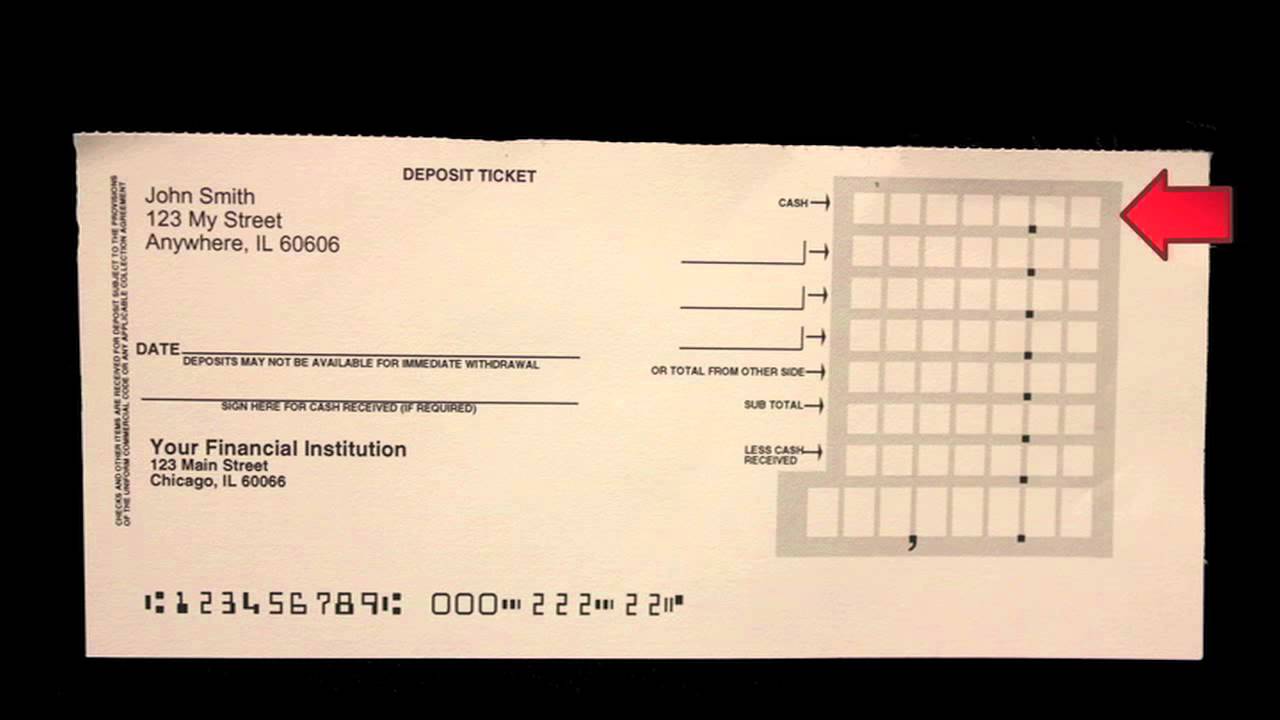

- Gather Your Information. Before you embark on the check-ordering journey, have your Wells Fargo account number and routing number handy. These vital details are usually found at the bottom of your checks.

- Verify Your Address. Ensure that your current mailing address is up-to-date with Wells Fargo to prevent any delivery hiccups. You can easily update your address online, over the phone, or in person at a branch.

- Review Your Order Carefully. Before finalizing your order, double-check all details, including the check design, quantity, and shipping address, to avoid any surprises.

- Keep a Record of Your Order. After placing your order, make note of the order confirmation number and expected delivery timeframe. This information will come in handy if you need to track your order or contact customer service.

- Securely Store Your New Checks. Once you receive your freshly minted checks, store them in a safe and secure location to prevent loss, theft, or unauthorized use.

Common Questions About Ordering Wells Fargo Checks

We understand that you might have a few lingering questions about ordering Wells Fargo checks. Here are answers to some frequently asked questions to provide further clarity and guidance.

How long does it take to receive new checks from Wells Fargo?

The delivery timeframe for new checks typically ranges from 7 to 10 business days. However, this can vary depending on factors such as the chosen shipping method and order volume.

Can I order checks if my account is new?

Yes, you can order checks for a new Wells Fargo account. Simply follow the standard ordering process online, by phone, or at a branch.

What should I do if I don't receive my checks within the expected timeframe?

If your checks haven't arrived within the estimated delivery window, reach out to Wells Fargo customer service for assistance.

Can I order checks for someone else's Wells Fargo account?

For security reasons, only the account holder can order checks.

Can I use my old checks if I order new ones?

While technically possible, it's generally not recommended to use old checks once you've ordered new ones. This helps prevent any confusion or issues with check numbers and account details.

Are there any fees for ordering checks?

Fees for ordering checks can vary depending on your account type and the chosen check design. It's always a good idea to confirm the fee structure with Wells Fargo during the ordering process.

Can I cancel or change my check order after it's been placed?

The ability to cancel or modify a check order depends on the order's status. If you need to make changes, contact Wells Fargo customer service as soon as possible.

What should I do if my checks are lost or stolen?

If you suspect your checks have been lost or stolen, it's crucial to report this to Wells Fargo immediately to prevent unauthorized use. They will guide you through the necessary steps to protect your account.

Tips for Managing Your Checks

Effortlessly navigating the realm of personal finance goes beyond simply ordering checks. Here are a few additional tips to elevate your check-writing and financial management game:

- Use a Pen with Permanent Ink. Opt for a pen with indelible ink to prevent alterations or fraud when writing checks.

- Record All Transactions. Diligently track every check you write in your check register to maintain accurate account balances and avoid overspending.

- Reconcile Your Account Regularly. Take the time to reconcile your Wells Fargo account statement with your check register each month to identify any discrepancies and ensure accuracy.

- Consider Online and Mobile Banking. Embrace the convenience of online and mobile banking to monitor your account, pay bills electronically, and stay informed about your finances.

Conclusion

In a world increasingly dominated by digital transactions, there's a certain satisfaction that comes with the tangible act of writing a check. Whether it's for a special occasion, a specific payee, or simply personal preference, having a fresh supply of checks on hand empowers you to manage your finances with ease and confidence. Ordering new checks from Wells Fargo is a straightforward process with several convenient options to suit your lifestyle. From the efficiency of online ordering to the personalized assistance of a local branch, you have the flexibility to choose the method that aligns best with your needs. By following the best practices outlined in this guide and staying informed about your account details, you can navigate the world of check ordering and financial management with grace and ease.

Wells Fargo Corporate Office Headquarters Address, Email, Phone Number - The Brass Coq

The Routing Number and Wells Fargo Pany - The Brass Coq

What is a cashier's check? - The Brass Coq

Wells, Fargo & Co. Checks - The Brass Coq

Online Wire Limit Wells Fargo at Rodney Maddux blog - The Brass Coq

Can I Print My Own Checks Wells Fargo - The Brass Coq

Wells Fargo Cashiers Check Psd Template with regard to Cashiers Check - The Brass Coq

Print Chase Deposit Slip - The Brass Coq

order new checks wells fargo phone number - The Brass Coq

Wells Fargo Routing Number - The Brass Coq

Wells Fargo Sample Bank Statement 2nd PDF.pdf - The Brass Coq

Cashier's check examples, examples of Cashier's check - The Brass Coq

Wells fargo routing number - The Brass Coq

Wells Fargo Routing Number - The Brass Coq

Wells Fargo Printable Checks - The Brass Coq