Dreaming of open waters and the gentle rocking of a boat? Securing a boat loan often hinges on your creditworthiness. Understanding the role of your credit score in this process can be the difference between realizing your nautical dreams and staying ashore.

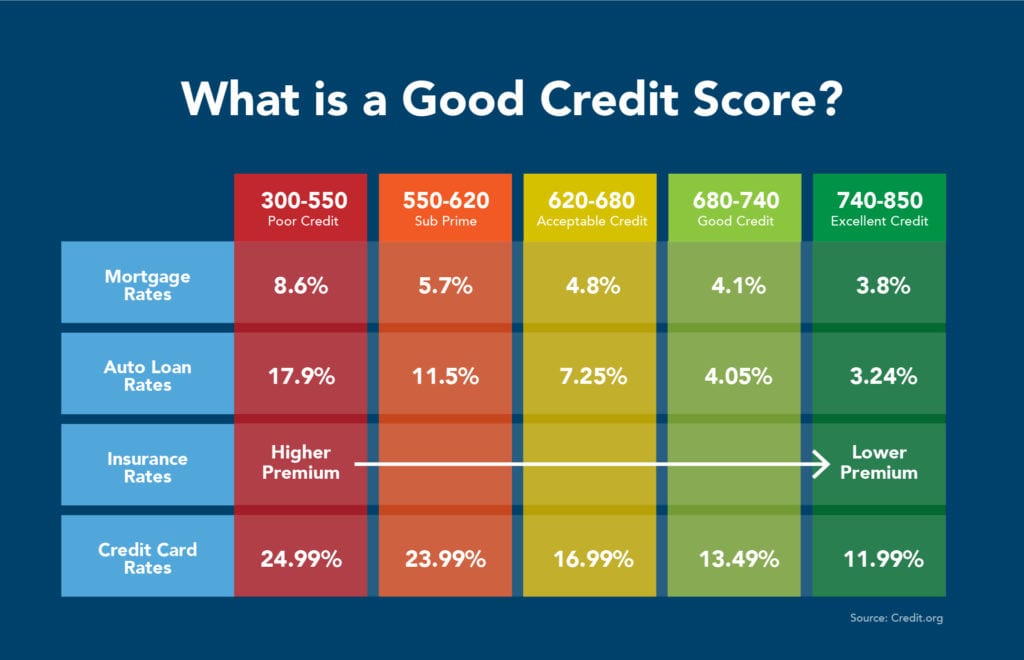

The credit score required for a boat loan is a key factor lenders consider when assessing your application. Like a map guiding your financial journey, your credit score provides lenders with insights into your financial responsibility. This numerical representation of your borrowing history helps determine the likelihood of you repaying the loan. A higher credit score generally translates to better loan terms, including lower interest rates and more favorable repayment periods.

Lenders utilize credit scores to gauge the risk associated with lending money. A strong credit score signals responsible financial behavior, suggesting a lower likelihood of defaulting on the loan. Conversely, a lower credit score may indicate a higher risk, potentially leading to higher interest rates or even loan denial. The specific credit score needed for a boat loan can vary based on factors such as loan amount, loan term, and the lender's individual policies.

While the exact credit score requirement can fluctuate, generally, a credit score above 650 is considered good for securing a boat loan. A score above 700 may qualify you for even more competitive rates and terms. However, even with a lower credit score, securing a boat loan may still be possible. Some lenders specialize in working with individuals with less-than-perfect credit, though these loans may come with higher interest rates and less favorable conditions.

Preparing for a boat loan application involves understanding your credit standing. Checking your credit report and addressing any inaccuracies is crucial. Building a positive credit history by paying bills on time, maintaining low credit card balances, and avoiding excessive debt can significantly improve your chances of loan approval. Demonstrating stable income and employment history also strengthens your application.

Factors influencing boat loan approval extend beyond credit score. Lenders also assess your debt-to-income ratio, employment history, and the value of the boat itself. The age and condition of the vessel play a role, as older or poorly maintained boats may pose a higher risk for the lender.

A higher credit score typically unlocks more advantageous loan terms. Lower interest rates, flexible repayment periods, and potentially lower down payment requirements are often associated with stronger credit profiles. This can lead to significant savings over the life of the loan.

Advantages and Disadvantages of Focusing on Credit Score for Boat Loans

| Advantages | Disadvantages |

|---|---|

| Better Loan Terms | Credit Score Isn't Everything |

| Increased Negotiation Power | Time and Effort to Improve Score |

Frequently Asked Questions about Credit Score for Boat Loans:

1. What is the minimum credit score for a boat loan? The minimum credit score varies by lender, but generally, a score above 650 is favorable.

2. Can I get a boat loan with bad credit? It's possible, but expect higher interest rates and stricter terms.

3. How can I improve my credit score? Pay bills on time, reduce debt, and avoid opening new credit accounts unnecessarily.

4. What factors besides credit score affect loan approval? Income, employment history, and the boat's value are considered.

5. How much of a down payment is required for a boat loan? Down payments typically range from 10% to 20% of the boat's purchase price.

6. What is the typical loan term for a boat loan? Loan terms vary, but typically range from 5 to 20 years.

7. What are some reputable boat loan lenders? Research lenders specializing in marine financing.

8. How can I pre-qualify for a boat loan? Many lenders offer pre-qualification options to estimate loan terms without impacting your credit score.

Tips for improving your credit score for a boat loan include consistently paying bills on time, reducing credit card balances, and limiting new credit applications. Monitoring your credit report regularly for errors and addressing any discrepancies promptly is also crucial.

Securing a boat loan is a significant step towards realizing your boating aspirations. Understanding the role of your credit score in this process is paramount. By actively managing your credit health and preparing thoroughly for the loan application, you can navigate the waters of boat financing with confidence and set sail towards your dream vessel. Begin by checking your credit report, addressing any issues, and building a strong financial foundation. The journey to owning a boat begins with a clear understanding of your creditworthiness and a commitment to responsible financial practices. Don't wait; start charting your course today!

Can I get a loan with credit score of 500 Leia aqui Can I get - The Brass Coq

credit score needed to get a boat loan - The Brass Coq

What Credit Score Is Needed to Buy a House - The Brass Coq

What Credit Score is Needed for a Student Loan - The Brass Coq

What Credit Score Is Needed to Buy a House in 2022 - The Brass Coq

Credit score ranges chart - The Brass Coq

Cars You Can Get With 600 Credit Score - The Brass Coq

How To Get A Boat Loan - The Brass Coq

Capital One Venture X Application Requirements Are you Eligible to Apply - The Brass Coq

What Credit Score is Needed to Buy a House - The Brass Coq

What Credit Score Do You Need For Clayton Homes at Josephine Torres blog - The Brass Coq

Which type of loan can you possibly qualify for with a credit score of - The Brass Coq

Capital One Platinum Card Credit Score Needed for Approval 2024 - The Brass Coq

Can you finance a motorcycle with a FICO score of 620 Leia aqui Can I - The Brass Coq

Credit score needed for the Chase Sapphire Preferred - The Brass Coq