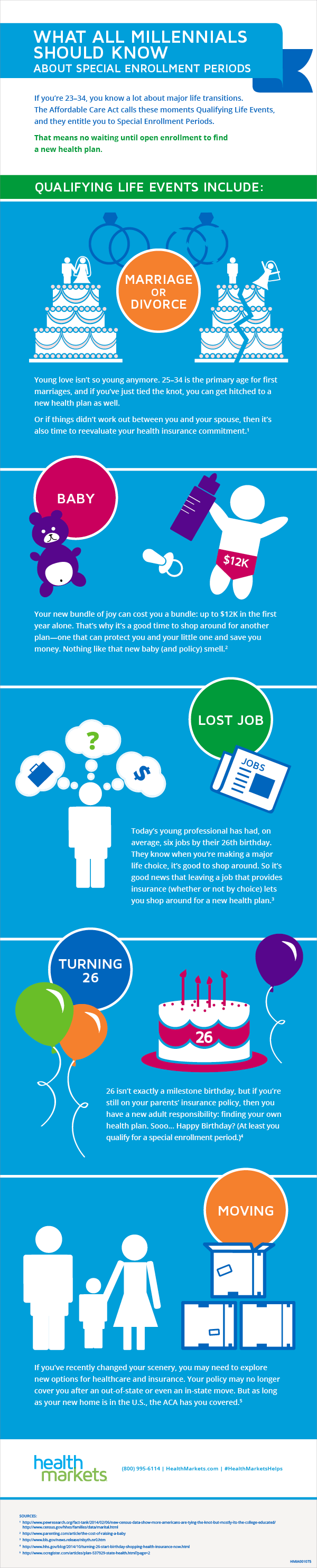

Life is a tapestry of moments, some subtle and mundane, others significant enough to shift our direction entirely. These pivotal crossroads, often termed "qualifying life events," act as windows of opportunity to reassess our choices and make necessary adjustments to crucial aspects of our lives, like healthcare, finances, and benefits.

Imagine a pebble dropped into still water. The ripples it creates represent the impact of these life events. A new job, marriage, the birth of a child, or even the loss of a loved one—each occurrence carries a weight that extends beyond the immediate experience.

Navigating these events with clarity and awareness is crucial. It's about recognizing the potential impact on our well-being and that of our loved ones, allowing us to make informed decisions that align with our evolving needs.

Think of "qualifying life events" as a gentle nudge from the universe, a reminder to pause, reflect, and ensure that the choices we've made continue to serve us in the best way possible. This isn't about adding stress to already significant moments; it's about empowerment—understanding our options and taking control during times of change.

In a world that often feels chaotic and uncertain, understanding these "qualifying life events" provides a sense of agency. It allows us to move forward, not with fear or uncertainty, but with a sense of preparedness, knowing we're equipped to handle whatever life throws our way. This understanding can be the key to unlocking greater peace of mind and stability as we journey through life's many chapters.

Advantages and Disadvantages of Qualifying Life Events

| Advantages | Disadvantages |

|---|---|

| Opportunity to re-evaluate coverage needs | Potential for increased costs with changes |

| Flexibility to make changes outside of open enrollment periods | Time sensitivity requiring prompt action |

| Possibility to add or remove dependents from coverage | Complexity in understanding qualifying events and options |

5 Best Practices for Navigating Qualifying Life Events

1. Stay Informed: Familiarize yourself with common qualifying life events and their implications for your specific circumstances.

2. Document Everything: Maintain records of the event, including dates, relevant documentation, and correspondence.

3. Act Promptly: Most qualifying events have time limits for making changes, so avoid delays.

4. Seek Guidance: Don't hesitate to reach out to benefit providers, employers, or insurance agents for clarification.

5. Review Regularly: Even without a qualifying event, periodically assess your coverage needs to ensure alignment with your life stage.

8 Common Questions & Answers about Qualifying Life Events

1. What is a Qualifying Life Event?

A significant change in your life, like marriage, birth, or job loss, that allows you to update your insurance or benefits outside the standard enrollment periods.

2. How Long Do I Have to Make Changes?

The timeframe varies, typically 30-60 days from the event date, so check your plan documents.

3. What If My Employer Doesn't Offer Coverage?

You might explore options through a spouse's plan or the Health Insurance Marketplace.

4. Do All Life Events Qualify?

No, there's a specific list, so consult your plan documents or provider for what's considered a qualifying event.

5. Can I Change Plans During These Periods?

Yes, qualifying events often permit switching plans to better suit your new circumstances.

6. What Proof Do I Need to Provide?

Documentation might include marriage certificates, birth certificates, or termination notices, depending on the event.

7. Where Do I Report a Qualifying Life Event?

Contact your employer's benefits department, your insurance provider, or the Marketplace, if applicable.

8. What If I Miss the Deadline?

You might have to wait until the next open enrollment period to make changes, so act promptly.

Life, in its essence, is about change. While we might not be able to predict when these "qualifying life events" will occur, understanding their significance empowers us to navigate them with greater clarity and confidence. By recognizing these moments as opportunities for reevaluation and adjustment, we transform potential stress into stepping stones, paving the way for a more secure and fulfilling future. Take the time to understand your options, seek guidance when needed, and remember that with each change comes the chance to shape a life that aligns with your evolving needs and aspirations.

Qualifying Life Events and the Impact on Health Insurance - The Brass Coq

What is a qualifying life event for health insurance? - The Brass Coq

The Amazing Truth About Qualifying Life Events for Millennials - The Brass Coq

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior - The Brass Coq

Fillable Online Proof of Qualifying Life Event Form Fax Email Print - The Brass Coq

Fillable Online Proof of qualifying life event form Fax Email Print - The Brass Coq

What Qualifies You For a Special Enrollment Period? - The Brass Coq

What is a qualifying life event? - The Brass Coq

Qualifying Life Events for Health Insurance - The Brass Coq

Init feature become verify via who Supervisors for Choice at of - The Brass Coq

What is a qualifying life event for health insurance? - The Brass Coq

Updating your benefits through a qualifying status change (life event) - The Brass Coq

Due to qualifying life events, Federal Employees Health Benefits can - The Brass Coq

Understanding Qualifying Life Events (QLEs) - The Brass Coq

Qualifying Life Events for Insurance: 2024 Guide - The Brass Coq