There's a certain elegance in efficiency, a quiet confidence in knowing things are in order. It's a principle that extends beyond the perfectly tailored suit or a well-appointed room; it's about streamlining the everyday, especially when it comes to significant financial commitments. In Malaysia, for many, that commitment begins with a PTPTN loan, a stepping stone to higher education. And just as technology has revolutionized how we learn, it's now transforming how we manage these loans, ushering in an era of transparency and ease with the PTPTN penyata pinjaman online.

Gone are the days of waiting in line, paper trails, and uncertainty. The digital age has ushered in a new era of financial management, and PTPTN, Malaysia's National Higher Education Fund Corporation, has embraced this evolution with the introduction of the online loan statement, or "penyata pinjaman online". This digital shift isn't merely about convenience; it represents a commitment to empowering borrowers with immediate access to their loan information, fostering a sense of ownership and responsibility from the outset.

To truly appreciate the significance of this online transformation, we need to rewind a bit. For years, PTPTN has played a pivotal role in shaping Malaysia's future by providing financial assistance to students pursuing higher education. The traditional system, while functional, often involved bureaucratic hurdles and a lack of immediate access to crucial information. Borrowers would have to physically visit PTPTN offices or wait for mailed statements, leading to potential delays and a sense of detachment from their financial obligations. The introduction of the online statement marks a significant departure from this model, placing the power of information directly in the hands of the borrower.

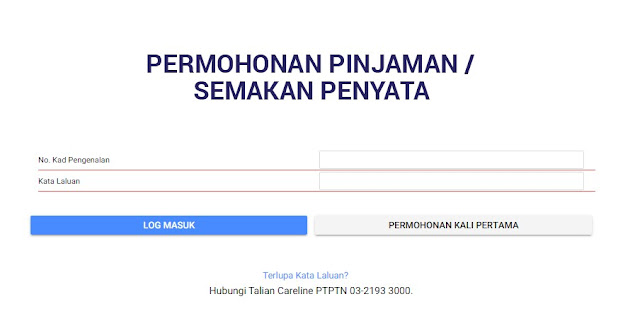

Imagine this: a recent graduate, fresh with ambition and ready to embark on their career journey. They can log in to the PTPTN portal from anywhere, at any time, and instantly access a detailed breakdown of their loan: the outstanding balance, repayment schedule, and even make payments with a few clicks. This level of transparency isn't just convenient; it's empowering. It allows borrowers to proactively manage their finances, make informed decisions about their repayment strategies, and ultimately, take charge of their financial futures.

The beauty of the PTPTN penyata pinjaman online lies in its simplicity and accessibility. It democratizes financial information, making it readily available to everyone, regardless of their tech-savviness. The platform is designed with user-friendliness in mind, featuring a clean interface and straightforward navigation that allows borrowers to effortlessly find the information they need. This ease of use removes the barriers that often intimidate individuals from engaging with their finances, promoting a sense of awareness and control that's crucial for responsible financial management.

Advantages and Disadvantages of PTPTN Penyata Pinjaman Online

| Advantages | Disadvantages |

|---|---|

| Convenience and 24/7 Accessibility | Requires Internet Access |

| Real-time Information and Updates | Potential for Security Risks (if not accessed through official channels) |

| Enhanced Transparency and Control | Technical Issues (website downtime, etc.) |

| Environmentally Friendly (reduces paper waste) | |

| Easy Payment Options |

In conclusion, the introduction of the PTPTN penyata pinjaman online marks a significant milestone in Malaysia's journey towards a digitally empowered society. It signifies a shift from a traditional, often cumbersome system to one that prioritizes transparency, accessibility, and user empowerment. By providing borrowers with the tools to effortlessly manage their loans, PTPTN is fostering a generation of financially responsible individuals equipped to navigate the complexities of personal finance with confidence and clarity. This digital transformation is not just about convenience; it's about building a more financially literate and empowered Malaysia, one online statement at a time.

Cara Semak Baki Pinjaman PTPTN (Online & SMS) - The Brass Coq

Semakan Penyata Pinjaman PTPTN Online - The Brass Coq

Cara Semak Baki Pinjaman PTPTN Secara Online - The Brass Coq

Semakan Penyata Pinjaman PTPTN Online - The Brass Coq

Semakan PTPTN: Semak Status Permohonan & Penyata Baki Pinjaman - The Brass Coq

Permohonan Diskaun dan Penangguhan Bayaran Pinjaman PTPTN Tahun 2023 - The Brass Coq

Semak Baki PTPTN Korang Disini, Simple & Pantas! - The Brass Coq

ptptn penyata pinjaman online - The Brass Coq

9 Steps to Pay Your Outstanding PTPTN Balance Online - The Brass Coq

Semak Penyata Pinjaman PTPTN Online - The Brass Coq

Cara Semakan Penyata Baki Pinjaman PTPTN Online - The Brass Coq

Cara Semak Nombor Pinjaman PTPTN Secara Online - The Brass Coq

Semakan Baki PTPTN Online & Cara Langsaikannya Secara Percuma! - The Brass Coq

Cara Check Baki Bayaran Balik Pinjaman PTPTN (Online) - The Brass Coq

Cara Daftar Bayaran Balik PTPTN Dengan Direct Debit Online - The Brass Coq