So, you need to send a payment that absolutely, positively has to be guaranteed. No bouncing, no waiting for clearance, just cold, hard cash (well, almost). You might be staring down a big purchase, maybe a down payment on a house or a used car from a seller who doesn't want to deal with personal checks.

Enter the official check, a seemingly old-fashioned but surprisingly useful tool in our digital age. Unlike a regular personal check, an official check is drawn directly on the bank's funds, giving it an extra layer of security and trustworthiness that your average check just doesn't have.

While electronic payments become more prevalent, sometimes you need the tangible nature of a paper document. This is where official checks, like those offered by Wells Fargo Bank, come into play. They bridge the gap between traditional banking and modern financial needs, providing a secure and reliable form of payment.

Let's be real, though. An official check isn't your daily driver when it comes to payments. They come with fees, and you'll need to physically visit a branch to get one. So, when does this financial dinosaur actually make sense? Think large transactions where the recipient wants that extra peace of mind. We're talking real estate deals, situations where a personal check just won't cut it.

Now, before you run off to the nearest Wells Fargo branch, let's dig into the nitty-gritty of official checks, how they work, and whether they're the right solution for your payment needs.

Advantages and Disadvantages of Official Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed by the bank, reducing risk of non-payment | Often come with a fee |

| Provide a physical record of payment | Require a trip to the bank |

| Accepted in situations where personal checks may not be | Can be less convenient than electronic payments |

Best Practices for Using Official Checks

1. Confirm Acceptance: Before you go through the hassle of getting an official check, double-check with the recipient that they will accept this form of payment.

2. Accurate Information: Ensure all the payee information is correct to avoid any delays or complications with cashing the check.

3. Secure Handling: Treat an official check like cash. Keep it in a safe place and report any loss or theft immediately to the bank.

4. Record Keeping: Always keep a record of the check number, date, amount, and the payee's name for your records.

5. Explore Alternatives: Consider if other forms of payment, like a wire transfer or cashier's check, might be more efficient for your needs.

Common Questions About Official Checks from Wells Fargo Bank

1. How much does an official check from Wells Fargo Bank cost? Fees can vary, so it's best to check with your local branch or Wells Fargo's website for the most up-to-date pricing.

2. Do I need to be a Wells Fargo customer to get an official check? You usually need an account with Wells Fargo to obtain an official check.

3. Can I get an official check online? Typically, you need to visit a Wells Fargo branch in person to request an official check.

4. How long is an official check from Wells Fargo Bank good for? Official checks do not usually expire, but it's best to confirm with the bank.

5. What if my official check is lost or stolen? Contact Wells Fargo immediately to report the issue and inquire about a replacement.

6. Can I track an official check? While not as trackable as electronic payments, you should be able to request a copy of the cashed check image from Wells Fargo for your records.

7. Are there limits on the amount of an official check? This varies by bank policy, so it's best to check with Wells Fargo for their specific limitations.

8. What information do I need to provide to get an official check? Be prepared with valid identification, your account information, and the exact amount and payee details for the check.

Tips and Tricks

If you frequently find yourself needing official checks, inquire about any potential fee waivers based on your account type or relationship with Wells Fargo. Consider if maintaining a certain balance could make you eligible for perks like free official checks.

In the end, while official checks from Wells Fargo Bank might seem like relics from a bygone era, they still serve a valuable purpose in certain financial transactions. By understanding their purpose, benefits, and drawbacks, you can confidently navigate the world of secure payments and make informed decisions about your money. Remember, sometimes the old-school methods still hold value in our increasingly digital world.

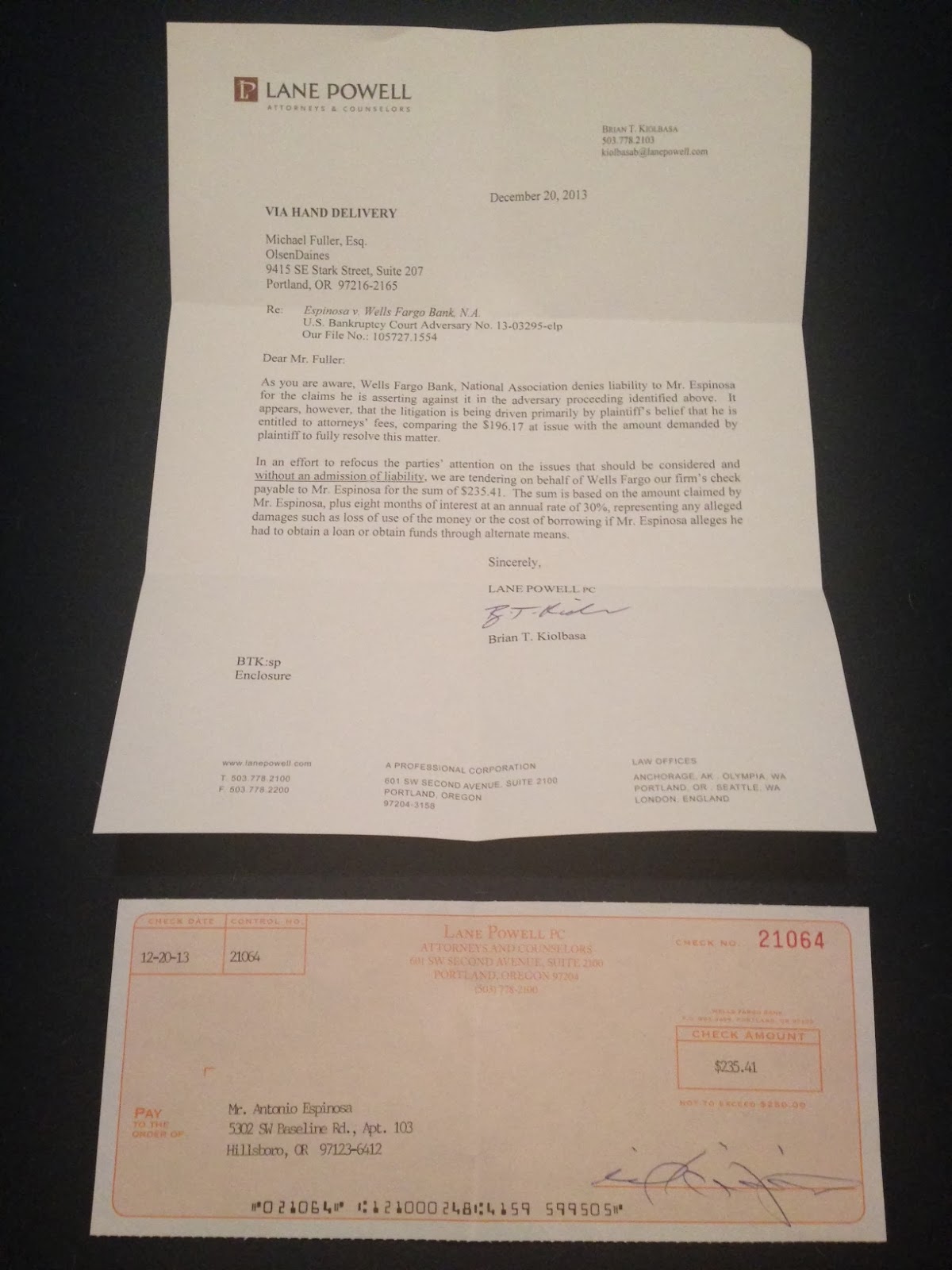

Underdog Law Blog: Wells Fargo 'Returns' Money It Disputes It Ever Took - The Brass Coq

official check from wells fargo bank - The Brass Coq

official check from wells fargo bank - The Brass Coq

Best Essay Writers Here - The Brass Coq

Wells Fargo Blank Check Template - The Brass Coq

Wells Fargo CEO Answers Questions About Unauthorized Accounts in Senate - The Brass Coq

Wells fargo online wire limit - The Brass Coq

Cashiers check printing software download - The Brass Coq

official check from wells fargo bank - The Brass Coq

official check from wells fargo bank - The Brass Coq

official check from wells fargo bank - The Brass Coq

Wells Fargo Aba Wiring Number - The Brass Coq

Wells Fargo Printable Checks - The Brass Coq

Wells Fargo & Company Bank Check - The Brass Coq

Topo 60 imagem modelo cheques - The Brass Coq