Buying a home is a significant milestone, often intertwined with dreams of stability and creating a space truly your own. But the path to homeownership can feel like navigating a complex maze, especially when it comes to financing. For many Malaysians, the dream of owning a home is made more attainable through government initiatives like the "Kadar Pinjaman Perumahan Kerajaan" – government housing loan rates. These rates, often more favorable than conventional loans, can be the key that unlocks the door to homeownership.

Imagine this: you've found the perfect home, the one that ticks all the boxes. But then comes the question of financing. The thought of navigating loan applications, interest rates, and repayment schemes can feel overwhelming. That's where understanding "Kadar Pinjaman Perumahan Kerajaan" can be a game-changer. These government-backed loan programs offer a helping hand, often with lower interest rates and more flexible terms, making homeownership more accessible to a wider range of Malaysians.

But what exactly are these government housing loan rates, and who are they designed to help? These programs are essentially government initiatives aimed at making homeownership more accessible, particularly for first-time homebuyers and those in specific income brackets. They offer attractive interest rates, which translate to potentially lower monthly payments compared to conventional loans. This can be a significant advantage, freeing up more financial breathing room for homeowners.

In a world where the cost of living continues to rise, having access to these programs can be incredibly empowering. It's not just about owning a physical structure; it's about security, stability, and building a future for yourself and your loved ones.

While navigating the world of housing loans may seem daunting, remember that resources and information are available to guide you through the process. Understanding the ins and outs of "Kadar Pinjaman Perumahan Kerajaan" can empower you to make informed decisions and potentially open doors to achieving your homeownership dreams.

This article will delve deeper into the specifics of government housing loan rates in Malaysia, providing you with the knowledge and insights needed to embark on your homeownership journey with confidence.

Advantages and Disadvantages of Kadar Pinjaman Perumahan Kerajaan

| Advantages | Disadvantages |

|---|---|

| Lower interest rates compared to conventional loans | Potential for longer processing times due to government involvement |

| More accessible to first-time homebuyers and lower income groups | May have stricter eligibility criteria compared to conventional loans |

| Can contribute to overall financial stability for homeowners | Limited choices in terms of housing options, often focused on affordable housing projects |

Navigating the path to homeownership in Malaysia can feel like a journey filled with twists and turns, but remember that resources like "Kadar Pinjaman Perumahan Kerajaan" are designed to provide support and guidance along the way. By arming yourself with information, understanding the nuances of government housing loan rates, and exploring the available options, you can take confident strides towards turning your dream of owning a home into a tangible reality.

Jadual Kelayakan Pinjaman Perumahan Kerajaan Yang Baru Mulai Januari - The Brass Coq

Carta Alir Proses Kerja - The Brass Coq

Elaun Penjawat Awam(Berapa Kadar Imbuhan Kerja Kerajaan) - The Brass Coq

Pinjaman Perumahan Kerajaan (LPPSA): 7 Soalan Patut Tanya - The Brass Coq

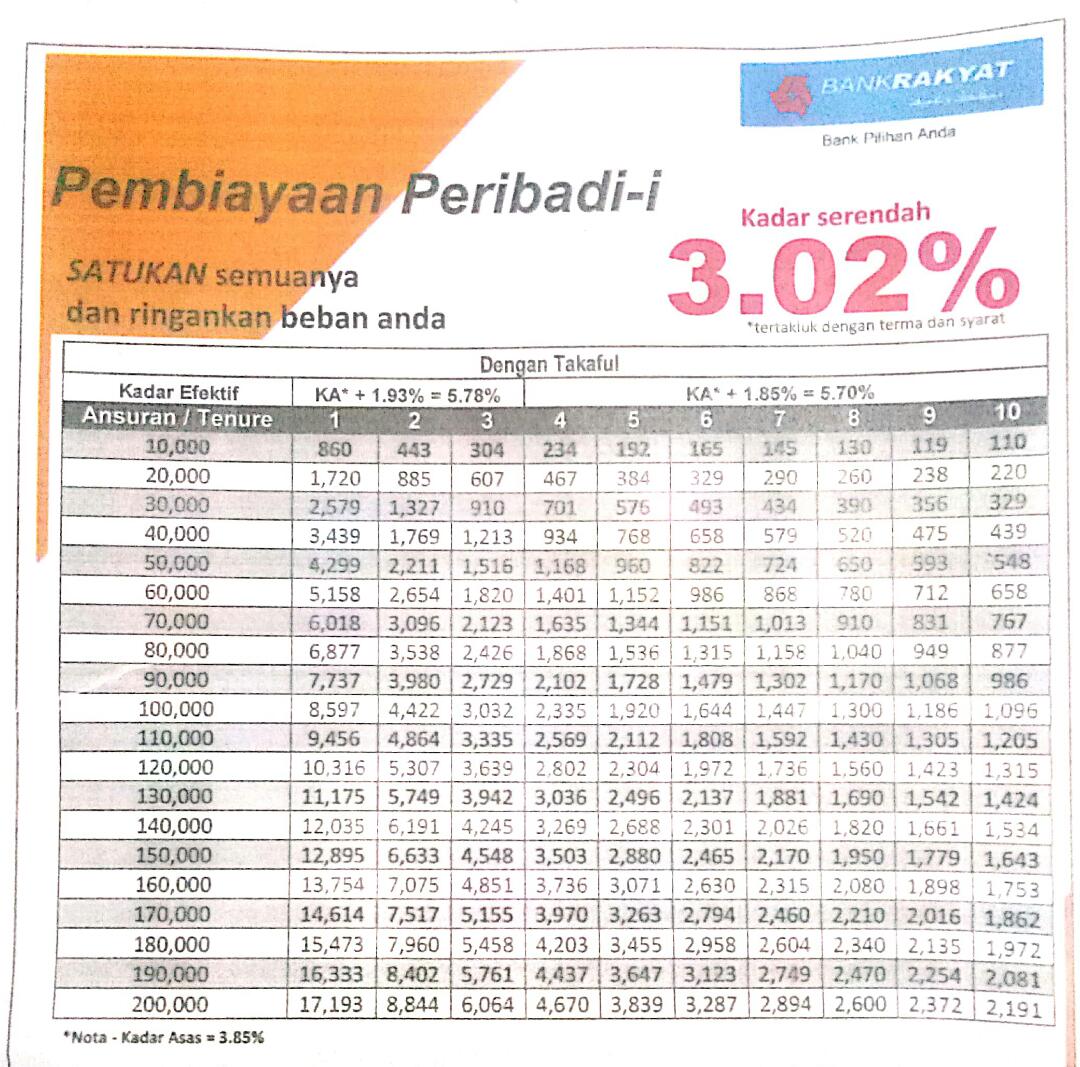

Pinjaman Peribadi Rhb Bank - The Brass Coq

Jawatan Kosong Jurutera ~ Kementerian Perumahan Dan Kerajaan Tempatan - The Brass Coq

Bajet 2023 : Kerajaan Diminta Selesaikan Isu Kadar Faedah Pinjaman - The Brass Coq

Loan Perniagaan Bank Rakyat, mencecah RM5.5 bilion - The Brass Coq

Kakitangan Kerajaan Jadual Bayaran Balik Pinjaman Perumahan Bsn - The Brass Coq

kadar pinjaman perumahan kerajaan - The Brass Coq

Eh! Boleh ke Nak Buat Pinjaman Perumahan Kerajaan (LPPSA) Kali Ke 2 - The Brass Coq

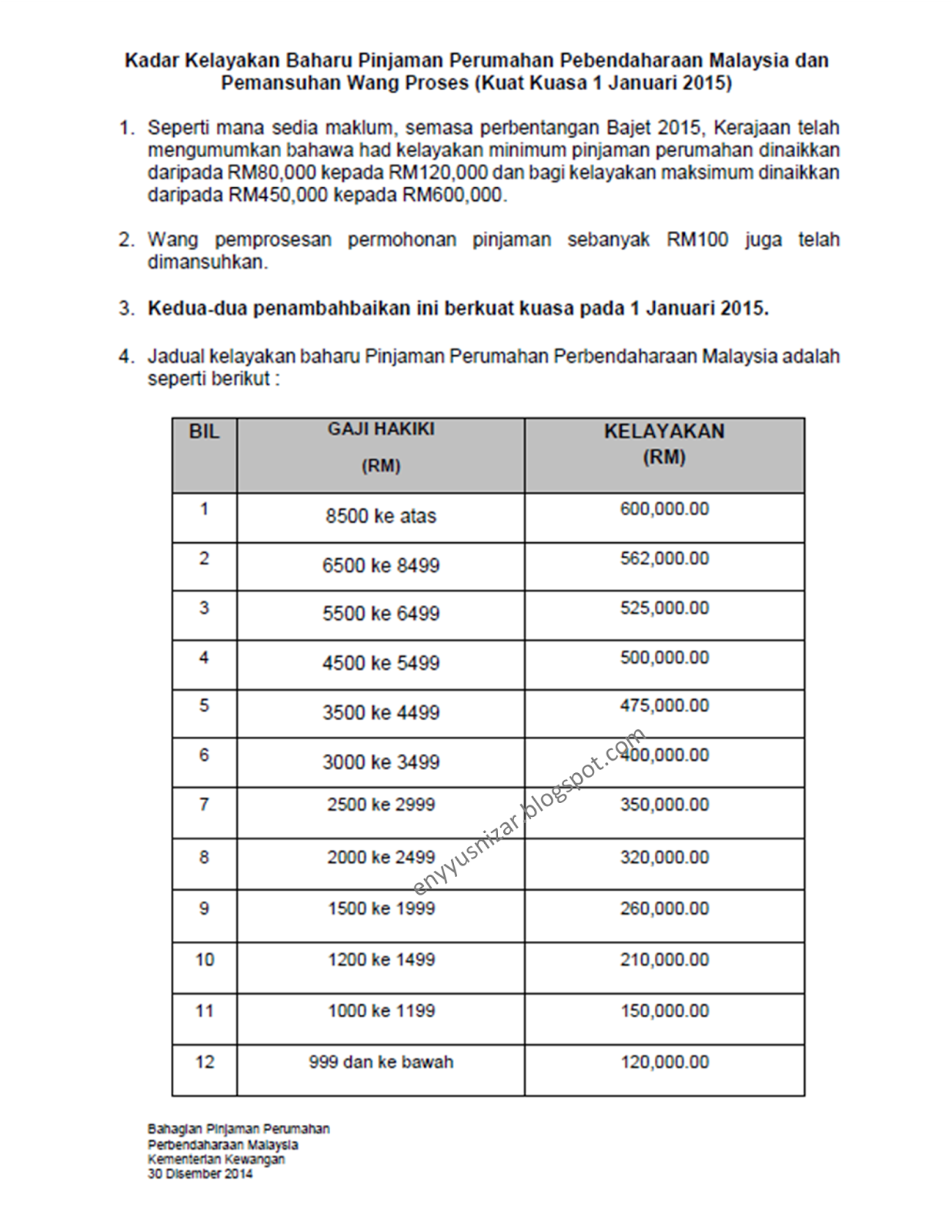

Kadar Kelayakan Pinjaman Perumahan Kerajaan Tahun 2015 - The Brass Coq

Berapakah Kadar Faedah Pinjaman Perumahan Anda? - The Brass Coq

Mudahnya Bina Rumah Dengan Pinjaman Perumahan Kerajaan (LPPSA) - The Brass Coq

Permohonan Pinjaman Perumahan Kerajaan LPPSA 2020 Online - The Brass Coq

.jpg?1611625323)