In a world rapidly transitioning towards digital transactions, the rustle of a checkbook might seem like a relic of the past. Yet, for many, the sight of a Bank of America check still holds relevance and practicality. Whether it's sending rent to a landlord who prefers traditional methods or receiving a personal check as a gift, understanding the role of checks in today's financial landscape remains important.

While the convenience of mobile payments and online banking has undoubtedly shifted financial habits, checks continue to serve specific purposes. For individuals who might not have easy access to digital banking tools or prefer the tangibility of paper transactions, checks offer a familiar and reliable method. This article delves into the ongoing relevance of Bank of America checks, examining their uses, benefits, and how they fit into our increasingly digital financial world.

The enduring use of checks can be attributed to several factors. For one, they provide a tangible record of transactions, which can be particularly useful for personal bookkeeping or situations where a physical document is required. Additionally, checks offer a sense of security for some, especially when dealing with large sums or individuals who might not be comfortable with online platforms.

Furthermore, the familiarity and ease of use associated with checks cannot be discounted. Writing a check requires minimal technical know-how and can be done without internet access, making it accessible to a wider demographic, including older generations or those with limited digital literacy.

However, as technology advances and digital payment methods become increasingly secure and user-friendly, the reliance on checks is gradually diminishing. The rise of mobile wallets, peer-to-peer payment apps, and online banking platforms offers faster, more efficient alternatives for managing finances.

Advantages and Disadvantages of Bank of America Checks

Let's weigh the pros and cons of using checks in today's financial landscape:

| Advantages | Disadvantages |

|---|---|

| Tangible record of transactions | Slower processing time compared to digital methods |

| Familiarity and ease of use | Risk of loss or theft |

| Accessibility for those without digital access | Potential for delays in funds availability |

| Security for large transactions or with unfamiliar recipients | Requirement of physical delivery or mailing |

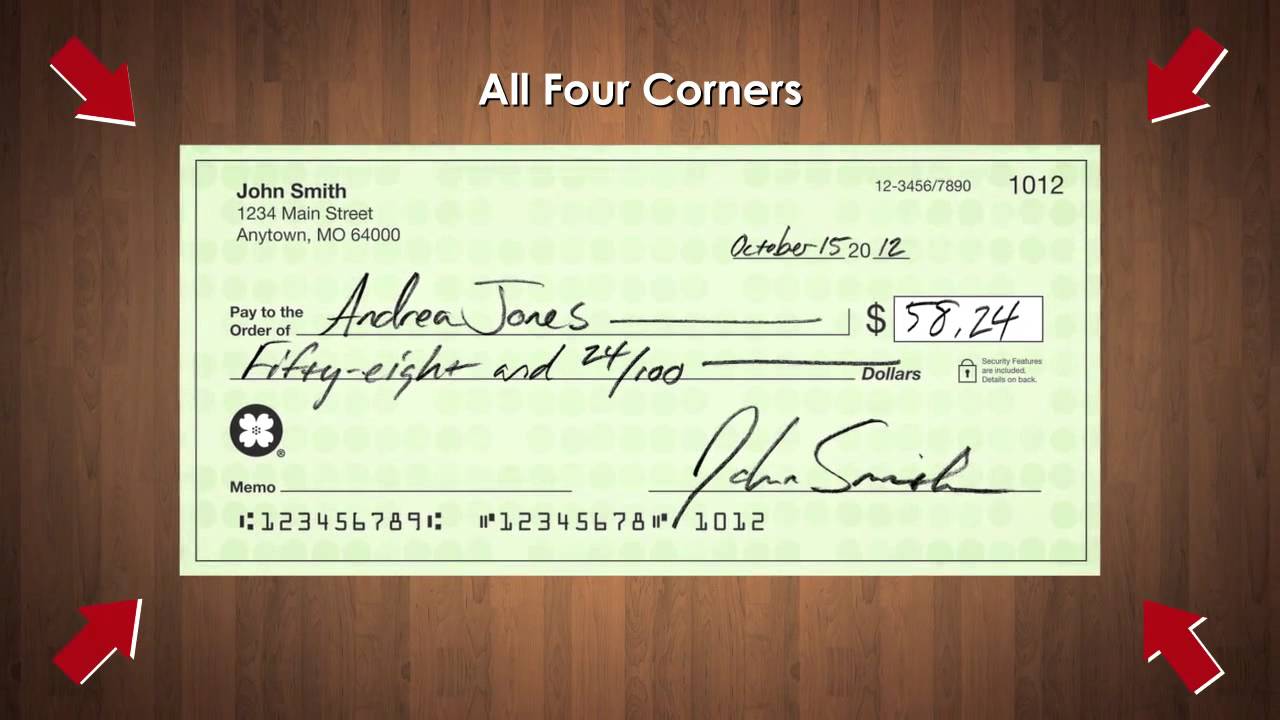

Best Practices for Using Bank of America Checks

While the use of checks might be declining, employing best practices can ensure security and efficiency when using them:

- Always use a pen: This prevents alterations to the check information.

- Write clearly and legibly: Ensure all details are easily readable to avoid processing errors.

- Double-check all information: Verify the payee's name, amount, and date before handing over the check.

- Keep a record of issued checks: Note the check number, date, payee, and amount for personal bookkeeping.

- Store unused checks securely: Protect your checks from theft or loss to prevent unauthorized use.

Common Questions About Bank of America Checks

Here are some frequently asked questions regarding Bank of America checks:

- Q: How do I order checks from Bank of America?

A: You can order checks online through your Bank of America account, by phone, or by visiting a local branch.

- Q: How long does it take for a Bank of America check to clear?

A: Check clearing times can vary depending on factors like the amount and the recipient's bank. It's best to allow for a few business days.

- Q: What happens if I lose a check?

A: Report a lost or stolen check to Bank of America immediately. They can help you cancel the check and prevent fraudulent use.

- Q: Can I deposit a check from another bank into my Bank of America account?

A: Yes, you can deposit checks from other banks through the mobile app, ATM, or by visiting a branch.

- Q: Are there fees associated with Bank of America checks?

A: Fees for checks can vary depending on your account type. Refer to your account terms and conditions or contact Bank of America for details.

While the convenience and speed of digital transactions continue to shape the financial landscape, Bank of America checks still retain their place for specific needs and demographics. Understanding their benefits, limitations, and best practices for use ensures that you can navigate the evolving world of financial transactions effectively.

As technology advances, it remains to be seen how the role of checks will further evolve. However, their continued relevance for certain situations underscores the importance of financial institutions providing a range of options to cater to diverse needs and preferences.

visualroute lite edition 2017 14.0h build 4774 - The Brass Coq

Como Llenar Un Cheque Bank Of America - The Brass Coq

Bank of America Order Checks Online - The Brass Coq

bank of america checks sample - The Brass Coq

bank of america checks sample - The Brass Coq

Us Bank Wiring Information - The Brass Coq

Bank Of America Personal Check in 2022 - The Brass Coq

How to Get Free & Single Checks from Bank of America Now - The Brass Coq

Pin by Evan Michael on Quick Saves - The Brass Coq

bank of america checks sample - The Brass Coq

Check Printing Bank Of America at Jenny Dooley blog - The Brass Coq

Western Bank New Mexico Routing Number at Michael Herrera blog - The Brass Coq

Bank Of America Número De Cuenta De Cheque Y Número De Ruta - The Brass Coq

bank of america checks sample - The Brass Coq

bank of america checks sample - The Brass Coq