In today's intricate financial landscape, transparency and documentation are paramount, particularly when it comes to employment and income. Whether you're applying for a loan, renting an apartment, or even sponsoring a visa, verifying your income is often a crucial step. This is where the concept of a salary declaration, or "surat pernyataan gaji per bulan" in Indonesian, comes into play.

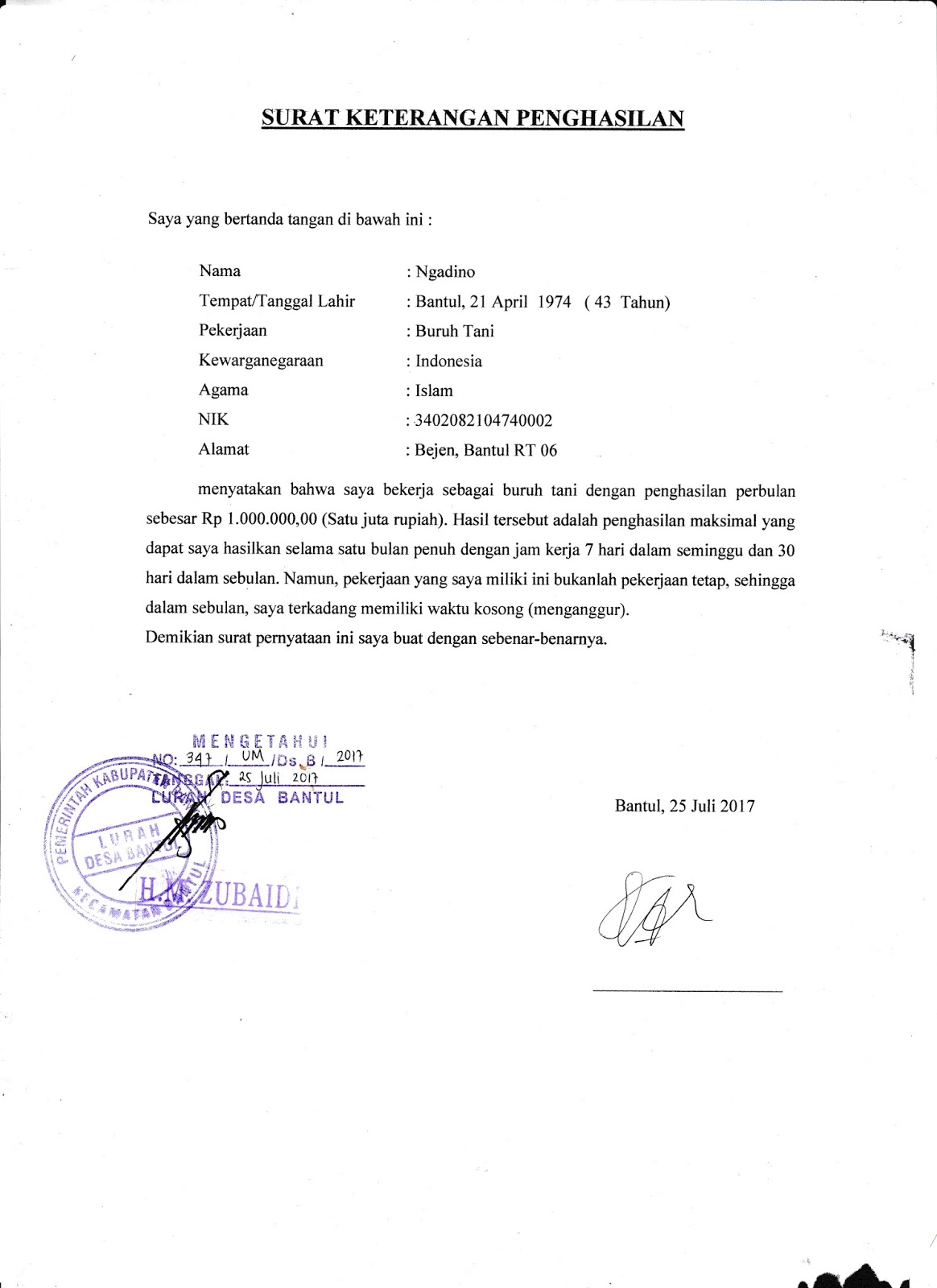

Essentially, a salary declaration serves as a formal statement that outlines an individual's monthly income. It acts as proof of earnings, assuring third parties that an individual receives a regular income. While it might seem like a simple document, a salary declaration plays a significant role in various financial transactions and holds considerable weight.

Imagine applying for a mortgage; the lender needs assurance that you can comfortably manage the monthly repayments. A salary declaration, often corroborated by bank statements, provides tangible proof of your income, supporting your loan application.

However, understanding the nuances of salary declarations extends beyond recognizing their purpose. There are different types of salary declarations, each tailored to specific situations. For instance, a self-declaration might suffice for certain scenarios, while others might require a more formal document validated by your employer.

This guide aims to unravel the complexities surrounding salary declarations, providing a comprehensive overview of their significance, types, potential benefits, and even challenges you might encounter. We'll delve into practical aspects, equipping you with the knowledge to navigate these processes confidently.

Advantages and Disadvantages of Formal Salary Declarations

Let's explore the pros and cons of utilizing formal salary declarations, often issued by employers:

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Handling Salary Declarations

Here are some best practices to ensure the accurate and ethical use of salary declarations:

- Honesty is Key: Always declare your income accurately and honestly. Falsifying information on a salary declaration is considered fraud and can have serious legal consequences.

- Clarity is Crucial: Ensure all details in your salary declaration are clear, concise, and easy to understand. This includes your personal information, employment details, and income specifics.

- Verification is Vital: If obtaining a formal salary declaration from your employer, review all information carefully for accuracy before submitting it.

- Security Matters: Treat your salary declaration as a sensitive document. Store it securely and only share it with legitimate entities when required.

- Know Your Rights: Familiarize yourself with your company's policies regarding salary declarations. Understand the process, turnaround time, and any associated fees.

Frequently Asked Questions (FAQs)

1. What if my employer doesn't provide formal salary declarations?

Some companies may have alternative processes, such as providing pay stubs or utilizing a third-party income verification service.

2. Can I create my own salary declaration?

While you can create a self-declaration of income, it might not carry the same weight as an employer-verified document, especially for significant financial transactions.

3. How long is a salary declaration considered valid?

The validity period can vary depending on the requesting entity. It's best to confirm the required validity period with the organization requesting the document.

4. What information is typically included in a salary declaration?

Essential details include your full name, address, employment details (company name, address, designation), salary breakdown (gross, net, allowances), date of issue, and authorized signature.

5. Can I use a salary declaration from a previous employer?

Generally, salary declarations are expected to reflect your current employment and income status. Using an outdated declaration might not be acceptable.

6. Is there a specific format for salary declarations?

While there isn't always a universally mandated format, companies often have templates or preferred formats for salary declarations.

7. What if there's an error on my salary declaration?

It's crucial to contact your employer or the issuing authority immediately to rectify any errors and obtain a corrected document.

8. Are digital salary declarations accepted?

Acceptance of digital formats depends on the requesting organization's policies. Some might require physical copies, while others might accept digital versions or e-signatures.

Conclusion

Navigating the world of salary declarations doesn't have to be daunting. By understanding their purpose, types, and best practices for handling them, you can confidently approach various financial scenarios. Remember, accurate documentation and transparency are crucial when dealing with income verification processes. Whether you're securing a loan, seeking accommodation, or fulfilling immigration requirements, a well-prepared salary declaration can be a valuable asset.

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq

surat pernyataan gaji per bulan - The Brass Coq