Have you ever received a check made out to someone else and wondered if you could deposit it into your own account? These are known as third-party checks, and they often come with questions and potential complications. If you bank with Chase and find yourself with a third-party check, understanding the bank's policies is crucial for a smooth transaction. This article dives into whether Chase Bank takes third-party checks, outlining the essential information you need to know.

Dealing with checks in today's increasingly digital age can feel like navigating a maze of rules and regulations. While mobile payments and online transfers gain popularity, checks remain a common method for various transactions. Third-party checks, specifically, often pop up in situations like receiving a gift, being reimbursed by a friend, or even inheriting funds. Understanding the ins and outs of how these checks work, especially at a major institution like Chase Bank, is essential for anyone dealing with them.

The acceptance of third-party checks varies significantly between financial institutions. Some banks outright refuse them due to the higher risk of fraud, while others may have specific guidelines and restrictions in place. This is where understanding Chase Bank's specific policies becomes paramount. By outlining their rules, we aim to clarify any confusion and empower you to manage your finances effectively.

Navigating the world of third-party checks doesn't have to be stressful. By arming yourself with the right information, you can avoid potential hurdles and ensure a smooth process. Whether you're a seasoned check depositor or a first-timer, a clear understanding of Chase Bank's policies will give you the confidence to manage your finances effectively.

This article serves as your comprehensive guide to understanding whether Chase Bank takes third-party checks. We'll delve into their specific policies, potential risks, and alternative solutions, providing you with the knowledge you need to make informed financial decisions.

Advantages and Disadvantages of Third-Party Checks

Let's weigh the pros and cons of dealing with third-party checks:

| Advantages | Disadvantages |

|---|---|

| Can be a convenient way to receive or transfer funds | Higher risk of fraud and complications compared to other methods |

| May be the only option for certain transactions or individuals | Can be subject to delays in processing and availability of funds |

| Provide a physical record of the transaction | May involve additional fees or restrictions depending on the bank |

Best Practices for Depositing Third-Party Checks

While Chase Bank's specific policies on third-party checks might not be readily available online, here are some general best practices to follow:

- Contact Chase Bank directly: The most reliable way to get accurate information is to reach out to Chase Bank's customer service or visit a local branch. They can provide up-to-date details about their policies on third-party checks.

- Verify the check's legitimacy: Before attempting to deposit, carefully examine the check for any signs of tampering or fraud. Ensure all information is accurate and legible.

- Gather necessary documentation: Be prepared to provide additional identification or documentation, such as your driver's license and the payee's endorsement.

- Be aware of potential delays: Understand that third-party checks may be subject to longer processing times than regular checks. It's crucial to factor in these potential delays, especially if you rely on the funds for immediate use.

- Consider alternative options: Depending on the situation, exploring alternative payment methods like money orders, cashier's checks, or electronic transfers might be more efficient and secure.

Common Questions and Answers

Here are some frequently asked questions about third-party checks at Chase Bank:

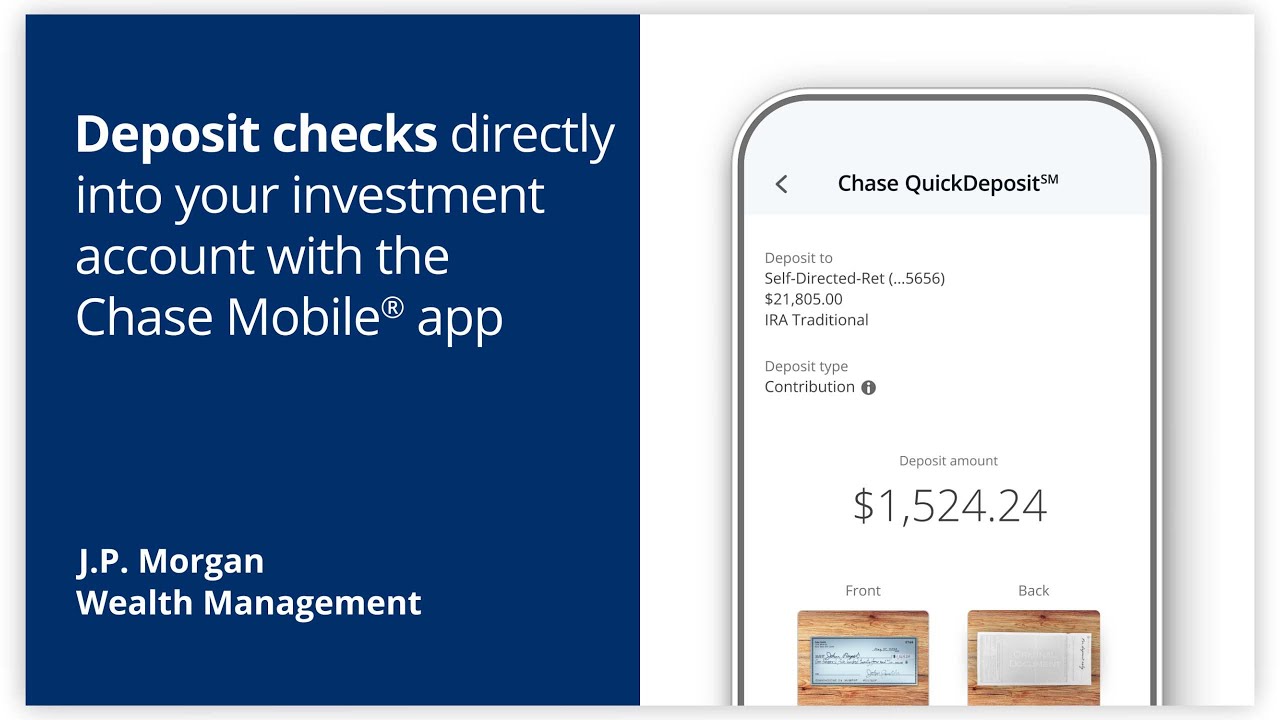

- Q: Can I deposit a third-party check into my Chase account online?

A: While you can deposit regular checks using Chase's mobile app, depositing a third-party check online is generally not recommended or might not be allowed. Contact Chase to confirm their specific procedures. - Q: What information do I need to provide when depositing a third-party check?

A: Be prepared to provide your account information, the payee's endorsement, and additional identification as requested by the bank. - Q: Is there a limit on the amount I can deposit from a third-party check?

A: Chase Bank, like many financial institutions, may have deposit limits for third-party checks. Inquire about their specific limits and any potential holds placed on the funds. - Q: What are the potential risks associated with third-party checks?

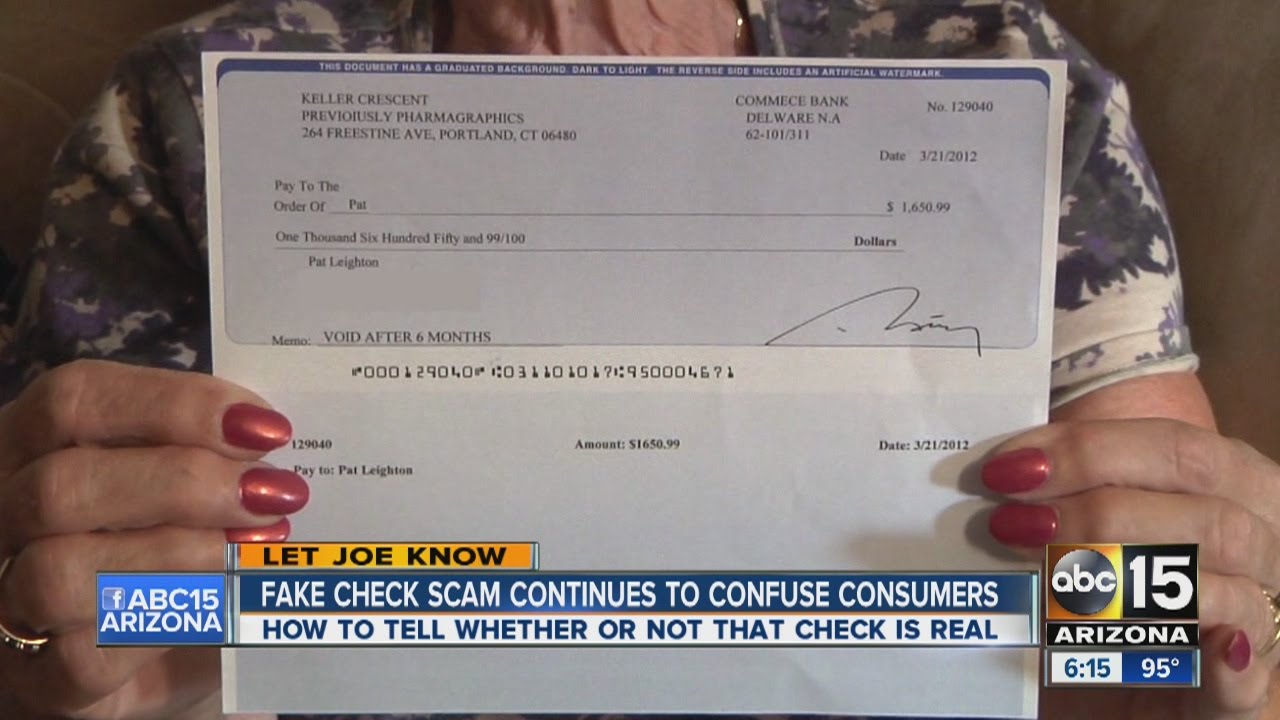

A: Third-party checks carry a higher risk of fraud or bouncing compared to regular checks. It's essential to be cautious and verify the legitimacy of the check and the payee. - Q: Are there any fees for depositing a third-party check?

A: While Chase Bank doesn't typically charge fees for depositing regular checks, they might have fees associated with third-party checks. Contact them to verify their fee structure. - Q: How long does it take for a third-party check to clear at Chase Bank?

A: The clearing time for third-party checks can vary but generally takes longer than regular checks. Expect a holding period, potentially up to several business days, before the funds become available. - Q: What should I do if a third-party check I deposited bounces?

A: Contact Chase Bank immediately to report the bounced check and discuss the necessary steps. Be prepared to provide documentation and cooperate with their investigation. - Q: Are there alternative methods to receive funds instead of a third-party check?

A: Yes, consider options like money orders, cashier's checks, or electronic transfers (ACH or wire) for faster, more secure transactions.

Conclusion

Dealing with third-party checks can feel complex due to varying bank policies and potential risks. While the specific guidelines for depositing third-party checks at Chase Bank might not be readily available online, understanding the general best practices and potential challenges can help you navigate the process smoothly. Remember to contact Chase Bank directly for the most up-to-date information regarding their policies, fees, and any potential restrictions. Being proactive and informed ensures a smoother financial experience, allowing you to manage your funds with confidence and avoid unnecessary hurdles.

How To Cash A Third Party Check At Chase - The Brass Coq

Third Party Check Cashing - The Brass Coq

How To Cash A Third Party Check - The Brass Coq

Exploring The Convenience Of Travelers Checks Issued By Chase Bank - The Brass Coq

How to Endorse a Check to Someone Else - The Brass Coq

does chase bank take third party checks - The Brass Coq

does chase bank take third party checks - The Brass Coq

Don't cash that check! It's a scam - The Brass Coq

Create fake bank statement template suntrust - The Brass Coq

How to Endorse Chase Bank Mobile Deposit? - The Brass Coq

How To Cash A Third Party Government Check - The Brass Coq

Who Cashes Third Party Checks Near Me? [+Endorsing] - The Brass Coq

Everything You Need to Know About Cashing a Third Party Check - The Brass Coq

Does Chase Bank Have a Notary? - The Brass Coq

Chase Checks Instantly Print Online On Any Printer Yourself - The Brass Coq

:max_bytes(150000):strip_icc()/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)

![Who Cashes Third Party Checks Near Me? [+Endorsing]](https://i2.wp.com/bucksandcents.com/wp-content/uploads/2021/05/Third-Party-Checks.jpg)