Have you ever looked at your paycheck and wondered, "Where did all my money go?" It's a common experience, and understanding salary deductions is key to managing your finances effectively. Whether you're just starting your career or a seasoned professional, knowing how your net pay is calculated gives you a clearer picture of your financial standing.

Salary deductions, sometimes called withholdings, are the amounts subtracted from your gross pay before you receive your paycheck. These deductions cover various mandatory and voluntary contributions, including taxes, insurance premiums, retirement savings, and more. While these deductions might seem like a chunk of your hard-earned money disappearing, they play a crucial role in your financial well-being, both now and in the future.

The concept of salary deductions has been around for decades, evolving alongside labor laws and social security systems. One of the most significant drivers for formalizing deductions was the need for governments to collect taxes efficiently. Over time, deductions expanded to include social security contributions, ensuring retirement benefits and healthcare for workers. Today, deductions encompass a broader range of benefits, including employer-sponsored health insurance, retirement savings plans, and even charitable contributions.

Mastering the art of understanding your salary deductions is vital for several reasons. Firstly, it empowers you to verify the accuracy of your paycheck, ensuring you're not being overcharged. Secondly, it allows you to track where your money is going, giving you better control over your finances and budgeting. Finally, understanding these deductions helps you plan for the future, by maximizing your retirement contributions or adjusting your withholdings to optimize your tax liability.

While the thought of delving into the complexities of deductions might seem daunting, a basic understanding can empower you to make informed financial decisions. By breaking down the components of your paycheck, you're taking a proactive approach to managing your money and securing your financial future.

Advantages and Disadvantages of Detailed Pay Stub Information

| Advantages | Disadvantages |

|---|---|

| Transparency and Trust | Potential for Information Overload |

| Error Detection | Privacy Concerns (for highly detailed breakdowns) |

| Financial Planning and Control | Complexity for Simple Deduction Systems |

While the table above outlines some general advantages and disadvantages, it's important to note that specific benefits and drawbacks can vary based on individual circumstances and the complexity of a country or company's deduction system.

Best Practices for Navigating Your Paycheck

Here are some practical tips to help you decode your pay stub and manage your deductions effectively:

- Review Your Pay Stub Regularly: Don't wait until tax season to scrutinize your pay stub. Make it a habit to check it each pay period for accuracy and to track deductions.

- Keep Your Pay Stubs Organized: Store your pay stubs securely, either digitally or in a physical file. This will be helpful for tax purposes and for tracking your income history.

- Understand Your Tax Withholdings: Familiarize yourself with your country's tax brackets and allowances. If you have multiple jobs or sources of income, ensure your withholdings are accurate.

- Maximize Retirement Savings: If your employer offers a retirement savings plan, try to contribute the maximum amount allowed. This not only helps you save for the future but can also offer tax benefits.

- Seek Professional Advice: If you're unsure about certain deductions or need help optimizing your withholdings, don't hesitate to consult a financial advisor or tax professional.

FAQs: Unraveling the Mysteries of Your Paycheck

Still have questions about those deductions? We've got you covered:

Q1: Why is my net pay less than my gross pay?

A: Your net pay is the amount you receive after all deductions are subtracted from your gross pay. These deductions cover taxes, insurance, retirement contributions, and more.

Q2: What are the most common types of salary deductions?

A: Common deductions include income tax, social security contributions, Medicare (in the US), health insurance premiums, retirement savings plan contributions, and sometimes union dues or other voluntary deductions.

Q3: Can I change my tax withholdings?

A: Yes, you can usually adjust your tax withholdings by submitting a new W-4 form (in the US) or the equivalent form in your country to your employer. This allows you to control how much tax is withheld from each paycheck.

Q4: What happens if my employer makes a mistake on my paycheck?

A: If you notice an error on your paycheck, immediately bring it to your employer's attention. They are legally obligated to correct any errors in your pay.

Q5: How do salary deductions affect my tax return?

A: Your salary deductions, particularly tax withholdings, directly impact your tax return. If you have had too much tax withheld throughout the year, you may receive a refund. Conversely, if you haven't had enough withheld, you may owe taxes.

Q6: Are there any deductions I can take advantage of to reduce my tax liability?

A: The specific deductions you qualify for vary depending on your location and individual circumstances. It's best to consult a tax professional to explore available deductions.

Q7: How can I learn more about my specific deductions?

A: Your pay stub should provide a breakdown of your deductions. If you need further clarification, reach out to your HR department or consult your company's payroll policies.

Q8: What are some resources available to help me understand salary deductions?

A: Government websites related to taxes and labor, online financial literacy resources, and certified financial advisors can provide valuable guidance on understanding salary deductions.

Mastering Your Money

Understanding salary deductions is an essential aspect of financial literacy. By familiarizing yourself with the components of your paycheck, you can make informed decisions about your money, optimize your withholdings, and plan for a secure financial future. Remember, knowledge is power when it comes to your finances, and taking the time to understand your pay stub can pay dividends in the long run.

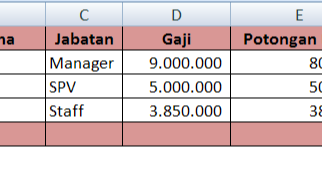

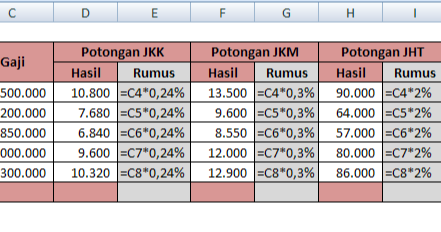

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

Lengkap! Besaran Iuran BPJS Ketenagakerjaan Karyawan - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq

cara menghitung potongan gaji - The Brass Coq