Ever feel like your wallet is a mysterious black hole of cards, each with a cryptic code? Well, let's shine a spotlight on one specific card—your NPWP card, the key to navigating the Indonesian tax landscape. What's the deal with that long string of digits, the "nomor NPWP pada kartu NPWP" as it's formally known? It's more than just a random sequence; it's your unique identifier in the Indonesian tax system.

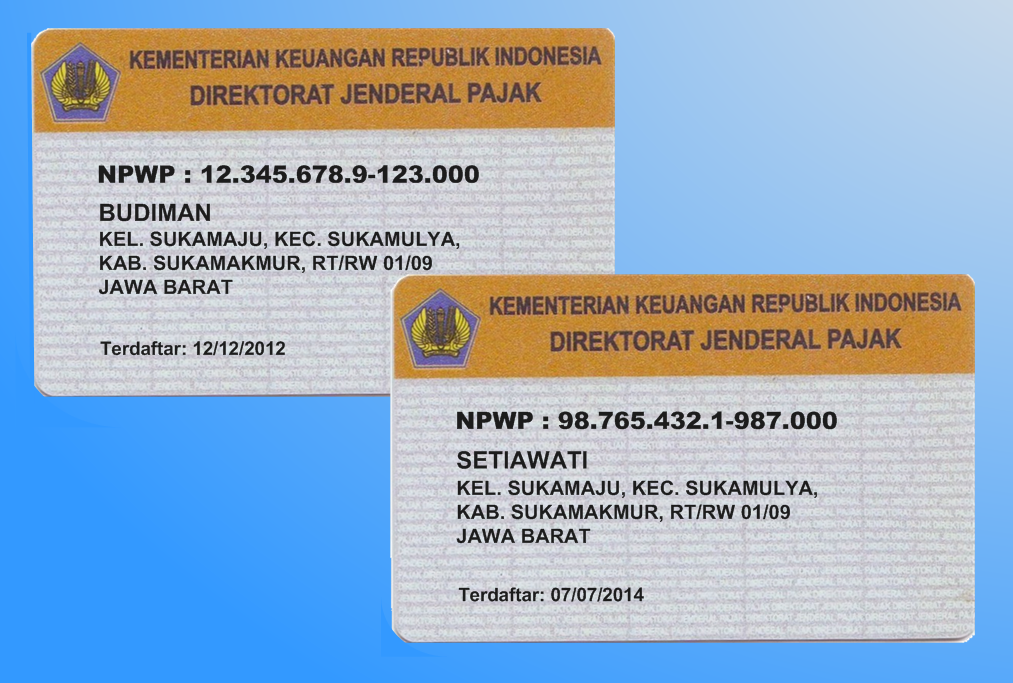

So, what exactly is this NPWP number printed on your card? It's your Taxpayer Identification Number, assigned by the Indonesian Directorate General of Taxes (DGT). Think of it as your fiscal fingerprint. Just like no two fingerprints are alike, no two NPWP numbers are the same. This number is essential for fulfilling your tax obligations in Indonesia, whether you're an individual or a business.

Why should you care about this number? Well, imagine trying to order online without an address. Similarly, without your NPWP number, you'll be stuck in the tax equivalent of no-man's-land. From opening a bank account to conducting business transactions, this number is your passport to smooth financial sailing in Indonesia. It allows the government to track tax payments, ensure compliance, and ultimately contribute to the nation's economic development.

The NPWP number format might seem confusing at first glance, but it's actually quite logical. It consists of a series of digits, each segment representing specific information, such as your tax office registration and individual identifier. Understanding this format can help you verify the validity of your NPWP card and avoid potential issues.

Historically, the NPWP system was implemented to streamline tax collection and administration in Indonesia. Before its introduction, the process was far less efficient, leading to complexities and potential for discrepancies. The NPWP system brought much-needed structure and transparency to the tax landscape, making it easier for both taxpayers and the government to manage their respective responsibilities.

The benefits of having and using your NPWP number are multifaceted. First, it simplifies tax compliance, allowing you to file and pay taxes with greater ease. Second, it opens doors to various financial services and business opportunities. Third, it fosters a sense of financial responsibility and contributes to a more transparent and efficient tax system.

To obtain an NPWP, you need to register with the DGT, either online or offline. The application process requires specific documentation, depending on your taxpayer classification (individual or business). Once approved, you'll receive your NPWP card, which prominently displays your unique NPWP number.

Advantages and Disadvantages of Having an NPWP

| Advantages | Disadvantages |

|---|---|

| Easier tax compliance | Potential for misuse if card is lost or stolen |

| Access to financial services | Administrative burden of maintaining records |

| Business opportunities |

Best Practice: Keep your NPWP card safe and treat it like any other important identification document.

FAQ: What do I do if I lose my NPWP card? You can request a replacement from the DGT.

Tips and Tricks: Store a digital copy of your NPWP card on your phone for easy access.

In conclusion, the nomor NPWP pada kartu NPWP, your Taxpayer Identification Number, is your essential key to navigating the Indonesian tax system. Understanding its significance, format, and benefits empowers you to fulfill your tax obligations efficiently and access a wider range of financial opportunities. By actively engaging with and utilizing your NPWP, you contribute not only to your own financial well-being but also to the overall development and stability of the Indonesian economy. Take the time to familiarize yourself with the details of your NPWP card, and don't hesitate to seek assistance from tax professionals or the DGT if you have any questions. Your financial journey in Indonesia begins with understanding and utilizing your NPWP.

Mengenal Lebih Jauh Apa Itu NPWP Dan Syarat Bikin NPWP - The Brass Coq

Cara Pelaporan Pajak Suami Istri Beda Npwp - The Brass Coq

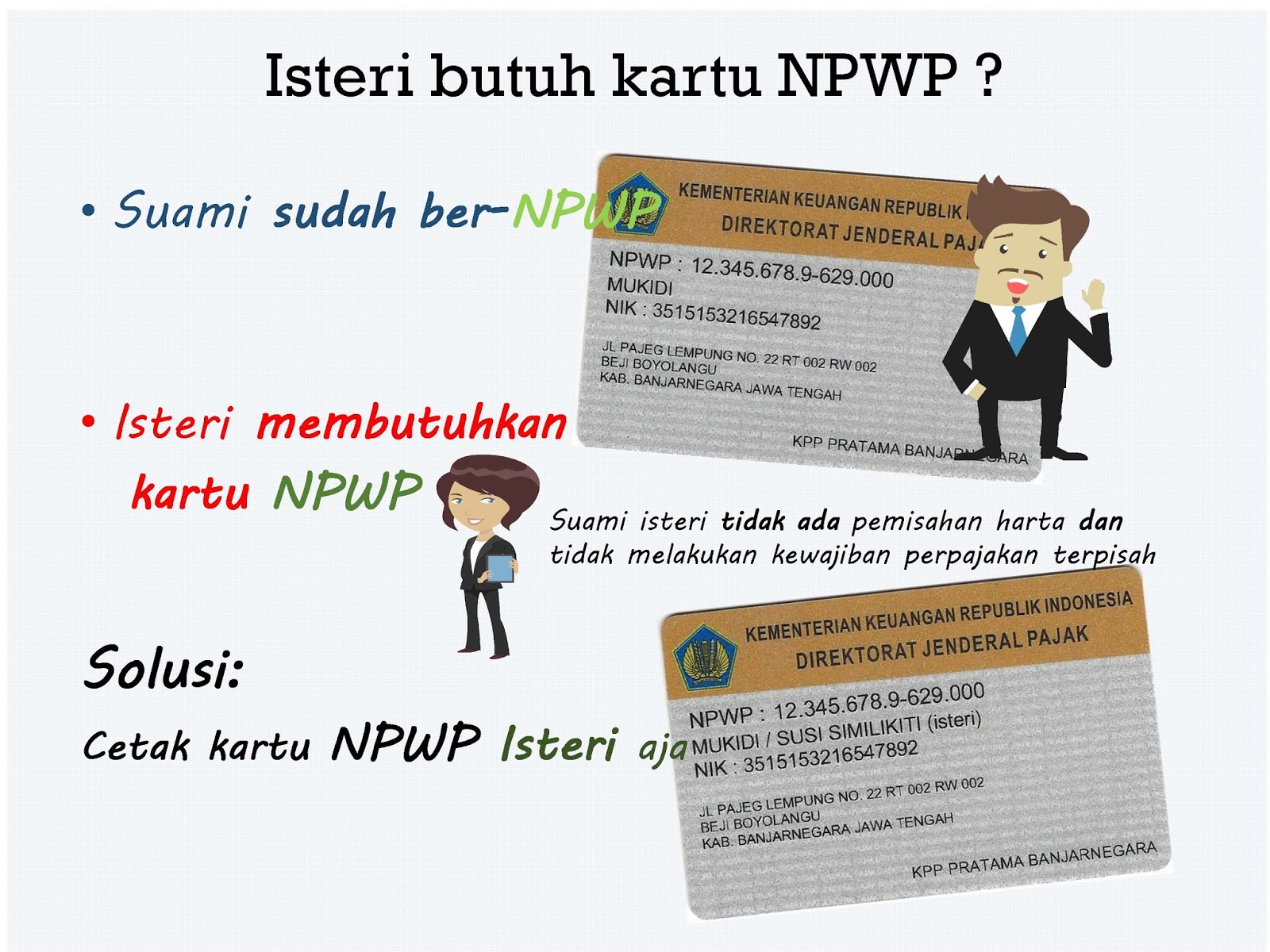

NPWP Istri Cara Membuat dan Penggabungan NPWP Suami Istri - The Brass Coq

nomor npwp pada kartu npwp - The Brass Coq

5 Cara Cek NPWP Online yang Mudah dan Praktis - The Brass Coq

Menyelisik Perbedaan NPWP Pusat dan Cabang - The Brass Coq

Apa itu NPWP Begini Cara Dapatkan Kartu Contohnya - The Brass Coq

5 Cara Cek Nomor NPWP Online dan Offline - The Brass Coq

Segera Laporkan SPT Tahunan Anda Begini Tata Cara Membuat EFIN - The Brass Coq

nomor npwp pada kartu npwp - The Brass Coq

Free Template Kartu NPWP Terbaru Format PSD CDR - The Brass Coq

Cara Mendaftar Npwp Online Pribadi - The Brass Coq

Kartu NPWP menggunakan Font apa - The Brass Coq

CARA BIKIN NOMOR POKOK WAJIB PAJAK ALIAS - The Brass Coq

Kartu NPWP menggunakan Font apa - The Brass Coq