In today's fast-paced digital world, the rustle of a paper check might seem like a relic of the past. Yet, checks remain a prevalent form of payment, and understanding how to deposit them correctly is crucial. This article dives into the specifics of the JP Morgan Chase bank address for checks, providing a comprehensive guide to ensure your funds reach their destination securely and efficiently.

Navigating the world of check deposits can feel overwhelming, especially with the rise of online banking and mobile apps. Knowing where to send your checks to JP Morgan Chase isn't always straightforward. This article will demystify the process, exploring various options for depositing checks, including the correct Chase bank check deposit mailing address, mobile deposit features, and best practices for a seamless experience.

Finding the appropriate JP Morgan Chase check deposit address isn't as simple as looking up a single, universal location. The correct mailing address for your check deposits can depend on several factors, including your account type, location, and the type of check you're depositing. We'll unravel these complexities and provide you with the resources to identify the correct address for your specific needs.

While the traditional method of mailing a check remains an option, JP Morgan Chase, like many other banks, offers convenient alternatives for depositing checks. Mobile check deposit, accessible through the Chase mobile app, allows you to deposit checks anytime, anywhere, using your smartphone. This article will delve into the benefits of mobile check deposit and provide a step-by-step guide on how to utilize this convenient feature.

Beyond simply knowing the correct JP Morgan Chase bank address for checks, understanding the best practices for secure check deposits is paramount. From endorsing your checks correctly to keeping records of your deposits, this article will equip you with the knowledge to ensure your financial transactions are handled safely and efficiently.

The history of JP Morgan Chase itself is intertwined with the evolution of check processing. As banking practices modernized, so did the methods for handling checks. From manual sorting to automated clearinghouses, the journey of a check from deposit to clearance has become increasingly sophisticated. Understanding this history sheds light on the importance of accurate deposit information.

While mobile check deposit offers unparalleled convenience, understanding its limitations is essential. There might be restrictions on the types of checks eligible for mobile deposit, such as limits on check amounts or restrictions on international checks. We'll address these potential limitations and offer solutions for handling different check types.

One key benefit of using mobile check deposit is the immediate availability of funds. Unlike mailing a check, which can take several days to clear, mobile deposit often provides faster access to your money. This can be crucial for managing expenses and maintaining a healthy cash flow.

Another advantage is the enhanced security provided by mobile deposit. By eliminating the need to physically mail a check, you reduce the risk of mail theft or loss. The encrypted nature of mobile banking apps further protects your sensitive financial information.

To deposit a check via the Chase mobile app, simply endorse the back of the check, open the app, navigate to the deposit section, take a clear photo of the front and back of the check, and submit. Ensure you have a strong internet connection for a smooth transaction.

Advantages and Disadvantages of Different Deposit Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Available to everyone | Slower processing time, risk of mail loss | |

| Mobile Deposit | Fast, convenient, secure | Potential limitations on check types |

| In-branch Deposit | Immediate processing | Requires a branch visit |

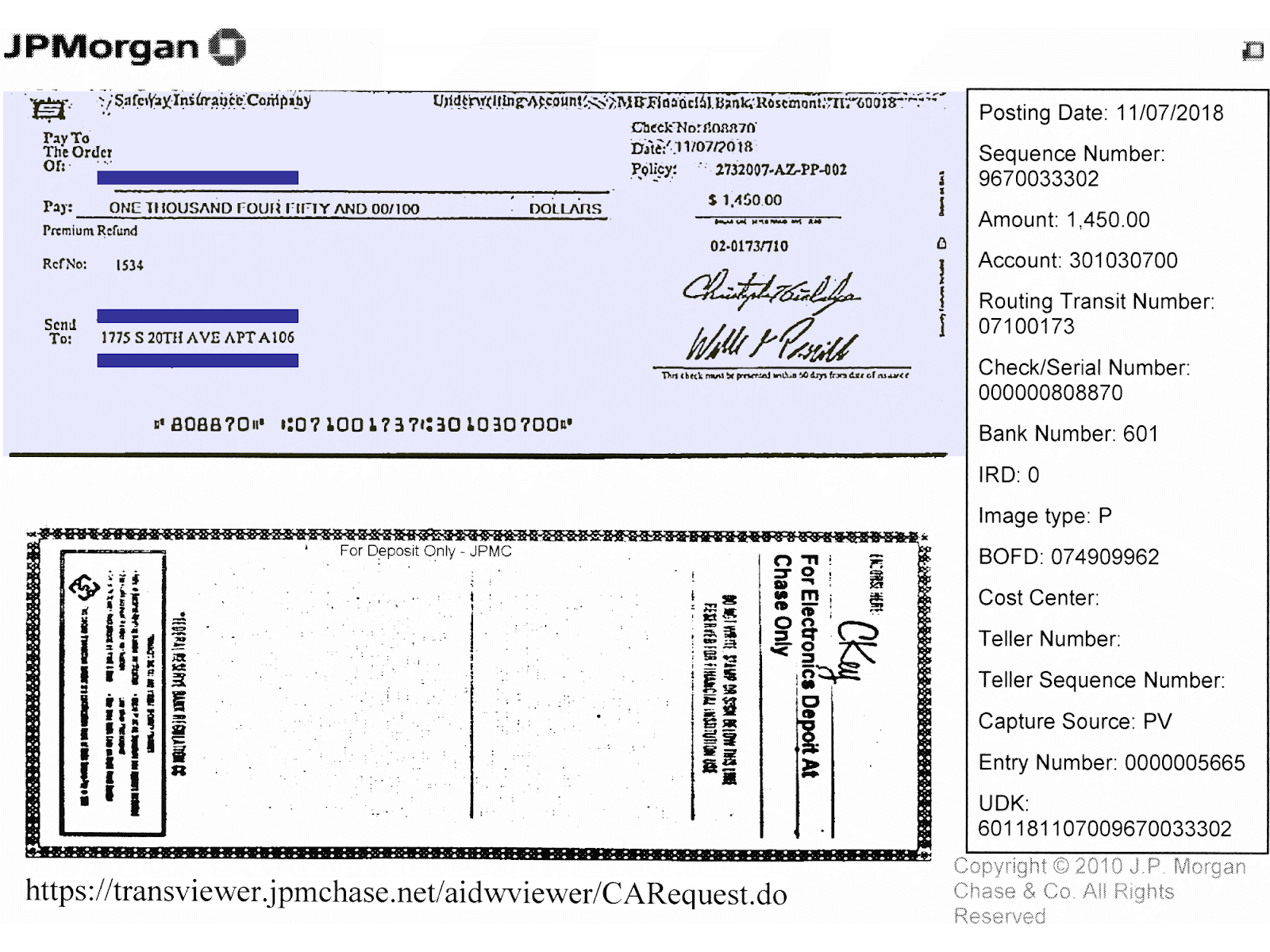

Best Practice: Always endorse your checks with "For Mobile Deposit Only at JP Morgan Chase" to prevent fraudulent use if the check is lost or stolen.

FAQ: Where do I find the correct JP Morgan Chase bank address for checks? Answer: Contact customer service or log into your online banking account for personalized deposit instructions.

Conclusion: Knowing the correct JP Morgan Chase bank address for checks, utilizing mobile deposit, and following best practices are crucial for efficient and secure financial management. Embrace the convenience of modern banking while safeguarding your funds. By understanding the nuances of check deposits, you can seamlessly navigate the financial landscape and ensure your money reaches its intended destination. This knowledge empowers you to take control of your finances and make informed decisions about your banking practices.

USA JP Morgan Chase bank proof of address statement template in Word - The Brass Coq

Chase Bank Sorry for Saying Millennials Are Poor Because They - The Brass Coq

jp morgan chase bank address for checks - The Brass Coq

Jp Morgan Chase Fdic Insured - The Brass Coq

A Reply from Chase for JP Morgan Reserve Applications - The Brass Coq

Chase Bank Check Template Inspirational Cashier Check Template Editable - The Brass Coq

jp morgan chase bank address for checks - The Brass Coq

Chase Logo Chase Bank Logos - The Brass Coq

jp morgan chase bank address for checks - The Brass Coq

jp morgan chase bank address for checks - The Brass Coq

How To Write A Check Chase - The Brass Coq

Things to Consider When Designing Your Startups Logo by ttunguz - The Brass Coq

JPMorgan Closes a Crypto Firm Account for Prohibited Operating - The Brass Coq

jp morgan chase bank address for checks - The Brass Coq

Chase Bank Wiring Number - The Brass Coq