In today's digital age, where transactions flit across cyberspace in milliseconds, the humble paper check might seem like a relic of the past. But hold on – the Bank of America check, a tangible representation of funds, remains a relevant and frequently used payment method. So, let's dive deep into the world of the legitimate Bank of America check and unravel its intricacies.

What exactly is a genuine Bank of America check? It's a negotiable instrument instructing the bank to pay a specific amount of money from a particular account to the person or entity named on the check. While digital payments gain traction, understanding the nuances of a physical Bank of America check is crucial for navigating financial transactions effectively.

From its historical roots in ancient banking practices to its modern-day usage, the check has undergone a fascinating evolution. Originally, checks were handwritten orders, but with the rise of standardized banking, pre-printed checks bearing the bank's details became the norm. The Bank of America check, specifically, reflects the bank's brand and security features, serving as a trusted method for various payments, from personal expenses to business transactions.

Navigating the realm of Bank of America checks can present some challenges. One significant concern is check fraud, which involves altering or forging checks for illegal gain. Understanding how to identify a genuine Bank of America check and implementing security measures are vital for protecting yourself against such fraudulent activities. This includes verifying the check's features, confirming with the issuer if necessary, and handling checks responsibly.

While the increasing popularity of electronic payments offers undeniable convenience, authentic Bank of America checks maintain their relevance for specific situations. They provide a physical record of transactions, offer a sense of security for some users, and are often preferred for certain types of payments, like rent or large purchases where digital methods might not be readily accepted. Understanding the benefits and limitations of checks empowers you to make informed financial decisions.

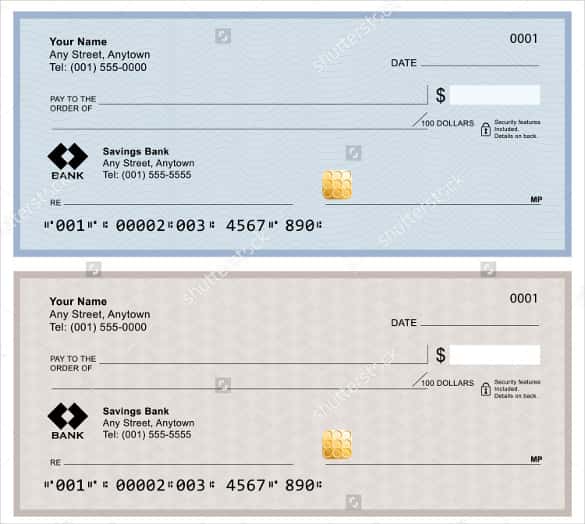

A valid Bank of America check typically includes the bank's logo, routing number, account number, check number, and security features like watermarks and microprinting. A simple example of using a Bank of America check is paying your monthly rent – you fill in the payee's name, the amount, and the date, sign the check, and hand it over to your landlord. This creates a paper trail of the transaction, offering both you and the recipient a tangible record.

Three key benefits of using Bank of America checks are: Control - you determine the exact amount and timing of the payment; Record Keeping - the physical check serves as proof of payment; and Acceptance - While some businesses prefer digital payments, many still accept and even require checks.

Advantages and Disadvantages of Bank of America Checks

| Advantages | Disadvantages |

|---|---|

| Tangible Record | Processing Time |

| Wide Acceptance | Risk of Fraud |

| Control Over Payment | Requires Mailing or Physical Delivery |

Five best practices for using Bank of America checks include: storing blank checks securely, reviewing your bank statements regularly, shredding voided or unused checks, writing checks in ink, and verifying the recipient's information carefully.

Frequently Asked Questions:

1. How do I order Bank of America checks? (Contact your local branch or use online banking)

2. What do I do if I lose a check? (Report it to Bank of America immediately)

3. How can I verify a Bank of America check is real? (Contact the bank to verify)

4. Can I stop payment on a Bank of America check? (Yes, through online banking or by contacting the bank)

5. How long are Bank of America checks valid? (Generally six months, but check with the bank)

6. What if I make a mistake writing a check? (Void the check and write a new one)

7. Can I deposit a Bank of America check at another bank? (Yes, though it might take longer to clear)

8. What information do I need to provide when cashing a Bank of America check? (Valid photo identification)

Tips and tricks: Keep your checkbook balanced, use a pen with indelible ink, write legibly, and always double-check the amount before signing.

In conclusion, while the digital age is transforming financial transactions, the genuine Bank of America check maintains a significant role in our financial landscape. Understanding its functionalities, benefits, and security aspects is essential for managing finances effectively. From its historical context to the practical applications of managing your checkbook, knowing how to use and safeguard Bank of America checks empowers you to navigate the world of personal and business finance with confidence. By adopting best practices and staying informed about potential risks, you can leverage the advantages of paper checks while mitigating potential downsides. So, whether it's paying your rent, making a donation, or settling a bill, the Bank of America check continues to offer a reliable and tangible way to manage your financial affairs. Embrace the power of the paper trail and ensure your financial transactions are secure and efficient. Take the time to familiarize yourself with the information provided above and stay informed about the latest security measures to protect yourself and your finances.

Free Check Printing Template - The Brass Coq

Merrill Lynch Wire Transfer Routing Number - The Brass Coq

Pin by Evan Michael on Quick Saves - The Brass Coq

How to Verify a Check Online - The Brass Coq

real bank of america check - The Brass Coq

Bamboozled 3 banks and a missing 500 check Where did this customers - The Brass Coq

Fake Wells Fargo Bank Statement Template - The Brass Coq

real bank of america check - The Brass Coq

Chase Cashiers Check Template - The Brass Coq

Bank Of America Cashier S Check Template - The Brass Coq

bank of america checks - The Brass Coq

Bank Of America Dept Az9 - The Brass Coq

Bank Of America Printable Checks - The Brass Coq

real bank of america check - The Brass Coq

Do Bank Checks Cost Money at Darcy Lopez blog - The Brass Coq