Singapore, a bustling hub of finance and innovation, attracts individuals and businesses from every corner of the globe. With its stable economy and strategic location, it's no wonder people are looking to set down roots, and that includes their financial roots. If you're considering making Singapore your new home, or even if you're just looking to diversify your financial portfolio, opening a bank account is often one of the first steps. But with so many options available, how do you choose the right bank for your needs?

CIMB Bank, a well-established player in the Southeast Asian banking scene, presents a compelling option for those seeking a reliable and accessible banking experience in Singapore. Known for its digital-first approach and competitive product offerings, CIMB Bank has been steadily gaining popularity among locals and expats alike. So, what makes a CIMB bank account opening in Singapore worth considering?

Before we delve into the specifics of opening a CIMB Bank account in Singapore, let's take a step back and understand the broader context. The financial landscape of Singapore is incredibly diverse, with a mix of local and international banks catering to a wide range of needs. This competitive environment means that banks are constantly striving to offer the best possible products and services to attract and retain customers.

For newcomers to Singapore, navigating this financial maze can feel daunting. That's why it's crucial to have access to clear and concise information about the various banking options available. This article aims to provide a comprehensive overview of CIMB Bank account opening in Singapore, covering everything from the bank's history and background to the benefits, steps involved, and frequently asked questions.

Whether you're a seasoned investor, a young professional starting your career, or an entrepreneur looking to expand your business, understanding the intricacies of opening a bank account in Singapore is essential. With the right information at your fingertips, you can make informed financial decisions that align with your individual goals and aspirations.

Advantages and Disadvantages of CIMB Bank Account Opening in Singapore

| Advantages | Disadvantages |

|---|---|

| Competitive interest rates on savings accounts | Limited branch network compared to local banks |

| User-friendly digital banking platform and mobile app | Some products and services may require a minimum balance |

| Wide range of financial products, including loans, credit cards, and investments | Customer service response times may vary |

Best Practices for CIMB Bank Account Opening in Singapore

To ensure a smooth and hassle-free account opening experience with CIMB Bank in Singapore, here are some best practices to keep in mind:

- Research and Compare: Before committing to any bank, take the time to research different options and compare their features, fees, and benefits.

- Prepare Required Documents: Gather all necessary documents, such as your passport, proof of address, and employment pass (if applicable), beforehand to avoid delays.

- Check Eligibility Criteria: Ensure you meet the bank's eligibility requirements for account opening, which may vary depending on your residency status and other factors.

- Explore Digital Options: Consider opening an account online for greater convenience and faster processing times.

- Review Terms and Conditions: Carefully review the account terms and conditions, including fees and charges, before signing any agreements.

Opening a bank account in a new country marks an exciting chapter in anyone's journey. With CIMB Bank, you'll find a blend of modern banking solutions and a commitment to customer satisfaction that can support your financial goals in Singapore.

Accounting Services in Singapore - The Brass Coq

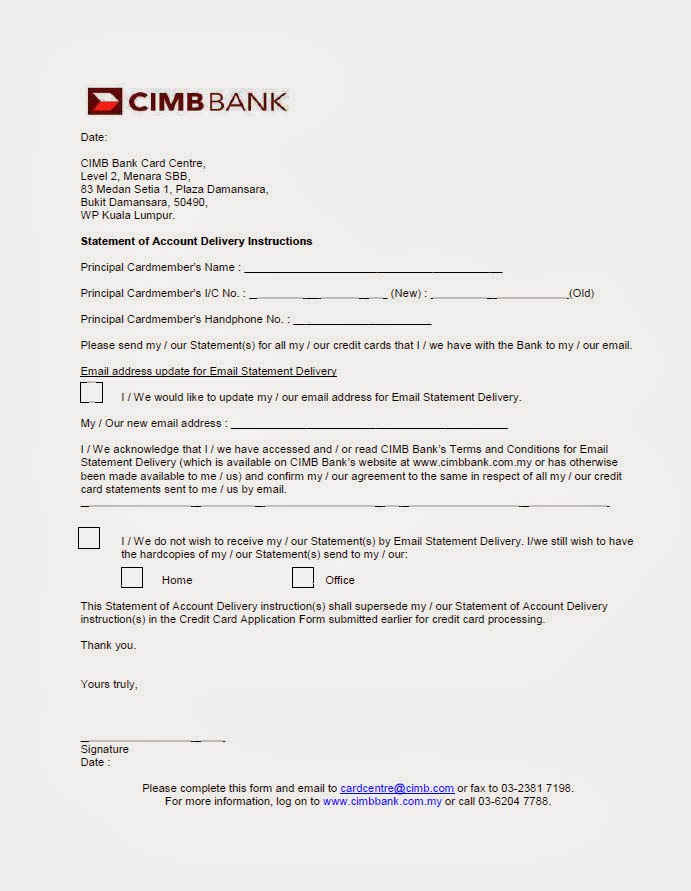

Malaysia Bank Statement Sample - The Brass Coq

Singapore Bank Account opening - The Brass Coq

CIMB Bank Singapore: Open Your Account Today and Enjoy Exclusive - The Brass Coq

Hong Kong considers introduction of re - The Brass Coq

cimb bank account opening singapore - The Brass Coq

SGD Fixed Deposit Account - The Brass Coq

Airwallex offers an all - The Brass Coq

CIMB To Allow Only One Registered Device For Authentication From End - The Brass Coq

Best Fixed Deposit Rates in Singapore 2024 - The Brass Coq

Company bank account opening Singapore in 2023 - The Brass Coq

The process of opening a bank account in Malaysia - The Brass Coq

Top business in Dubai - The Brass Coq

About: CIMB Clicks Singapore (iOS App Store Version) Apptopia - The Brass Coq

OCBC Corporate Bank Account Opening Singapore - The Brass Coq