In our increasingly digital world, you might find yourself pulling out your phone to pay for most things. But sometimes, a good old-fashioned check is exactly what you need. Maybe you're sending a gift, paying rent, or dealing with a business that prefers a paper trail. So, what if you're a Chase customer wondering, "Can you get checks at Chase?"

The answer is a resounding yes! Chase Bank, like most major financial institutions, understands that while digital is convenient, there's still a need for physical checks. Whether you've just opened a new account or have been with Chase for years, getting your hands on a stack of checks is a straightforward process.

Ordering checks through Chase is simple. You have several avenues at your disposal, each designed to fit your comfort level with technology and your need for speed. From the ease of online ordering to a quick phone call or even a visit to your local branch, Chase provides options for everyone.

While the digital age has revolutionized banking, the humble check persists. Why? Because sometimes, it's simply the most practical or preferred method of payment. Whether it's due to security concerns, personal preference, or the nature of the transaction, checks continue to hold a relevant place in our financial toolkit.

This article delves into the details of obtaining checks from Chase, addressing common questions, exploring the different ordering methods, and highlighting the benefits and any potential drawbacks you should be aware of. We aim to provide you with all the information you need to confidently navigate the process of getting checks for your Chase account.

Advantages and Disadvantages of Getting Checks at Chase

| Advantages | Disadvantages |

|---|---|

| Convenient ordering options (online, phone, branch) | Potential cost for ordering checks |

| Chase offers a variety of check designs and styles | Delivery time might be longer than other services |

| Secure ordering process through official Chase channels | May require a minimum order quantity |

Best Practices for Ordering Checks

1. Order in Bulk: Ordering larger quantities of checks usually lowers the per-check cost.

2. Review Your Information: Double-check your name, address, and account number before placing your order to avoid errors.

3. Explore Design Options: Chase offers various check designs and styles; choose one that suits your preferences.

4. Secure Delivery: Opt for trackable shipping to ensure your checks arrive safely and on time.

5. Consider Alternatives: If you rarely use checks, explore alternatives like cashier's checks or money orders for infrequent needs.

Common Questions and Answers About Getting Checks at Chase

Q1: Can I get checks for free at Chase?

While Chase might offer promotional periods with free checks, they typically come with a cost.

Q2: How long does it take to get checks from Chase?

Delivery time varies depending on the order method and shipping option but generally takes 5-7 business days.

Q3: What if I need checks immediately?

For urgent needs, consider requesting a cashier's check or a money order at your local Chase branch.

Q4: Can I order checks if my account is new?

Yes, you can order checks as soon as your account is open and active.

Q5: What if I run out of checks?

You can quickly place a reorder online, by phone, or at a branch.

Q6: Can I customize my Chase checks?

Yes, Chase offers customization options for designs, images, and personal information.

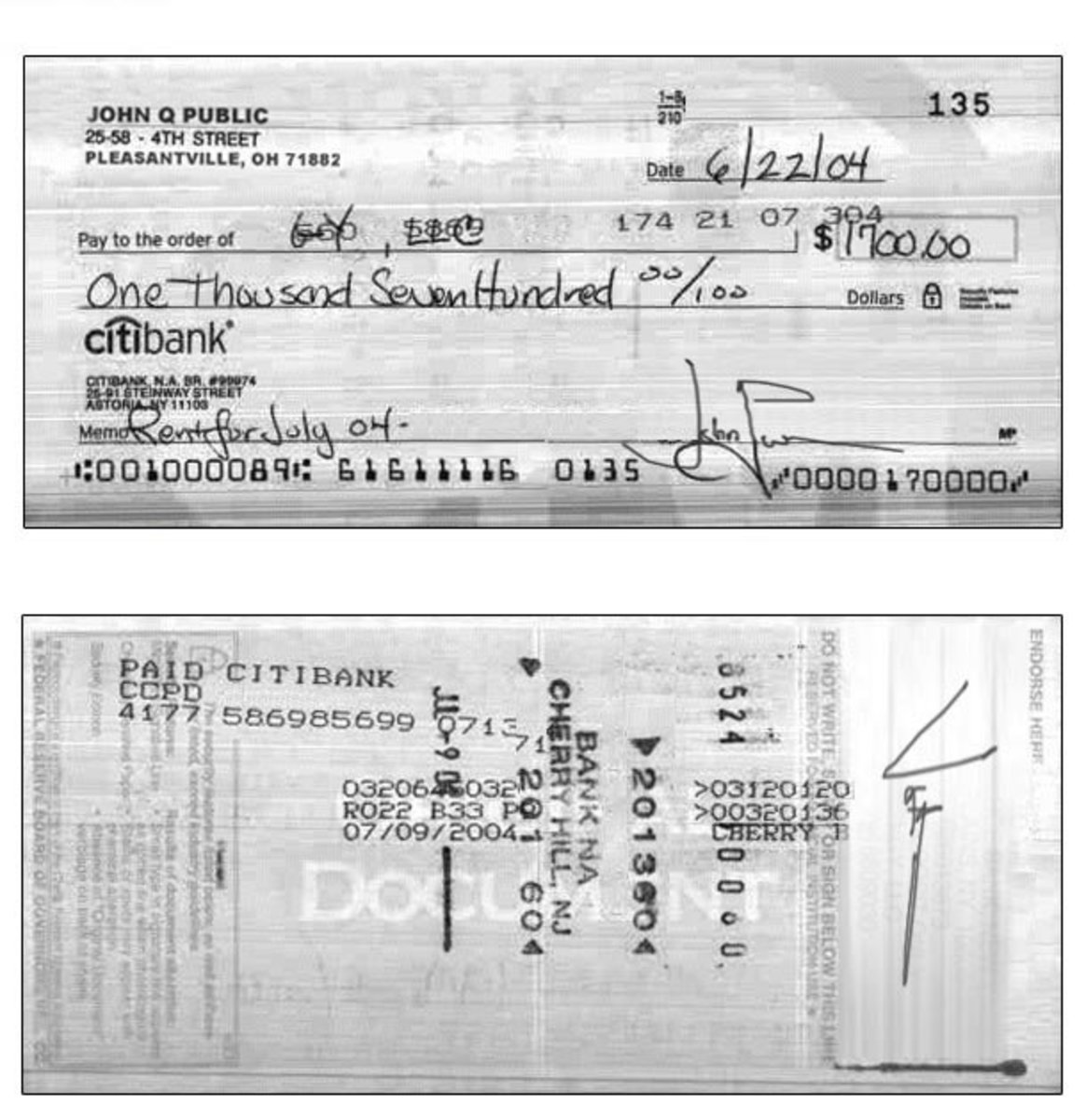

Q7: What security features do Chase checks have?

Chase checks incorporate security features like microprinting, watermarks, and security inks to prevent fraud.

Q8: Can I use Chase checks at other banks?

Yes, Chase checks can be used at any bank or financial institution that accepts checks.

Tips and Tricks

* Consider ordering duplicate checks to help with record-keeping.

* Look for discounts or promotions on Chase checks, especially for new customers.

* If you're concerned about check security, inquire about additional security features like fraud protection.

In conclusion, obtaining checks from Chase is a straightforward process with several convenient options available. While the digital age has propelled us towards electronic transactions, physical checks continue to play a crucial role in various financial situations. Whether it's for personal or business use, understanding the methods, benefits, and potential drawbacks of ordering checks empowers you to manage your finances effectively. By following the best practices outlined in this guide and staying informed about Chase's offerings, you can confidently navigate the world of checks, ensuring you have the right payment method at your fingertips whenever the need arises.

can you get checks at chase - The Brass Coq

can you get checks at chase - The Brass Coq

Create fake bank statement template suntrust - The Brass Coq

can you get checks at chase - The Brass Coq

can you get checks at chase - The Brass Coq

Get Your Funds Faster With Chase Mobile Check Deposits - The Brass Coq

Checkbook lets you email anyone a digital check and deposit it free - The Brass Coq

can you get checks at chase - The Brass Coq

Chase Bank Wiring Fee - The Brass Coq

Chase incoming wire routing number - The Brass Coq

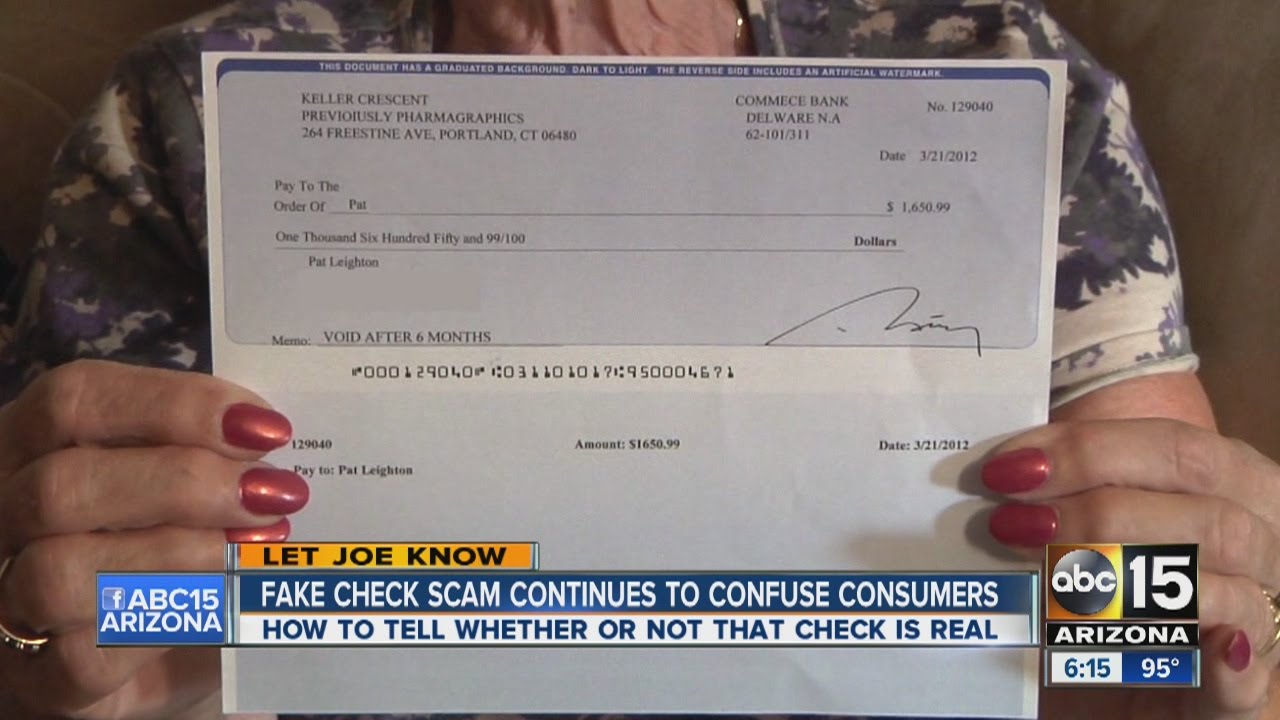

The Top 5 Most Common Check - The Brass Coq

How to Write a Chase Check (with Example) - The Brass Coq

Blank Check To Practice Writing - The Brass Coq

Resultado de imagen para bank of america usa cashiers check samples - The Brass Coq

visualroute lite edition 2017 14.0h build 4774 - The Brass Coq