Have you ever found yourself with a check made out to someone else and wondered, "Can I just deposit this into my Bank of America account?" It's a common question, and the answer isn't always straightforward. While Bank of America generally allows for third-party check deposits, certain conditions and procedures need to be followed. Let's delve into the intricacies of depositing someone else's check at Bank of America to make sure you're fully equipped to handle this situation.

Depositing someone else's check, also known as a third-party check, is a relatively common practice. It can occur in various scenarios, such as when someone is repaying a loan, gifting money, or even when a business receives a check with a slightly inaccurate payee name. Banks, including Bank of America, have policies in place to handle these situations while also mitigating potential risks associated with fraud and forgery.

Understanding the bank's policies is crucial for a smooth transaction. Failure to comply with the requirements can lead to delays, rejections, or even potential legal issues in more serious cases. This article aims to equip you with the necessary knowledge to confidently navigate the process of depositing someone else's check at Bank of America, ensuring a secure and hassle-free experience.

Historically, depositing a check made out to someone else was a simple over-the-counter transaction. However, with the rise in check fraud, banks have implemented stricter regulations and security measures. These measures are in place to protect both the bank and the account holders from potential financial losses.

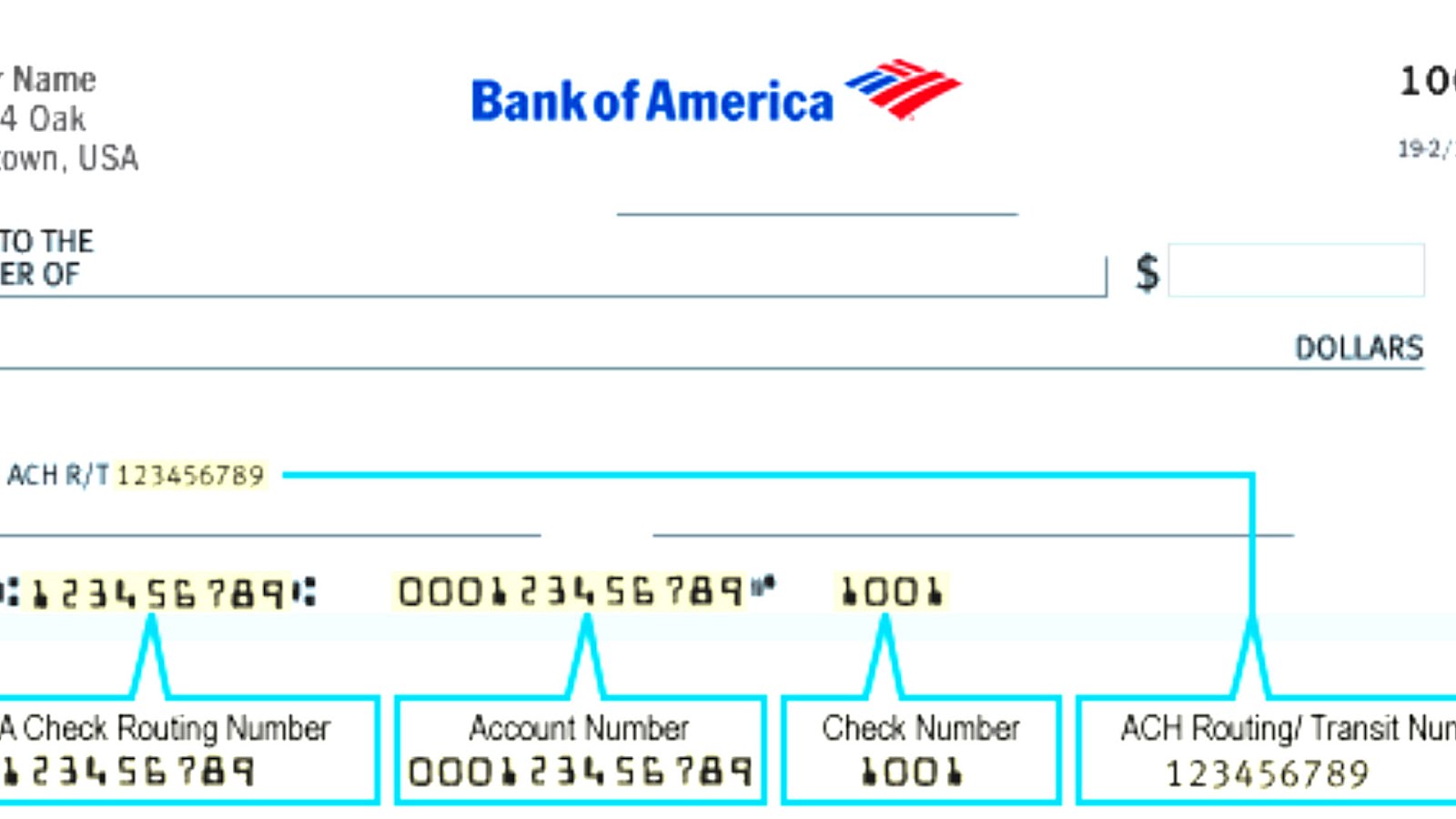

The evolution of banking technology has also impacted how third-party checks are processed. The advent of mobile check deposits and online banking has introduced both convenience and additional layers of verification. While technology has streamlined certain aspects, understanding the specific requirements for depositing someone else's check at Bank of America remains essential.

Advantages and Disadvantages of Depositing Someone Else's Check at Bank of America

| Advantages | Disadvantages |

|---|---|

| Convenience for the recipient | Potential for delays or rejections |

| Faster access to funds compared to mailing the check | Risk of fraud or disputes |

Best Practices for Depositing Someone Else's Check

While the possibility of depositing a check made out to another person at Bank of America exists, it's crucial to proceed with caution and follow the recommended best practices:

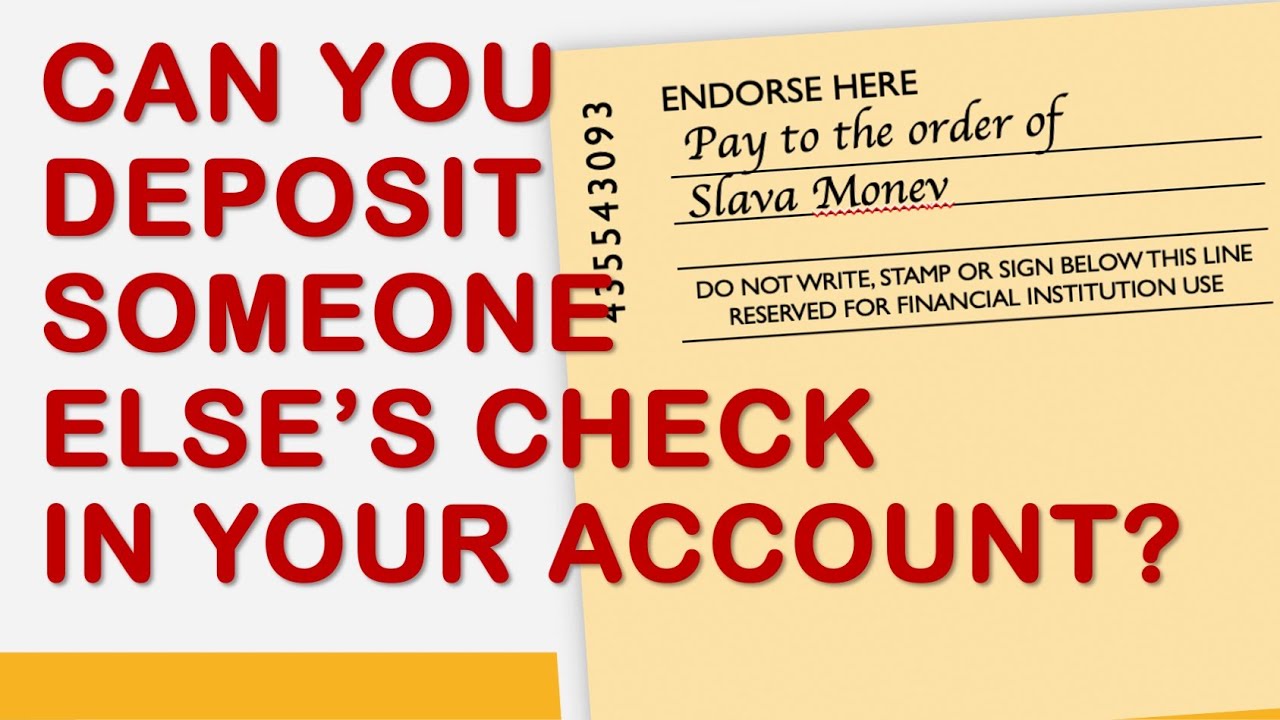

- Obtain Consent and Endorsement: Before attempting to deposit the check, always obtain explicit permission from the original payee. The payee will need to endorse the check by signing their name on the back, ideally in your presence.

- Verify Check Details: Carefully examine the check for any errors, discrepancies, or signs of tampering. Pay close attention to the payee's name, the amount, and the signature. If anything seems amiss, it's best to consult with the bank or the check issuer.

- Choose the Appropriate Deposit Method: For smaller check amounts, using Bank of America's mobile deposit feature might be a viable option. However, for larger checks or those deemed higher risk, an in-person deposit at a branch is generally recommended.

- Be Prepared for Additional Verification: Bank of America may require additional identification or documentation, especially for larger checks or first-time third-party deposits. Be prepared to present a valid government-issued photo ID and any other requested documents.

- Monitor Your Account: After depositing the check, closely monitor your account for any unusual activity or discrepancies. If the check is returned or there are any issues, address them with the bank immediately.

By adhering to these best practices, you can significantly minimize the risk of complications and ensure a smoother experience when depositing someone else's check at Bank of America. Remember, clear communication, due diligence, and a thorough understanding of the bank's requirements are key to successfully navigating this process.

Navigating the world of third-party check deposits doesn't have to be a daunting task. By understanding the ins and outs, following the correct procedures, and staying informed about Bank of America's specific requirements, you can ensure a smooth and secure transaction for everyone involved. Remember, a little knowledge goes a long way in the world of finance!

Can You Deposit Someone Else's Check In Your Account? - The Brass Coq

How to Endorse a Check - The Brass Coq

Can I deposit someone else's stimulus check in my account? - The Brass Coq

Can You Deposit Someone Else - The Brass Coq

Cómo endosar un cheque - The Brass Coq

Bank Of America Deposit Slip Printable - The Brass Coq

Is it permissible to deposit a check issued to someone else into my - The Brass Coq

What Is Endorse A Check - The Brass Coq

How to Endorse a Check Correctly without any Mistake - The Brass Coq

Can You Deposit Someone Else's Check? - The Brass Coq

Bank Of America Deposit Slip Printable - The Brass Coq

Can you deposit someone else - The Brass Coq

Where Do I Sign A Check Quick and Easy Solution - The Brass Coq

Can You Deposit Someone Else's Check in Your Account - The Brass Coq

How To Sign A Check Over To Someone Else Bank Of America - The Brass Coq

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)