We live in a digital age - we pay bills online, send money with a tap on our phones, and hardly ever use cash. So, it’s easy to forget about those old-fashioned paper things: checks. But sometimes, you need one. Maybe your landlord prefers a rent check, or you're sending a gift to a relative who isn't tech-savvy. And suddenly, that little booklet of checks feels incredibly important. If you’re a Wells Fargo customer, you might be wondering: where do I even begin?

This article delves into the world of checks for Wells Fargo customers. We’ll answer that burning question – can I get blank checks from Wells Fargo? – and much more. We'll explore the different ways to order checks, understand the security features, and address any concerns you might have.

Let's start by acknowledging the elephant in the room - sometimes, it feels like checks are going the way of the dinosaurs. But the truth is, they still serve a purpose. While the world embraces digital payments, checks offer a tangible and reliable method for certain transactions. For many, they provide a sense of security and control that tapping a screen simply can't replicate.

Now, back to Wells Fargo. As one of the largest financial institutions in the United States, they've kept up with the times, offering a range of digital banking services. But do they still cater to those who need paper checks? You bet they do! Wells Fargo understands that their customers have diverse needs, and accessing checks is still an important service they provide.

So, breathe a sigh of relief – getting blank checks from Wells Fargo is absolutely possible. The process is surprisingly simple, and there are options to suit different preferences. Whether you're tech-savvy and prefer ordering online or appreciate the personal touch of visiting a branch, Wells Fargo has you covered. In the following sections, we'll break down these options, guide you through the ordering process, and equip you with all the information you need to navigate the world of checks with Wells Fargo.

Advantages and Disadvantages of Getting Checks From Wells Fargo

Let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Convenience: Order online or in-branch | Cost: May involve fees depending on your account and check style |

| Security: Wells Fargo checks come with various security features | Slower than digital payments: Checks require mailing and processing time |

| Widely Accepted: Checks are still a common payment method | Risk of Loss or Theft: Physical checks require safekeeping |

Best Practices for Ordering and Using Checks

Here are a few tips to keep in mind:

- Verify Your Information: Double-check your name, address, and account number before placing an order to avoid errors.

- Choose the Right Check Style: Wells Fargo offers a variety of designs and features – select what suits your needs and preferences.

- Order in Advance: Don't wait until the last minute to order checks, as processing and delivery take time.

- Store Checks Securely: Keep your blank checks in a safe place to prevent loss, theft, or unauthorized use.

- Monitor Your Account: Regularly review your bank statements to track check usage and identify any discrepancies.

Common Questions and Answers

Here are some frequently asked questions:

1. How do I order checks from Wells Fargo?

You can order checks online through Wells Fargo Online, by phone, or at a Wells Fargo branch.

2. How much do checks cost?

The cost of checks varies depending on your account type, check design, and quantity ordered.

3. How long does it take to get checks from Wells Fargo?

Delivery time depends on the ordering method and shipping option you choose. It usually takes 7-10 business days for standard delivery.

4. Can I get expedited shipping for my checks?

Yes, Wells Fargo offers expedited shipping for an additional fee.

5. What should I do if my checks are lost or stolen?

Immediately report lost or stolen checks to Wells Fargo by phone or at a branch to prevent unauthorized use.

Tips and Tricks

Consider ordering duplicate checks or a checkbook cover for added security and organization.

Take advantage of online bill pay and mobile check deposit to reduce your reliance on paper checks whenever possible.

In conclusion, while the world increasingly embraces digital transactions, the humble check remains a relevant and essential tool for many. If you’re a Wells Fargo customer wondering, “Can I get blank checks from Wells Fargo?” – the answer is a resounding yes! Wells Fargo provides convenient options for ordering checks and ensures their security with various features. By understanding the process, fees, and security measures, you can confidently navigate the world of checks and manage your finances effectively. Remember to always prioritize the security of your checks and personal information.

How to Quickly Find Your Wells Fargo Routing Number - The Brass Coq

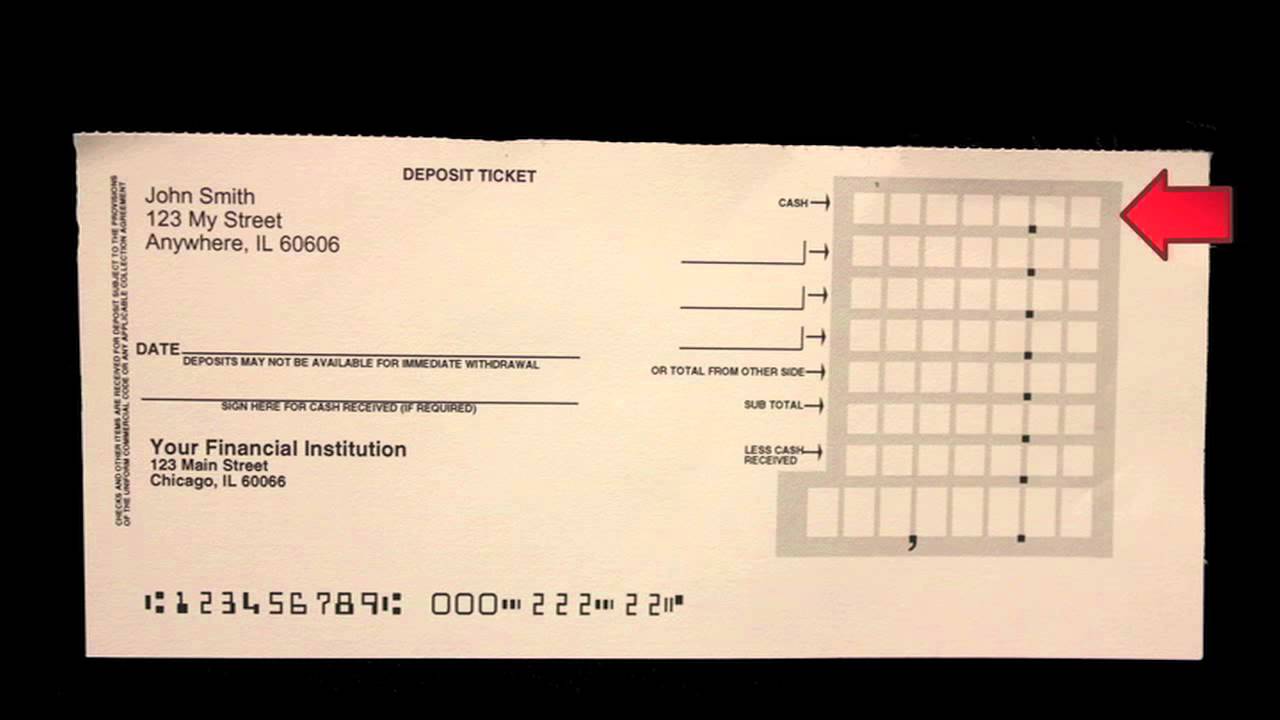

Wells Fargo Bank Deposit Slip - The Brass Coq

Wells Fargo Freezing Accounts 2024 - The Brass Coq

Wells Fargo Printable Checks - The Brass Coq

Wells Fargo Blank Deposit Slip Printable - The Brass Coq

can i get blank checks from wells fargo - The Brass Coq

How To Quickly Spot a Wells Fargo Scam Text [2023 Update] - The Brass Coq

Printable Blank Cashiers Check - The Brass Coq

can i get blank checks from wells fargo - The Brass Coq

can i get blank checks from wells fargo - The Brass Coq

Pin by Denisha Pace on Quick Saves - The Brass Coq

Wells Fargo Bank Account Number On Check - The Brass Coq

Wells Fargo Ach Form - The Brass Coq

Wells Fargo Blank Check Template - The Brass Coq

Blank Check Template Check more at - The Brass Coq

![How To Quickly Spot a Wells Fargo Scam Text [2023 Update]](https://i2.wp.com/assets-global.website-files.com/6082ee0e95eb6459d78fac06/637d3364b7f25bf56f27e3ea_Y-DMaYrorOlg_70sQslD5MesmIbkLTjCf3NokUvnhCq3xl09zchsODEpS7VeRe2fjnuZCD8KiJ9ec83sitnIZ9ZdeXnhwDOdhVgwX0B3DMrxYyutiQMmEE4alWheCL2VvKTN4skX-VgF0-yyds5-Lqb9fBwJQ6Kbo3fobKLXkcqwG1kItFJlkMLQVWOAGw.jpeg)