The Texas coastline whispers tales of opportunity, and for the discerning investor, Calhoun County tax sales might just be the siren's call. These sales offer a unique entry point into the Texas real estate market, potentially yielding significant returns. But navigating these waters requires careful consideration and a keen understanding of the process.

Calhoun County tax sales arise when property owners fail to pay their property taxes. To recoup the delinquent taxes, the county auctions off the liens on these properties. Purchasing a tax lien grants the buyer the right to collect the owed taxes, plus interest and penalties, from the original property owner. If the owner doesn't redeem the lien within a specified period, the lien holder can potentially foreclose on the property.

Historically, tax sales have been a vital mechanism for local governments to ensure the continuous flow of tax revenue, which funds essential public services. The evolution of these sales in Calhoun County reflects the broader trends in Texas, balancing the need for revenue collection with the rights of property owners. Understanding this historical context is crucial for any prospective buyer.

Participating in Calhoun County tax sales carries both potential rewards and inherent risks. The possibility of acquiring property at below-market value is undoubtedly enticing. However, due diligence is paramount. Thorough research into the property's condition, title history, and any existing encumbrances is essential to avoid unforeseen complications.

Before venturing into the world of Calhoun County tax sales, prospective buyers must familiarize themselves with the legal framework governing these transactions. Texas law dictates specific procedures and timelines that must be adhered to. Consulting with a real estate attorney or tax professional is highly recommended to ensure compliance and mitigate potential legal risks.

A key aspect of successful tax sale participation is understanding the bidding process. Auctions are typically conducted online or in person. Buyers need to set a clear budget and bidding strategy. Overbidding can erode potential profits, while underbidding might lead to losing out on desirable properties. Researching comparable property values is crucial for making informed bidding decisions.

While the allure of discounted properties is strong, potential pitfalls exist. Properties sold at tax sales may come with hidden issues, such as structural damage, environmental concerns, or title disputes. Conducting thorough due diligence, including property inspections and title searches, is essential to mitigate these risks.

One benefit of Calhoun County tax sales is the potential for high returns. Successfully acquiring a property below market value and either reselling it or holding it as a rental property can generate significant profit. Another benefit is the relatively low barrier to entry compared to traditional real estate investing. Finally, tax sales provide a diversified investment opportunity, allowing investors to expand their portfolios with unique real estate assets.

Advantages and Disadvantages of Calhoun County Texas Tax Sales

| Advantages | Disadvantages |

|---|---|

| Potential for high returns | Risk of unforeseen property issues |

| Relatively low barrier to entry | Complex legal procedures |

| Diversified investment opportunity | Competition from other bidders |

Frequently Asked Questions:

1. Where can I find information on upcoming Calhoun County tax sales? Answer: Check the Calhoun County website and local newspapers.

2. What are the payment methods accepted at tax sales? Answer: This varies, so contact the Calhoun County tax office.

3. Can I inspect the properties before the sale? Answer: Research access policies within Calhoun County.

4. What happens if the property owner redeems the lien? Answer: You receive the owed taxes, interest, and penalties.

5. How long do I have to foreclose on a property if the lien isn't redeemed? Answer: Consult Texas law and the terms of the sale.

6. Are there any resources available to help me research properties? Answer: Yes, online databases and local real estate professionals can be helpful.

7. What are the typical closing costs associated with a tax sale purchase? Answer: Vary, so consult with a title company or real estate attorney.

8. How can I stay updated on Calhoun County tax sale information? Answer: Subscribe to notifications on the county website and monitor local legal publications.

In conclusion, Calhoun County, Texas tax sales present a compelling opportunity for savvy investors seeking potentially lucrative real estate deals. However, careful planning, thorough research, and a clear understanding of the legal and procedural landscape are essential for navigating this complex process. By diligently assessing properties, conducting due diligence, and formulating a sound bidding strategy, investors can maximize their chances of success and minimize potential risks. The potential rewards of acquiring property at below-market value can be significant, making Calhoun County tax sales an attractive avenue for those willing to embrace the challenges and navigate the complexities of this unique investment arena. Remember to consult with legal and financial professionals before participating in any tax sale to ensure informed decision-making and protect your investment.

Calhoun County Shapefile and Property Data - The Brass Coq

calhoun county texas tax sales - The Brass Coq

Car Sales Tax In California Calculator at Carletta Sutliff blog - The Brass Coq

calhoun county texas tax sales - The Brass Coq

Calhoun County Georgia Tax Map - The Brass Coq

Communication with Calhoun 911 Has Become an Issue - The Brass Coq

Calhoun County Sc Vehicle Tax at Kerry Langlois blog - The Brass Coq

Calhoun County Sc Vehicle Tax at Kerry Langlois blog - The Brass Coq

Calhoun county appraisal district and county tax information - The Brass Coq

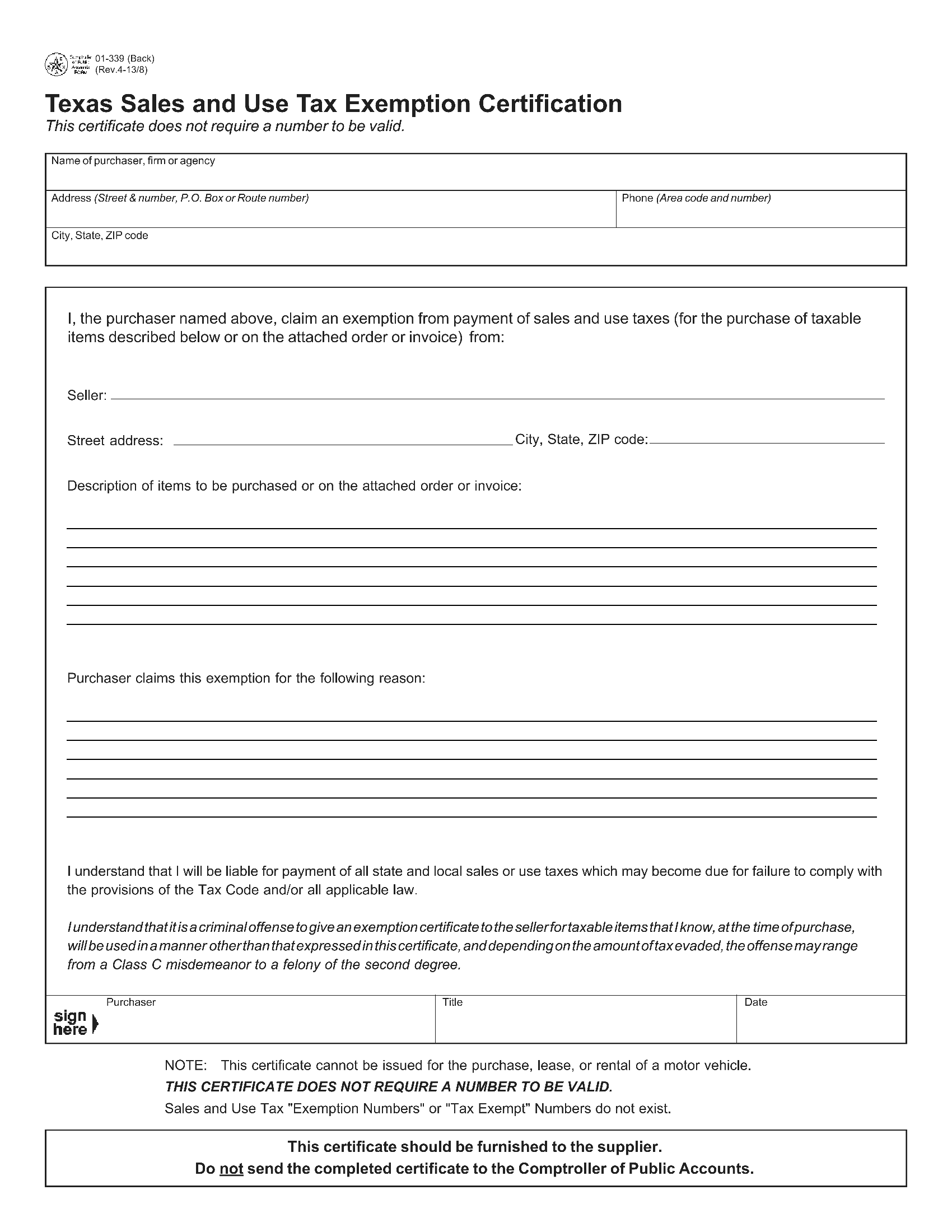

Texas Resale Certificate Fillable Form - The Brass Coq

Calhoun County MS Wall Map Color Cast Style by MarketMAPS - The Brass Coq

Calhoun County AL Wall Map Color Cast Style by MarketMAPS - The Brass Coq

Calhoun County MI Zip Code Wall Map Basic Style by MarketMAPS - The Brass Coq

Lucas County Real Estate Tax Rates at Walter Davis blog - The Brass Coq